Privacy & Terms

Privacy & Terms

Privacy Policy

Probus understands the significance of maintaining every user’s information privacy and is committed to maintaining the integrity, confidentiality and security of their information/data. Hence, it has in place the Privacy Policy which protects the personal information that it collects from its users.

This privacy policy applies to every user including former & current visitors and online customer/s. By visiting or/and using our website/portal/mobile application, you agree to the Probus Privacy Policy.

As per the privacy policy, by using and/or registering yourself at https://play.google.com/store/apps/details?id=in.probusinsurance.app application you authorize Probus Insurance Broker Private Limited (including its representatives, affiliates, and its business partners) to contact you via email or phone call or SMS and offer you our services and products.

In addition to it, you hereby agree that you authorize Probus to contact you for the above mentioned purposes even if you have registered yourself under DND or DNC or NCPR service(s). Your authorization, in this regard, shall be valid as long as your account is not deactivated by either you or us.

- Collection of Data

- – Personal Identification Information

Collection of personal identification information in ways including but not limited to when you visit, register, transact, fill out a form on our website/mobile application respectively and in connection with other activities, services, features, or resources which we make available on our website/mobile application. You may be asked for, as appropriate, name, email address, mailing address, phone number. You may, however, visit our website/mobile application anonymously. We will collect personal identification information from you only if you voluntarily submit such information to us. You can always refuse to provide personal identification information, which may keep you from engaging in certain website/mobile application-related activities.

- – Non-Personal Identification Information

Collection of non-personal identification information whenever you interact with our website/mobile application. Non-personal identification information may include the browser name, the type of computer and technical information about your means of connection to our website/mobile application, such as the operating system, the Internet service providers utilized, and other similar information.

Purposes of collection of your data

- -> We use your information to:

- Solve queries submitted by you.

- Process applications submitted by you.

- Anticipate and resolve problems with any services supplied to you.

- Administer or otherwise carry out our obligations in relation to any agreement with our business partners.

- To make our website and the services offered better. We may combine the information we get from you with information about you we get from our business partners or third parties.

- Send notices, communications relevant to your use of the services offered on the website.

- — Security

We take complete care to protect the information collected from you by employing appropriate technical and security measure at all instances. We ensure complete protection against unauthorized/unlawful use/alteration of information and any accidental loss, destruction or damage to information by deploying multiple physical, procedural and electronic security measures.

In spite of all these measures, no electronic storage method or transmission method can be considered as completely secure and neither can we guarantee you ultimate security. It is highly recommended that even you take the responsibility of maintaining the confidentiality and security of your login, id and password and avoid disclosing these credentials to any third party.

- — Information Sharing and Disclosure

The information or data which you have submitted on the Probus website/mobile application might be shared to any third party or business provider or service provider without obtaining your consent under the following situations:

- – If the information is required or requested by law or by any court or governmental agency/authority to disclose for identity or verification purpose. Moreover, the disclosures are made to these bodies for prevention, detection, investigation or prosecution and punishment of offences. However, the disclosures made are done in good faith and belief such that it is reasonably necessary for enforcing these Terms and Conditions for complying with the applicable laws and regulations.

- – Probus proposes to share such information within its company, officers, employees for processing personal information on its behalf. We also ensure that the recipients of this information agree to process such information based on our instructions and in compliance with this Privacy Policy and any other appropriate confidentiality and security measures.

- – Probus shall transfer information about you in case we are merged or acquired by another company.

- – Collection of cookies

Our site may use cookies to enhance your experience.

A piece of data stored on the user’s computer tied to user’s information is a cookie. Probus might use both sessions: Persistent Cookies (used by PRP to store whether, for example, you want your password remembered or not, and other information)

Note: Cookies used on the PRP website do not contain personally identifiable information and ID cookies (wherein once you close your browser or log out, the cookie terminates and is erased).

A persistent cookie is a small text file stored on your computer’s hard drive for an extended period. Session ID cookies may be used by PRP to track user preferences while the user is visiting the website. They also help to minimize load times and save on server processing.

- — Links to other websites

There might be affiliates or other sites linked to Probusinsurance.com/mobile application. Any kind of personal information that you provide to those sites is not our property. These affiliated sites may have different privacy practices and we encourage you to read their privacy policies of this website when you visit them.

- — Modifications/changes/Update in the privacy policy

Probusinsurance.com/mobile application holds the right to make changes in the policy from time to time, at its sole discretion. We may update this privacy policy to reflect changes to our information practices and encourage you to periodically review.

- – Acceptance of the Privacy Policy

By using Probusinsurance.com/mobile application, you accept the terms of this Privacy Policy. If you do not agree with the terms mentioned above, we request you to not use this website/portal/mobile application. Your continued use of the website/mobile application following the posting of changes to this privacy policy terms will be deemed your acceptance of the changes made.

