Are you feeling the stress of increasing health insurance premiums and sky-high hospital bills? You are definitely not alone. Medical inflation is one of the most pressing issues today, with healthcare costs climbing faster than the general inflation rate. Because of this, health insurance policies are also getting pricier and harder to afford, especially for… Continue reading Rising hospital bills and health insurance premiums: Will Budget 2026 help to regulate this? Check what experts are demanding from hospital groups and IRDAI

Category: Probus In News

Union Budget 2026 Must Prioritise Cyber Insurance For Digital India

On a typical morning in urban India, digital systems quietly run the country. A student logs into an online class, a delivery driver follows a GPS route, and a pensioner checks her bank balance on a mobile app. None of this feels remarkable anymore and that is precisely the point. Digital platforms have evolved into… Continue reading Union Budget 2026 Must Prioritise Cyber Insurance For Digital India

Budget 2026 Expectations Live Updates: Finance minister must balance recovery and fiscal roadmap

Budget 2026 Expectations Live Updates: Come February 1, Finance Minister Nirmala Sitharaman will present her record ninth consecutive Union Budget — the longest streak ever by any finance minister — at 11 AM. Markets will stay open, with NSE and BSE operating regular trading hours, as investors and businesses brace for announcements shaping FY27. All… Continue reading Budget 2026 Expectations Live Updates: Finance minister must balance recovery and fiscal roadmap

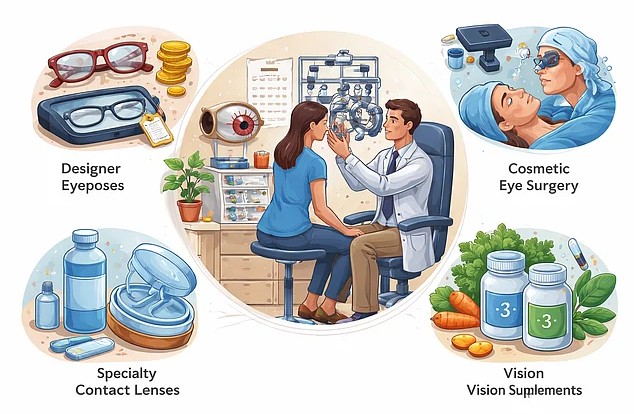

Eye-Care Expenses You Can’t Insure – And How To Plan for Them

From an insurer’s lens, eye care is still seen as a predictable and recurring expense rather than a sudden medical risk. Glasses, contact lenses, and routine eye check-ups are costs most people incur regularly, much like dental care. “Health insurance in India is primarily designed to protect against high, unexpected hospitalization expenses, not everyday medical needs.… Continue reading Eye-Care Expenses You Can’t Insure – And How To Plan for Them

Over 50% of vehicles lack third-party insurance; is yours among them? Know legal consequences, cost of coverage, and savings

A lot of vehicle owners believe they drive responsibly and follow every rule, but accidents can happen out of the blue, and it’s not always your fault. Just one unexpected accident could lead to legal issues and compensation claims running into lakhs, even if you weren’t at fault. The reason? You might not have third-party… Continue reading Over 50% of vehicles lack third-party insurance; is yours among them? Know legal consequences, cost of coverage, and savings

Kidney Transplants And Health Insurance: What’s Covered, What’s Not

In general, most comprehensive health insurance policies cover kidney transplants after the waiting period has ended. “Coverage generally includes hospitalization expenses related to the transplant surgery, which can include surgeon fees, intensive care unit (ICU) charges, the cost of a hospital room, diagnostic tests, and medications that are administered during the patient’s hospitalization,” says Arun… Continue reading Kidney Transplants And Health Insurance: What’s Covered, What’s Not

Home Loan Insurance Costs Less Than You Think

Home loan insurance primarily covers the outstanding loan amount in case of the borrower’s death. Some policies also cover permanent disability or critical illness. In such situations, the insurer settles the outstanding loan with the lender, helping the family retain ownership of the home. Home Loan Insurance Premiums Are A Small Portion of The EMI … Continue reading Home Loan Insurance Costs Less Than You Think

Higher health insurance coverage at least cost: Do super top-up plans live up to their promise? Mind the pitfalls

Nowadays, cancer treatment, organ transplant and other critical treatments can set you back Rs 10-15 lakh in just a few days. For a lot of families, that’s more than a year’s savings, all gone before they even get the discharge summary. With medical costs continuing to rise, many policyholders are increasingly chasing hefty health insurance… Continue reading Higher health insurance coverage at least cost: Do super top-up plans live up to their promise? Mind the pitfalls

Overseas Travel Insurance Rebounds: 96.73 Lakh Lives Covered In 2024-25

The Insurance Regulatory and Development Authority of India’s (Irdai) annual report for 2024–25 points to a sharp rebound in overseas travel insurance, mirroring the strong revival in outbound travel. During the year, insurers provided overseas travel cover to about 96.73 lakh individuals through nearly 27.97 lakh policies. This represents a substantial volume of international travel… Continue reading Overseas Travel Insurance Rebounds: 96.73 Lakh Lives Covered In 2024-25

Things to keep in mind while buying health insurance for parents in high-pollution areas

Choosing the right health insurance is no easy task, and most of us make critical mistakes in the process, especially for parents in high-pollution areas. A common mistake health insurance buyers make is to underestimate respiratory risks and opt for low-coverage plans. Such health insurance plans don’t provide adequate coverage for pollution-related complications, even though… Continue reading Things to keep in mind while buying health insurance for parents in high-pollution areas