The Insurance Regulatory and Development Authority of India (Irdai) has mandated that all health insurance policies cover Ayurveda, Yoga & Naturopathy, Unani, Siddha, and Homeopathy (AYUSH) treatments. The industry is definitely intended and moving forward in the right direction, but the benefits are still not as flexible as regular hospitalization coverage. Insurers are paying more… Continue reading Insurers Expand AYUSH Benefits—With Caps, Caution, And Caveats

Category: Probus In News

New car buyers alert: The smart way to choose your car insurance policy

Often, when you are caught up in the thrill of buying a new car, you might have done your homework to snag a great deal on your vehicle, but you might still end up losing money by opting for a pricey car insurance policy. This happens because most people tend to buy their first car… Continue reading New car buyers alert: The smart way to choose your car insurance policy

Why A Simple Medical File Can Speed Up Your Health Insurance Claim

There is no requirement or condition in a health insurance policy that old test reports, prescriptions, or treatment histories must be produced. The past treatment history and other particulars will be recorded by the hospital where the insured is admitted for treatment, and further courses of treatment will be decided accordingly by the treating doctor.… Continue reading Why A Simple Medical File Can Speed Up Your Health Insurance Claim

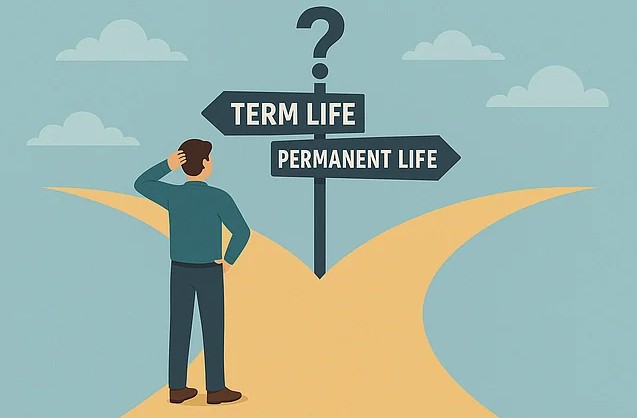

Convertible Life Insurance: Does It Make Sense, And Should You Convert?

Convertible term insurance is a term insurance policy that initially provides coverage for a fixed term. However, it allows the policyholder to convert it into a permanent (whole or endowment) policy without undergoing a fresh medical exam. We take a look at whether such policies make sense and whether you should convert. Convertibility Allows Upgrading… Continue reading Convertible Life Insurance: Does It Make Sense, And Should You Convert?

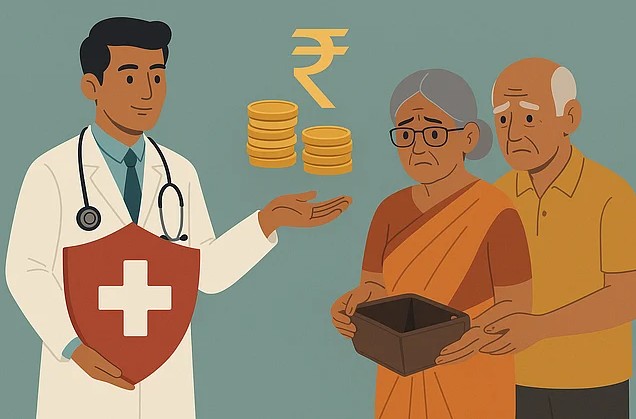

Ayushman Bharat’s New Senior Cover Helps, But Out-of-Pocket Gaps Remain

The Ayushman Bharat–Pradhan Mantri Jan Arogya Yojana (AB-PMJAY) offers Rs 5 lakh annual coverage per family for secondary and tertiary healthcare. According to media reports, eligible families can now extend this limit to Rs 10 lakh. This is due to a special top-up introduced for senior citizens aged 70 and above. Extra Rs 5 Lakh… Continue reading Ayushman Bharat’s New Senior Cover Helps, But Out-of-Pocket Gaps Remain

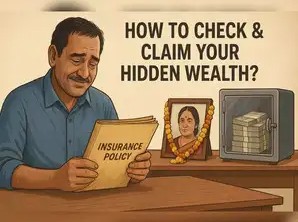

Have unclaimed insurance amount? Here’s how to check and claim your hidden wealth

Did you know that in India, more than Rs 25,000 crore is lying unclaimed in insurance policies with different insurance companies? This happens because policyholders either forget to make a claim or their nominees are unaware that such policies exist. In many instances , families miss out on these dormant funds due to outdated bank… Continue reading Have unclaimed insurance amount? Here’s how to check and claim your hidden wealth

Probus Appoints Atrey Bhardwaj As Chief Growth Officer

Probus has appointed Atrey Bhardwaj as Chief Growth Officer as the Insurtech and insurance broking firm sharpens its focus on scale, digital expansion and distribution-led transformation. Bhardwaj brings more than twenty years of experience across insurance and financial services, spanning marketing, sales, distribution strategy and corporate partnerships. His leadership tenures at Bajaj Allianz Life Insurance,… Continue reading Probus Appoints Atrey Bhardwaj As Chief Growth Officer

Probus Recognized Among Top 50 Mid-Size Companies in India’s Best Workplaces™ for Women 2025

Probus, a rapidly growing name in India’s financial services and insurance broking space, has been honoured as one of India’s Best Workplaces™ for Women 2025 (Top 50 Mid-size) by Great Place to Work® India. This great recognition underlines Probus’s intentional drive to create an environment in which women are empowered, inclusivity is embraced, and all… Continue reading Probus Recognized Among Top 50 Mid-Size Companies in India’s Best Workplaces™ for Women 2025

What If the Wedding Doesn’t Go As Planned? Insurance Has You Covered

Weddings are emotional milestones and come with big spending. Sometimes, unexpected situations like fire, sudden illness, or natural calamity can disrupt months of planning and force a family to postpone/cancel the event. These are things that cannot be planned in advance, but in case a wedding is cancelled for any reason, it can be a… Continue reading What If the Wedding Doesn’t Go As Planned? Insurance Has You Covered

Does Your Health Insurance Cover Gym And Sports Injuries?

Rohan Mehta, 32, a marketing professional from Pune, suffered a ligament tear during a gym workout. His insurer covered hospitalization but denied physiotherapy expenses. He later added a personal accident plan for wider protection. What Is Covered What Is Not If you are a gym rat or into sports, your health insurance covers you for… Continue reading Does Your Health Insurance Cover Gym And Sports Injuries?