Terms of Use

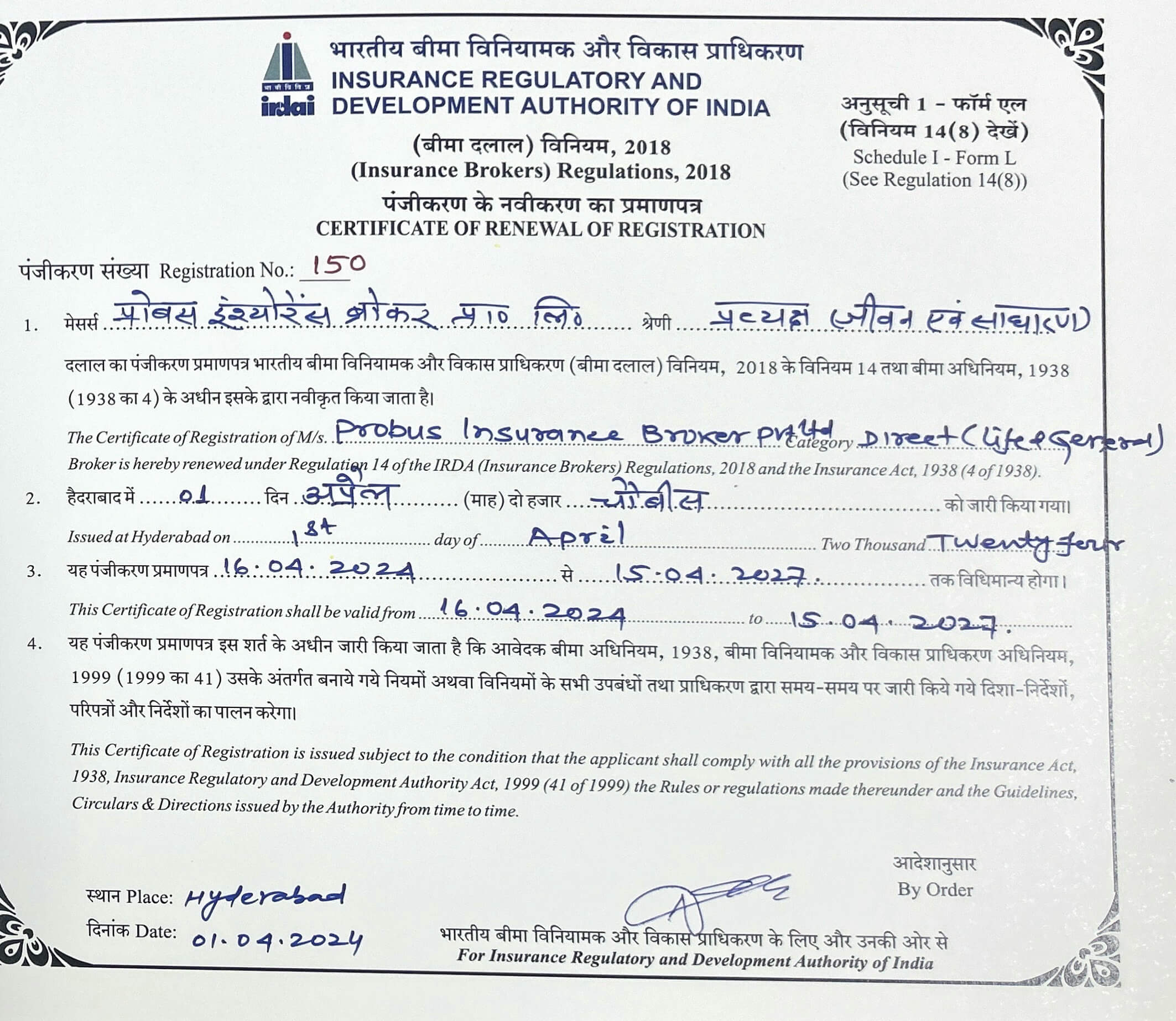

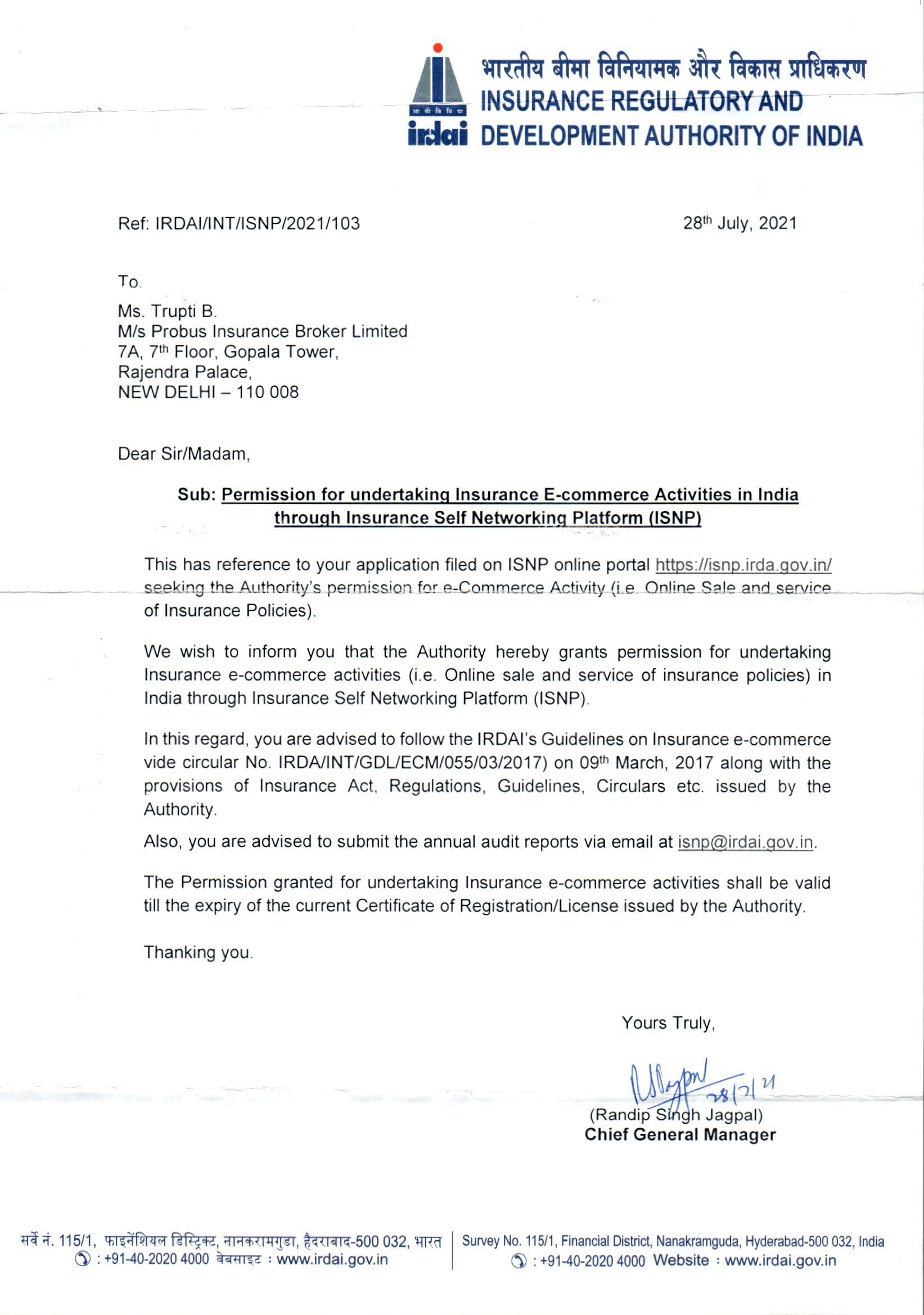

Probus Insurance Broker Private Limited (herein referred to as “Probus”) possesses and operates the website https://www.probusinsurance.com/ to offer its customers a seamless way of buying insurance products from multiple insurance companies. Probus is a Certified Insurance Broker holding a Direct Broking (Life & General) license issued by the insurance regulator, Insurance Regulatory and Development Authority of India (IRDAI) vide Licence No.150 and Direct Broker code IRDA/DB 106/03.

Probus to safeguard their customers, request them to read all the Terms of Use (ToU) (hereafter referred to as ‘Terms of Use Agreement’) available on the website/mobile application and accept the same at their sole discretion by adhering to it as stated on the website/mobile application.

The applicability of the Terms of Use Agreement becomes effective as soon as, including but not limited to your visit and access to the Products, Services, Information, Resources, Tools, etc. and any other information related/available on the website/mobile application provided by us.

Probus at any time reserves the right and holds the power to change/modify/revise as needed, the Terms of Use Agreement without any prior notice to you. Your continuous access of the Probus website/mobile application signifies the acceptance by you of the modified Terms of Use Agreement.

- Responsible Use and Conduct

- Through visiting and accessing our website/mobile application that we make available to you for the various direct and indirect services, you agree to use these services with the intent as permissible under this Terms of Use Agreement, applicable Rules & Regulations of the Indian Law and online practices & guidelines by the authority.

- You agree to make account in our website/mobile application with the details belonging to you.

- While availing any of the online services you agree to always provide accurate, correct, and up to date information.

- The responsibility of maintaining the confidentiality of any login information associated with your account to use/access our online services lies with you along with all the activities that occur under your account/s.

- You specifically agree not to access (or attempt to access) any of our online services through any automated, unethical, or unconventional means.

- Attempting to copy, duplicate, reproduce, sell, trade, or resell our services is strictly prohibited.

- You are solely responsible for any consequences, losses, or damages that we may directly or indirectly incur or suffer due to any unauthorized activities conducted by you.

- If you choose to use any communication tool made available for you by us to submit any type of content, then it is your personal responsibility to use these tools in a responsible and ethical manner.

- Indemnity

You hereby agree to indemnify, defend and hold Probusinsurance.com and its director, POSP, owners, employees, information providers, licensors and licensees (collectively, the “Indemnified Parties”), affiliates harmless from and against any and all liability and costs incurred by the Indemnified Parties in connection with any claim arising out of any breach of the Agreement or the foregoing representations, warranties and covenants, without limitation, attorneys’ fees and costs. You shall cooperate in complete absolute manner when required in the defense of any claim. Probusinsurance.com reserves the right, at its own expense, to assume the exclusive defense and control of any matter otherwise subject to indemnification by you and you shall not, in any event, settle any matter without the written consent of Probusinsurance.com.

- Limitation of Liability

You expressly understand and agree that Probus and its subsidiaries, affiliates, officers, employees, POSP, partners and licensors shall not be liable to you for any direct, indirect, incidental, special, consequential or exemplary damages, including, but not limited to, damages for loss of profits, goodwill, use, data or other intangible losses (even if Probus has been advised of the possibility of such damages), resulting from use of the website, content or any related services.

- Disclaimer of Liability and Warranty

The Content, Products, and Services Published on this website/mobile application may exhibit inaccuracies or errors, including pricing errors. Probus disclaims all liabilities/warranties for any errors or other inaccuracies relating to any information present in the entire website/mobile application. We expressly reserve the right to correct any pricing errors on the website/mobile application and/or on pending reservations made under an incorrect price.

Probus makes no representation about the suitability of the information, software, products, and services contained on this website/mobile application for any purpose, and the inclusion or offering of any products or services on this website/mobile application does not constitute any endorsement or recommendation of such products or services. All these assets are provided “AS IS” without warranty of any kind.

Probus and/or its affiliates disclaims being liable for any direct, indirect, punitive, incidental, special, or consequential damages arising out of, or in any way connected with, your access to, display of or use of this website/mobile application or with the delay or inability to access, display or use this website/mobile application (including, but not limited to, your reliance upon opinions appearing on this website/mobile application; any computer viruses, information, software, linked websites, products, and services obtained through this website; or otherwise arising out of the access to, display of or use of this website) whether based on a theory of negligence, contract, tort, strict liability, or otherwise, and even if Probus and/or its affiliates their respective service providers have been advised of the possibility of such damages.

The service providers providing services on this website/mobile application are independent affiliates and Probus are not liable for the acts, errors, omissions, representations, warranties, breaches or negligence of any such service providers or for any personal injuries, death, property damage, or other damages or expenses resulting therefore. Probus and its affiliates have no liability and will make no refund in the event of any delay, cancellation, strike, force majeure or other causes beyond their direct control, and they have no responsibility for any additional expense omissions delays or acts of any government or authority.

- Disclaimer of Online Availability, Impressions, and Click-Through

There is no guarantee/warranty regarding online availability, impressions, and click-through of https://play.google.com/store/apps/details?id=in.probusinsurance.app application, its web pages, and any material, information, links, or content presented on the web pages. This information may be unavailable for online access at any time.

- Modification and Notification of Changes

Probus possess the absolute authority to do modifications/revisions/addition/exclusion in the Terms of Use from time-to-time, at its sole discretion. We may update this Terms of Use to reflect changes to our information practices and at the same time, also encourage you to review periodically.

- Trademarks, Intellectual Property Rights and Copyright

The trademarks, logos and service marks (“Marks”) displayed on the website/mobile application are the property of Probus and other associated parties and service providers. The users are forbidden from utilizing any Marks without the written permission of Probus or such third party which may own the Marks.

All information and content, including any software programs available on or through the website (“Content”)/mobile application, is protected by copyright. The users are prohibited from modifying, duplicating, sharing, trading, permitting, transmitting, advertising, publishing, creating derivative works or utilizing any Content available on or through the website/mobile application for commercial/public purposes.

- Termination of Your Use

You agree that we may, at our sole discretion, suspend or terminate your access to all or part of our website/mobile application and services with or without notice and for any reason, including, without limitation, breach of this user agreement. Any suspected illegal, fraudulent, or abusive activity may be grounds for terminating your relationship and may be referred to appropriate law enforcement authorities. Upon suspension or termination, your right to use the resources we provide will immediately cease, and we reserve the right to remove or delete any information that you may have on file with us, including any account or login information.

- Survival of Terms After Agreement Ends

Notwithstanding any other provisions of this ToU or any general legal principles to the contrary, any provision of this ToU that imposes or considers continuing obligations on a party will survive the expiration or termination of this ToU.

- General

If any of these conditions are deemed invalid, void, or for any reason unenforceable, the parties agree that the court should endeavor to give effect to the parties’ intentions as reflected in the provision, and the unenforceable condition shall be deemed severable and shall not affect the validity and enforceability of any remaining condition. The headings are just for reference purposes only and do not limit the section scope or extent.

This ToU and the relationship between you and Probus will be governed by the laws of India without regard to its conflict of law provisions. You and Probus agree to submit to the personal jurisdiction of the courts located in Mumbai jurisdiction with respect to any legal proceedings that may arise in connection with this ToU.

The failure of Probus to act with respect to a breach by you or others does not waive its right to act with respect to subsequent or similar breaches. Probus takes no responsibilities to take action against all breaches of this ToU. Other than as explicitly provided in this ToU, there shall be no third-party beneficiaries to this ToU. This ToU constitutes the complete agreement between you and Probus and governs your use of the website, superseding any prior agreements between you and the company with respect to the website.

- Acceptance of the Terms of Use

By using https://play.google.com/store/apps/details?id=in.probusinsurance.app application, you accept the terms of this Terms of Use Agreement. If you do not agree with the terms mentioned above, we request you to not use this website/mobile application. Your continued use of the website following the posting of changes to this agreement terms will be deemed your acceptance of the changes made.

Disclaimers

Probus Insurance intends to maintain transparency and provide unbiased and clear information about insurance products and services. The data or/and information is generic in nature and hence we are in no manner or form responsible for any discrepancies in the data/information published on our website. We ensure complete efforts to offer exact, unbiased and accountable data to the best of our ability.

All the information provided on our portal is subject to its discretion and there is no intention/purpose of breaching any ancillary rights or intellectual property. There is likely to be occurrence of changes in the information provided in the portal without prior notice and any such changes in the public utility would be communicated on our portal. Also, we ensure that whatever material we post on our portal is of top quality, precise and accurate, however, we are not legally responsible for the same in any manner what so ever.

Also, the employees, partners and other staffs of Probus Insurance are not responsible for any loss/damage/harm incurred from the usage of information from the portal. We advise our customers to use their own discretion for such instances.

Since insurance is a subject matter of solicitation and market risks, it is the customer’s responsibility to comprehend the limitations of insurance policies and the risks associated with it. We do not take any liability under any circumstances, form/manner for such cases.

We also suggest you to go through the subject and offer documents carefully. The information available on the portal is for insurance and financial purposes. On basis of mutual understanding between us and the customers, we make it clear that our customers association with the portal will be at the customer’s sole discretion and risk.

The visitors to this and every third party are hereby informed that the owners of the Probus Insurance portal are not the agents, corporate agents, related party or intermediaries of the insurers, whose products are dealt with in this website or portal. We try our best to make correct policy or product comparisons, features, quotes, etc, based on the information provided by the insurers, it is made abundantly clear that Probus Insurance Broker Private Limited, its directors, shareholders, officers and employees are in no way responsible to or liable for any one for his/her investment decision, and every prospect or investor or policyholder shall be solely responsible for the consequences of his or her decision.

Procedures, processes and timelines for Post Sales servicing of insurance policies

LIFE INSURANCE

Issuance and crediting of the Policy Document / Certificate of Insurance /Proposal Form / Medical Reports, etc.

- Filling up the Proposal Form:

Underwriting of insurance proposal is done basis the disclosures by the life insured/proposer in the proposal form, hence it is mandatory to verify the details filled in the proposal form and authenticate them through OTP (One-time password) authentication. On completion of proposal form filling and payment, a copy of proposal form in PDF along with payment acknowledgment will be sent to the customer’s registered E-mail ID.

The proposal form has various sections which the proposer is required to fill. Below are the sections:

- Customer Details – This section contains details like Basic Information, Contact Details, Address Details and Plan Details.

- Redirection to Insurer’s website – As soon the basic details are filled in our portal the customer gets redirected to insurer’s portal wherein he again has to fill the required details.

- Review & Acceptance – This section contains details of all the information filled up in previous sections for easy review and acceptance of proposal by the customer.

- Pay – Customer has to make the payment for policy purchased. Customer may be required to make the payment & then fill the complete form or he may complete filling the form and then make the payment.

- Document Upload:

In upload documents section, customer has to upload self-attested copy of below mentioned documents:

- Photograph.

- Address proof (Communication & Permanent address).

- Identity proof.

- Income proof.

Organising medical check-ups and submission of medical reports

Here, the medical is arranged if required after the payment has been done by the customer. The customer needs to select a preferred date and time for medical checkup. The medical checkup can be either at customer’s residence or he / she will be required to visit the insurer’s empaneled diagnostic centers. Details of these are available on schedule medical page and in case of any changes, customer will be informed accordingly.

Policy underwriting & decision of policy issuance is made by the insurer. Once the policy is issued, policy pack will be sent to customer at his / her communication address as selected on the proposal form by the insurer but the soft copy of the issued policy shall be sent to customer’s email id by the insurer.

Issuance of Endorsement

An endorsement is issued to the policyholder whenever any contractual changes (permitted by the plan/policy) are requested by the policyholder, accepted by the Insurer and made in the policy. The turnaround time is 2 to 3 working days from the date of receipt of complete documents. The customer can contact us on 7304332968 or Email us at business.support@probusinsurance.com.

Change of Policy Terms and Conditions/Details Change

1. Correction of Date of birth:

Change of DOB request means a change or correction in the Date of Birth of the policyholder, life insured or nominee/trustee. Customer needs to fill & submit below mentioned documents:

- Email from register email id or Request letter duly signed by the policyholder.

- Date of Birth Proof.

- Additional Premium (wherever applicable due to change of DOB).

- Revised Illustration duly signed (wherever applicable due to change of DOB).

2. Change of nomination:

As per policy contract, policyholder may nominate any other person, to whom the money secured under the policy shall be paid in the event of death of the policyholder. If in case, a customer wants to place a request for change of nominee he / she need to submit below mentioned documents:

- Email from register email id or Request letter duly signed by the policyholder, mentioning new nominee name, DOB & Relation with insured along with the supporting documents.

- In case nominee is a minor then Email from register email id or Request letter duly signed by the policyholder, mentioning appointee name, DOB & Relation with nominee along with the supporting documents.

All the requests are forwarded to insurance company and insurer does the needful. Insurer informs the customer and us. The Turnaround time is 2 to 3 working days from the date of receipt of complete documents for such changes to be made.

Collection of renewal premiums and remittance to insurers

Customer has to directly go to insurer’s website and pay the renewal premium. Customer can input policy number for which premium is due and enter the DOB of the life insured. Pay the amount due on the Payment Gateway through internet banking, debit card, credit card. Receipt for renewal payment will be sent to register E-mail Id immediately after the payment. For any service related queries, customer can contact us on 7304332968 or Email us at business.support@probusinsurance.com.

Change of Name / Address

1. Change of name:

In case of change of name, a policyholder needs to submit below mentioned documents:

- Email from register email id or Request letter duly signed by the policyholder.

- A valid name change proof (on which customer’s DOB should match with our records)

- Name Change affidavit (as per state value) in case of after marriage name change and religion change.

2. Change of address:

In case of change of address, a policyholder needs to submit:

- Email from register email id or Request letter duly signed by the policyholder.

- Valid address Proof of new address.

The Turnaround is 2 to 3 working days from the date of receipt of complete documents.

Registration of Assignment / Nomination / Change of Nomination

1. For Assignment:

As per policy contract, policyholder may nominate any other person, to whom the money secured under the policy shall be paid in the event of death of the policyholder. The assignment is done in the policies when nominee is below 18 years of age or minor. The assignee details like Name, DOB and relation between nominee & assignee is required.

2. For nomination:

As per policy contract, policyholder may nominate any other person, to whom the money secured under the policy shall be paid in the event of death of the policyholder. The nominee details like Name, DOB and relation between insured & nominee is required.

3. For change of nomination:

As per policy contract, policyholder may nominate any other person, to whom the money secured under the policy shall be paid in the event of death of the policyholder. If in case, a customer wants to place a request for change of nominee he / she needs to submit below mentioned documents:

- Email from register email id or Request letter duly signed by the policyholder, mentioning new nominee name, DOB & Relation with insured along with the supporting documents.

- In case nominee is a minor then Email from register email id or Request letter duly signed by the policyholder, mentioning appointee name, DOB & Relation with nominee along with the supporting documents.

The Turnaround is 2 to 3 working days from the date of receipt of complete details/documents.

Surrender, Maturity, Withdrawals, Free look Cancellations, Return Benefit Payouts

1. Surrender

Every policy plan has got a surrender value which generates in 2 years or 3 years depending upon the company and product chosen. For receiving the surrender value customer has to surrender the policy before the maturity of the policy term. Customer can contact us on 7304332968 or Email us at business.support@probusinsurance.com or visit the branch of insurer.

2. Maturity

No maturity benefit is available in term plan.

3. Withdrawal

No withdrawal is available in term plan.

4. Free look cancellation

Customer can contact us on 7304332968 or email us at business.support@probusinsurance .com or visit the branch of insurer.

5. Return Benefit Payout

There are some term plans which have Return Benefit payout option available with the policy plan. Here, once the policy matures the insured if has chosen Return Benefit payout option can get the net premium paid during the policy term. The premium amount is paid back to the insured as return benefit excluding GST amount.

Loan Against Policy

Loan against policy does not happen in term insurance.

Fund Switching / Premium Redirection

Fund switching / Premium Redirection does not happen in term insurance.

Declarations Update

In most of the cases the life insurance proposal forms require the person taking the policy to declare the existing life insurance policies due to financial underwriting. Insurers want to ensure that the aggregate sum assured of an individual is not out proportion with his /her annual income. Financial underwriting is more important in case of term insurance than in case of endowment or ULIP policies. The declaration can be made while taking the policy.

Extension of Cover

In term insurance the insured can choose the extension of cover option. This option can be taken by the insured in the plan when he/she is single or before marriage.

Revival/ Cancellation of Policy

1. Revival

Insured can revive the policy by paying the renewal amount along with penalty charges.

2. Cancellation

Insured can cancel the term policy if he crosses the eligibility amount of cover of one policy from an insurer.

Transfer of Policy

In term insurance no transfer of policy happens.

Duplicate Policy

Customer can contact us on 7304332968 or email us at business.support@probusinsurance.com or visit the branch of insurer.

Death / Maturity Claims

For placing a claim request the policy holder can call to insurer at their customer service number or they can call us on our claim service no.9372589505 or write to us at claims@probusinsurance.com. Our team will connect you to the insurer. The claim is settled and paid by the insurance company directly to the customer’s account. If the customer does not receive the satisfactory service or have any other escalations, he/she can use the same e-mail id and phone no. to get the concerns resolved. Depending upon the requests/ escalations the TAT is 15 to 30 working days.

Other Service Operations as may be specific for the product

Not Applicable.

HEALTH INSURANCE

Offer and Acceptance of the Proposal Form

1. Filling up the proposal form:

Underwriting of insurance proposal is done basis the disclosures by the insured/proposer in the proposal form, hence it is mandatory to verify the details filled in the proposal form and authenticate them through OTP (One-time password) authentication.

The proposal form has various sections which the proposer is required to fill. Below are the sections:

- Proposer Details – This section contains details like proposer name, marital status, DOB, occupation contact details and nominee details.

- Insured Member – This section contains details of Insured member/s. The details are name, DOB, gender, height, weight and nominee details.

- Medical History – This section contains details on medical history of the insured and any toxic substance consumption.

- Other Details – This section contains Customer Declaration and Acceptance by the insured/proposer.

2. Review and Pay:

Here, customer receives an OTP in their given mobile number. The Customer needs to enter the OTP to authenticate the details provided in the proposal form. The OTP is sent on customer’s mobile. Once the customer enters the OTP then he can make the payment by himself/herself or the link can be sent by the POS to the customer.

3. Organizing medical checkup and submission of medical reports:

Medical checkups are required by the Insurers per the plan that the customer has procured. If the plan requires a medical checkup – once customer has made the payment of the recently purchased online plan, he/she would be routed to complete the next steps i.e. Schedule Medical (if applicable).

Issuance of the policy

1. The policy is issued immediately if the policy plan does not require a medical assessment of the proposer/insured.

2. In case where the medical examination/assessment is involved and underwriter’s approval is required. The policy issuance takes time of 7 working days from the date of receipt of complete documents and details.

Issuance of endorsement

An endorsement is issued to the policyholder whenever any contractual changes (permitted by the plan/policy) are requested by the policyholder, accepted by the Insurer and made in the policy. The turnaround time is 7 working days from the date of receipt of complete documents.

Change of Policy Terms and Conditions/Details Change

1. Correction of Date of Birth:

Change of DOB request means a change or correction in the Date of Birth of the policyholder, life insured or nominee/trustee. Customer needs to submit below mentioned documents:

- Email from register email id or Request letter duly signed by the policyholder.

- Date of Birth Proof.

- Additional Premium (wherever applicable due to change of DOB).

The turnaround time is 7 working days from the date of receipt of complete documents.

2. Change of Name:

In case of change of name, a policyholder needs to submit below mentioned documents:

- Email from register email id or Request letter duly signed by the policyholder.

- A valid name change proof (on which customer’s DOB should match with our records).

- Name Change affidavit (as per state value) in case of after marriage name change and religion change.

3. Change of address:

In case of change of address, a policy holder need to submit below mentioned documents:

- Email from register email id or Request letter duly signed by the policyholder.

- Valid address Proof of new address.

4. Change of nomination:

As per policy contract, policyholder may nominate any other person, to whom the money secured under the policy shall be paid in the event of death of the policyholder. If in case, a customer wants to place a request for change of nominee he / she needs to submit below mentioned documents:

- Email from register email id or Request letter duly signed by the policyholder, mentioning new nominee name, DOB & Relation with insured along with the supporting documents.

- In case nominee is a minor then Email from register email id or Request letter duly signed by the policyholder, mentioning appointee name, DOB & Relation with nominee along with the supporting documents.

- The turnaround time is 7 working days from the date of receipt of complete documents by the Insurer.

5. Increase in sum assured / Decrease in Sum assured:

As per policy contract, this transaction is allowed only at the time of renewal. This request can be processed after customer submits below mentioned documents:

- Email from register email id or Request letter duly signed by the policyholder

- Change Request form (wherever applicable)

- Additional Premium (wherever applicable)

- Medicals (wherever applicable).

The turnaround time is 10 working days from the date of receipt of complete documents.

Collection of renewal premiums and remittance to insurers

Customer has to directly go to insurer’s website and pay the renewal premium. Customer can input policy number for which premium is due and enter the DOB of the life insured. Pay the amount due on the Payment Gateway through internet banking, debit card, credit card. Receipt for renewal payment will be sent to register E-mail Id immediately after the payment. For any service related queries, customer can contact us on 7304332968 or Email us at business.support@probusinsurance.com.

Settlement and payment of claims

For placing a claim request the policy holder can call to insurer at their customer service number or they can call us on our claim service no.9372589505 or write to us at claims@probusinsurance.com. Our team will connect you to the insurer. The claim is settled and paid by the insurance company directly to the customer’s account. If the customer does not receive the satisfactory service or have any other escalations, he/she can use the same e-mail id and phone no. to get the concerns resolved. Depending upon the requests/ escalations the TAT is 15 to 30 working days.

Other service operation as may be specific for the products

Not Applicable.

MOTOR & TWO WHEELER

Offer and Acceptance of the Proposal Form

1. Filling of the Proposal Form:

The customer can fill the form in portal. The proposal form has various sections which the proposer is required to fill. Below are the sections:

- Owner Details– This section contains details like owner name, gender, marital status, DOB, occupation and contact details.

- Vehicle Details– This section contains details Registration No. & Date, Engine No, Chassis No. and Hypothecation details.

- Other Details– This section contains details like nominee details, previous policy details and customer Declaration.

2. Review and Pay:

Here, customer receives an OTP in their given mobile number. The Customer needs to enter the OTP to authenticate the details provided in the proposal form. The OTP is sent on customer’s mobile and e-mail id. Once the customer enters the OTP then he can make the payment by himself/herself or the link can be sent by the POS to the customer.

3. Organizing inspection and submission of video inspection report:

Once customer has made the payment of the purchased online plan, he/she would be routed to complete the next steps i.e. Schedule an Inspection (if applicable).

Issuance of the policy

1. The policy is issued immediately.

2. In case where inspection is required for the vehicle the policy issuance takes time of 7 working days from the date of receipt of complete documents.

Issuance of endorsement

An endorsement is issued to the policyholder whenever any contractual changes are accepted and made in the policy. Please refer to below sections of this document for types of changes and their respective documentation. The turnaround time is 7 working days from the date of receipt of complete documents by the Insurer.

1. Vehicles details change:

In case of vehicle detail change, the policyholder needs to submit below mentioned documents:

- Email from register email id or Request letter duly signed by the policyholder.

- Registration Certificate (RC).

- Additional Premium (wherever applicable due to change in NCB, IDV, Ownership transfer, CC Fuel type, CNG addition, MFG year, Legal liability for paid driver & model and variant).

2. Risk start date change:

As per contract risk start date can be changed on the basis of below mentioned documents:

- Email from register email id or Request letter duly signed by the policyholder.

- Previous year policy.

3. Change of name:

In case of change of name, a policyholder needs to submit below mentioned documents:

- Email from register email id or Request letter duly signed by the policyholder.

- RC Copy.

- Previous year policy copy (wherever applicable).

4. Change of address:

In case of change of address, a policy holder need to submit below mentioned documents:

- Email from register email id or Request letter duly signed by the policyholder.

- Valid address Proof of new address.

5. Change of nomination:

As per policy contract, policyholder may nominate any other person, to whom the money secured under the policy shall be paid in the event of death of the policyholder. If in case, a customer wants to place a request for change of nominee he / she need to submit below mentioned:

- Email from register email id or Request letter duly signed by the policyholder, mentioning new nominee name, DOB & Relation with insured along with the supporting documents.

6. Correction in Registration Date, Manufacturing Date, Registration No.,Engine No.,Chassis No., Cubic Capacity, GVW, Fuel type and NCB:

In case of above mentioned changes a policyholder needs to submit below mentioned documents:

- Email from register email id or Request letter duly signed by the policyholder.

- RC Copy.

7. Hypothecation:

In case of Hypothecation a policyholder needs to submit below mentioned documents:

- Email from register email id or Request letter duly signed by the policyholder.

- RC copy where hypothecation details are already available.

- Invoice copy or finance company letter for new vehicle.

8. Make, Model and Variant:

In case of these changes a policyholder needs to submit below mentioned documents:

- Email from register email id or Request letter duly signed by the policyholder.

- RC Copy.

9. Ownership Transfer:

In case of ownership transfer a policyholder needs to submit below mentioned documents:

- Email from register email id or Request letter duly signed by the policyholder.

- Supporting documents depending upon insurer to insurer.

Collection of renewal premiums and remittance to insurers

Customer has to directly go to insurer’s website and pay the renewal premium. Customer can input policy number for which premium is due and enter the DOB of the life insured. Pay the amount due on the Payment Gateway through internet banking, debit card, credit card. Receipt for renewal payment will be sent to register E-mail Id immediately after the payment. For any service related queries, customer can contact us on 7304332968 or Email us at business.support@probusinsurance.com.

Pre-inspection of risks

The pre-inspection of risks is done for the all the motor policies except two wheelers. The inspection is required where there are Break-in policies. There are two ways of the vehicle inspection.

1. Self-inspection:

In self-inspection the customer after filling the required details online receives the link for the inspection after which he / she is required to download the mobile application for further inspection. After customer does the needful he receives an e-mail of the inspection report and a message on the recommendation/ non-recommendation of vehicle for policy issuance. The time taken to generate the report ranges from 3 to 4 hours. After the inspection of the risk the customer receives a payment link.

2. Inspection by Agency:

In inspection by agency the agency is involved. The insurer’s agency does the inspection and sends the report to us simultaneously customer also receives a message on the recommendation/ non-recommendation of vehicle for policy issuance. The time taken to generate the report ranges from 3 to 4 hours. After the inspection of the risk the customer receives a payment link.

Appointment of surveyors/ advocates

The surveyor is appointed when the customer chooses inspection by agency. The surveyor is the inspection agency of the risk. The surveyors/advocates are appointed during claim as well.

Submission of survey reports

Submission of survey report/s happen/s at the time of inspection and claim both.

Settlement and payment of claims

For placing a claim request the policy holder can call to insurer at their customer service number or they can call us on our claim service no.9372589505 or write to us at claims@probusinsurance.com. Our team will connect you to the insurer. The claim is settled and paid by the insurance company directly to the customer’s account. If the customer does not receive the satisfactory service or have any other escalations, he/she can use the same e-mail id and phone no. to get the concerns resolved. Depending upon the requests/ escalations the TAT is 10 to 15 working days.

Other service operation as may be specific for the products

Not Applicable.

NON-MOTOR (SME)

Offer and Acceptance of the Proposal

1. The E-Quotes are given to the customer depending upon his requirement and after that the customer chooses one company to buy insurance. He fills the required details online in the portal after which the payment options are given to him. Once the customer makes the payment the policy is issued and given to customer in PDF format in mail and WhatsApp.

2. The E-Quotes are given to the customer depending upon his requirement and after that the customer can choose one company to buy insurance. Once the customer chooses the company he can fill the required online in the portal along with stamp and self-attested E-Quote copy. Once all the details are filled the payment options are given to the customer and customer makes the payment. The policy is issued and given in PDF format in mail and WhatsApp.

Issuance of the policy

1. The policy is issued directly for some products and policy in PDF format is given to the customer.

2. Some companies take 2 to 3 working days to issue the policy so the issuance of policy takes some days to get issued.

Issuance of endorsement

An endorsement is issued to the policyholder whenever any contractual changes (permitted by the plan/policy) are requested by the policyholder, accepted by the Insurer and made in the policy. The turnaround time is 7 working days from the date of receipt of complete documents. The request is handled Offline.

Collection of renewal premiums and remittance to insurers

Customer has to directly go to insurer’s website and pay the renewal premium. Customer can input policy number for which premium is due and enter the DOB of the life insured. Pay the amount due on the Payment Gateway through internet banking, debit card, credit card. Receipt for renewal payment will be sent to register E-mail Id immediately after the payment. For any service related queries, customer can contact us on 7304332968 or Email us at business.support@probusinsurance.com.

Pre-inspection of risks

The occupancies which require pre-inspection for policy issuance cannot be issued through online.

Appointment of surveyors/ advocates

The surveyors/advocates are appointed only during claim.

Submission of survey reports

Submission of survey report/s happen/s at the time of claim.

Settlement and payment of claims

As we are an intermediary, insured intimate to us if there is a claim then details are sent to insurer. The list of requirements which insurer needs is given to insured. After which the surveyor assesses and finalizes the claim amount. In some cases, advocate is appointed for assessment and decision on final settlement amount. The claim amount is credited in customer’s account.

For placing a claim request the policy holder can call to insurer at their customer service number or they can call us on our claim service no.9372589505 or write to us at claims@probusinsurance.com. Our team will connect you to the insurer. The claim is settled and paid by the insurance company directly to the customer’s account. If the customer does not receive the satisfactory service or have any other escalations, he/she can use the same e-mail id and phone no. to get the concerns resolved. Depending upon the requests/ escalations the TAT is 15 to 30 working days.

Other service operation as may be specific for the products

Not Applicable.

The Sexual Harassment of Women At Workplace (Prevention, Prohibition and Redressal) Act, 2013

Introduction

Probus Insurance Broker Pvt Ltd. (PIBPL) recognises the right of every employee and volunteer to be able to attend work and to perform their duties without being subjected to any form of sexual harassment.

It isthe obligation and responsibility of every employee and volunteer to ensure that the workplace isfree from sexual harassment.

PIBPL is fully committed to its obligation to eliminate sexual harassment in the workplace.

Purpose & Objective

The purpose of this document is to outline PIBPL’s position on sexual harassment and to document the process which is to be followed if any grievances arise.

The objective in implementing and enforcing this policy is to define workplace sexual harassment, prohibit it in all forms, carry out appropriate disciplinary measures in the case of violations, and provide procedures for lodging complaints about conduct that violates this policy and investigating sexual harassment claims.

Scope

This policy applies to all employees of the Company and those working for the company at all locations. All employees, including Directors, President, VP’s, AVP’s, Regional Heads and Managers, will be subject to discipline, up to and including discharge, for any act of sexual harassment they commit.

Definitions

Sexual harassment means any unwelcome sexual advance, unwelcome request for sexual favours, or other unwelcome conduct of a sexual nature which makes a person feel offended, humiliated or intimidated, and where that reaction is reasonable in the circumstances. Examples of sexual harassment include, but are not limited to,

• staring or leering

• unnecessary familiarity, such as deliberately brushing up against you or unwelcome touching

• suggestive comments or jokes

• insults or taunts of a sexual nature

• intrusive questions or statements about your private life

• displaying posters, magazines or screen savers of a sexual nature

• sending sexually explicit emails or text messages

• inappropriate advances on social networking sites

• accessing sexually explicit internet sites

• requests for sex or repeated unwanted requests to go out on dates

• behaviour that may also be considered to be an offence under criminal law, such as physical assault, indecent exposure, sexual assault, stalking or obscene communications

Behaviour that is based on mutual attraction, friendship and respect is not sexual harassment.

Policy

The Company will not tolerate sexual harassment under any circumstances. Responsibility lies with every Employee/Associate to ensure that sexual harassment does not occur.

This policy applies to conduct that takes place in any work-related context, including conferences, work functions, social events and business trips.

A breach of this policy will result in disciplinary action, up to and including termination of employment. The Company strongly encourages any employee who feels that they have been sexually harassed to take immediate action. If an employee or volunteer feels comfortable in doing so, it is preferable to raise the issue with the person directly with a view to resolving the issue by discussion. The employee or volunteer should identify the harassing behavior, explain that the behavior is unwelcome and offensive and ask that the behavior stops.

Alternatively, or in addition, they may report the behavior in accordance with the relevant procedure. Once a report is made the organization has the right to determine how the report should be dealt with in accordance with its obligations and this policy.

Any reports of sexual harassment will be treated seriously and promptly with sensitivity. Such reports will be treated as completely confidential up to the point where a formal or informal complaint is lodged against a particular person, at which point that person must be notified under the rules of natural justice. Complainants have the right to determine how to have a complaint treated, to have support or representation throughout the process, and the option to discontinue a complaint at any stage of the process.

The alleged harasser also has the right to have support or representation during any investigation, as well as the right to respond fully to any formal allegations made. There will be no presumptions of guilt and no determination made until a full investigation has been completed.

No employee or volunteer will be treated unfairly as a result of rejecting unwanted advances. Disciplinary

action may be taken against anyone who victimizes or retaliates against a person who has complained of sexual harassment, or against any employee or volunteer who has been alleged to be a harasser. All employees and volunteers have the right to seek the assistance of the relevant tribunal or legislative body to assist them in the resolution of any concerns.

Managers or Seniors who fail to take appropriate corrective action when aware of harassment of a person will be subject to disciplinary action.

Complaint Resolution Procedures

Individuals should report complaints of conduct believed to violate Company’s sexual harassment policy according to the policy’s complaint procedures. To initiate a formal investigation into an alleged violation of this policy, employees may be asked to provide a written statement about the alleged misconduct to the HR head / ICC. Complaints should be submitted as soon as possible after an incident has occurred. The HR head may assist the complainant in completing the statement. To ensure the prompt and thorough investigation of a sexual harassment complaint, the complainant should provide as much of the following information as is possible:

1. The name, department and position of the person or persons allegedly causing the harassment. 2. A description of the incident(s), including the date(s), location(s) and the presence of any witnesses.

3. The effect of the incident(s) on the complainant’s ability to perform his or her job, or on other terms or conditions of his or her employment.

4. The names of other individuals who might have been subject to the same or similar harassment. 5. What, if any, steps the complainant has taken to try to stop the harassment.

6. Any other information the complainant believes to be relevant to the harassment complaint.

An aggrieved employee needs to file a written complaint to ICC from three months from the date of the incident and in case of series of such incidents within three months from the last such incident. However, any delay in filing the complaint can be condoned by the committee upto further three months. In case of physical or mental incapability of the aggrieved woman, her legal heirs or such other person as described in Rule 6 of The Sexual Harassment of Women at Workplace (Prevention, Prohibition and Redressal) Rules, 2013 (“the Rules”) may make a complaint.

On receiving the complaint the committee, before initiating an inquiry, may take steps to settle the matter between her and the respondent through conciliation and when a settlement is arrived no further inquiry is conducted. If the conciliation fails or any term of the settlement arrived at has not been complied with by the respondent, the committee shall proceed further with the inquiry.

Internal Complaint Committee (ICC) comprises of the following members

Introduction

Probus Insurance Broker Pvt Ltd. (PIBPL) recognises the right of every employee and volunteer to be able to attend work and to perform their duties without being subjected to any form of sexual harassment.

It isthe obligation and responsibility of every employee and volunteer to ensure that the workplace isfree from sexual harassment.

PIBPL is fully committed to its obligation to eliminate sexual harassment in the workplace. Purpose & Objective

The purpose of this document is to outline PIBPL’s position on sexual harassment and to document the process which is to be followed if any grievances arise.

The objective in implementing and enforcing this policy is to define workplace sexual harassment, prohibit it in all forms, carry out appropriate disciplinary measures in the case of violations, and provide procedures for lodging complaints about conduct that violates this policy and investigating sexual harassment claims.

Scope

This policy applies to all employees of the Company and those working for the company at all locations. All employees, including Directors, President, VP’s, AVP’s, Regional Heads and Managers, will be subject to discipline, up to and including discharge, for any act of sexual harassment they commit.

Definitions

Sexual harassment means any unwelcome sexual advance, unwelcome request for sexual favours, or other unwelcome conduct of a sexual nature which makes a person feel offended, humiliated or intimidated, and where that reaction is reasonable in the circumstances. Examples of sexual harassment include, but are not limited to,

- staring or leering

- unnecessary familiarity, such as deliberately brushing up against you or unwelcome touching

- suggestive comments or jokes

- insults or taunts of a sexual nature

- intrusive questions or statements about your private life

- displaying posters, magazines or screen savers of a sexual nature

- sending sexually explicit emails or text messages

- inappropriate advances on social networking sites

- accessing sexually explicit internet sites

- requests for sex or repeated unwanted requests to go out on dates

- behaviour that may also be considered to be an offence under criminal law, such as physical assault, indecent exposure, sexual assault, stalking or obscene communications

Behaviour that is based on mutual attraction, friendship and respect is not sexual harassment. Policy

The Company will not tolerate sexual harassment under any circumstances. Responsibility lies with every Employee/Associate to ensure that sexual harassment does not occur.

This policy applies to conduct that takes place in any work-related context, including conferences, work functions, social events and business trips.

A breach of this policy will result in disciplinary action, up to and including termination of employment. The Company strongly encourages any employee who feels that they have been sexually harassed to take immediate action. If an employee or volunteer feels comfortable in doing so, it is preferable to raise the issue with the person directly with a view to resolving the issue by discussion. The employee or volunteer should identify the harassing behavior, explain that the behavior is unwelcome and offensive and ask that the behavior stops.

Alternatively, or in addition, they may report the behavior in accordance with the relevant procedure. Once a report is made the organization has the right to determine how the report should be dealt with in accordance with its obligations and this policy.

Any reports of sexual harassment will be treated seriously and promptly with sensitivity. Such reports will be treated as completely confidential up to the point where a formal or informal complaint is lodged against a particular person, at which point that person must be notified under the rules of natural justice. Complainants have the right to determine how to have a complaint treated, to have support or representation throughout the process, and the option to discontinue a complaint at any stage of the process.

The alleged harasser also has the right to have support or representation during any investigation, as well as the right to respond fully to any formal allegations made. There will be no presumptions of guilt and no determination made until a full investigation has been completed.

No employee or volunteer will be treated unfairly as a result of rejecting unwanted advances. Disciplinary

action may be taken against anyone who victimizes or retaliates against a person who has complained of sexual harassment, or against any employee or volunteer who has been alleged to be a harasser. All employees and volunteers have the right to seek the assistance of the relevant tribunal or legislative body to assist them in the resolution of any concerns.

Managers or Seniors who fail to take appropriate corrective action when aware of harassment of a person will be subject to disciplinary action.

Complaint Resolution Procedures

Individuals should report complaints of conduct believed to violate Company’s sexual harassment policy according to the policy’s complaint procedures. To initiate a formal investigation into an alleged violation of this policy, employees may be asked to provide a written statement about the alleged misconduct to the HR head / ICC. Complaints should be submitted as soon as possible after an incident has occurred. The HR head may assist the complainant in completing the statement. To ensure the prompt and thorough investigation of a sexual harassment complaint, the complainant should provide as much of the following information as is possible:

- The name, department and position of the person or persons allegedly causing the harassment. 2. A description of the incident(s), including the date(s), location(s) and the presence of any witnesses.

- The effect of the incident(s) on the complainant’s ability to perform his or her job, or on other terms or conditions of his or her employment.

- The names of other individuals who might have been subject to the same or similar harassment. 5. What, if any, steps the complainant has taken to try to stop the harassment.

- Any other information the complainant believes to be relevant to the harassment complaint.

An aggrieved employee needs to file a written complaint to ICC from three months from the date of the incident and in case of series of such incidents within three months from the last such incident. However, any delay in filing the complaint can be condoned by the committee upto further three months. In case of physical or mental incapability of the aggrieved woman, her legal heirs or such other person as described in Rule 6 of The Sexual Harassment of Women at Workplace (Prevention, Prohibition and Redressal) Rules, 2013 (“the Rules”) may make a complaint.

On receiving the complaint the committee, before initiating an inquiry, may take steps to settle the matter between her and the respondent through conciliation and when a settlement is arrived no further inquiry is conducted. If the conciliation fails or any term of the settlement arrived at has not been complied with by the respondent, the committee shall proceed further with the inquiry.

Internal Complaint Committee (ICC) comprises of the following members

| Internal Committee (IC) members | ||

| Name | Contact Number | Email Id |

|---|---|---|

| Trupti Balasubramaniam | 9790917082 | Trupti@probusinsurance.com |

| Anita Teli | 9819581317 | Anita@probusinsurance.com |

| Bhawna Sharma | 9594951225 | Bhawna@probusinsurance.com |

| Sarita Joshi | 9022985808 | Sarita@probusinsurance.com |

| Vidhi Shah (external) | 9324182599 | vidhi@synapsepr.in |

Discipline

Employees who violate this policy are subject to appropriate discipline. If an investigation results in a finding that this policy has been violated, the mandatory minimum discipline is a written reprimand. The discipline for very serious or repeat violations is termination of employment. Persons who violate this policy may also be subject to civil damages or criminal penalties.

Confidentiality

All inquiries, complaints and investigations are treated confidentially. Information is revealed strictly on a need-to-know basis. Information contained in a formal complaint is kept as confidential as possible. However, the identity of the complainant is usually revealed to the respondent and witnesses. The HR takes adequate steps to ensure that the complainant is protected from retaliation during the period of the investigation. All information pertaining to a sexual harassment complaint or investigation is maintained by the HR head in secure files. The HR head can answer any questions relating to the procedures for handling information related to sexual harassment complaints and investigations to complainants and respondents.

Protection To Complainant / Victim

The Company is committed to ensuring that no employee who brings forward a harassment concern is subject to any form of reprisal. Any reprisal will be subject to disciplinary action.

The Company will ensure that the victim or witnesses are not victimized or discriminated against while dealing with complaints of sexual harassment.

However, anyone who abuses the procedure (for example, by maliciously putting an allegation knowing it to be untrue) will be subject to disciplinary action.

Conclusion

In conclusion, the Company reiterates its commitment to providing its employees, a workplace free from harassment/ discrimination and where every employee is treated with dignity and respect.

Discipline

Employees who violate this policy are subject to appropriate discipline. If an investigation results in a finding that this policy has been violated, the mandatory minimum discipline is a written reprimand. The discipline for very serious or repeat violations is termination of employment. Persons who violate this policy may also be subject to civil damages or criminal penalties.

Confidentiality

All inquiries, complaints and investigations are treated confidentially. Information is revealed strictly on a need-to-know basis. Information contained in a formal complaint is kept as confidential as possible. However, the identity of the complainant is usually revealed to the respondent and witnesses. The HR takes adequate steps to ensure that the complainant is protected from retaliation during the period of the investigation. All information pertaining to a sexual harassment complaint or investigation is maintained by the HR head in secure files. The HR head can answer any questions relating to the procedures for handling information related to sexual harassment complaints and investigations to complainants and respondents.

Protection To Complainant / Victim

The Company is committed to ensuring that no employee who brings forward a harassment concern is subject to any form of reprisal. Any reprisal will be subject to disciplinary action.

The Company will ensure that the victim or witnesses are not victimized or discriminated against while dealing with complaints of sexual harassment.

However, anyone who abuses the procedure (for example, by maliciously putting an allegation knowing it to be untrue) will be subject to disciplinary action.

Conclusion

In conclusion, the Company reiterates its commitment to providing its employees, a workplace free from harassment/ discrimination and where every employee is treated with dignity and respect.

Privacy & Terms