Smart Investing Made Simple: The Power of an Integrated Investment Plan

Smart investors constantly search for financial products that deliver both safety and growth potential. The Securities and Exchange Board of India (SEBI) is developing an

Life Insurance

Life insurance is a contract signed between a policyholder or insured person and an insurance provider. This contract determines a specific and pre-decided sum (also known as “Cover Amount or “Sum Assured”) to be paid to the policyholder’s family after his/her death. The sum of the insurance policy is paid in lieu of a certain amount of premium.

The plan ensures that you as well as your family members are able to receive the much-needed financial support in case of your untimely demise due to any reason, such as accident, critical illness, and so on. Despite the fact that human life cannot be quantified, a monetary sum can assist the dependents in continuing their lives without abandoning their necessities and requirements.

Your dependents will receive a lump-sum amount after your death.

Be it your children’s education or wedding, you can support your children with a child plan.

Similar to other insurance policies, a life insurance policy functions in a manner that the policyholder must pay a premium for a set period of time. After the death of the insured person, the insurance company will cover the financial needs of the insured’s family. The amount to be paid by the insurance company will depend upon the premium the insured person paid to the company.

Let’s understand life insurance with a simple example:

Mr. Wilson wants to protect his family in case of his early death. So, he buys a 20-year life insurance policy with a premium of Rs. 15,000 per year. If Mr. Wilson dies within the 20-year term, the insurance company will pay his family the beneficiary amount of Rs. 15,00,000. In case the policyholder is caught up with a terminal or critical illness, the insurance company will pay a lump sum amount for the medical expenses.

Therefore, life insurance provides much-needed financial assistance to the family members of the insured person in the event of emergencies.

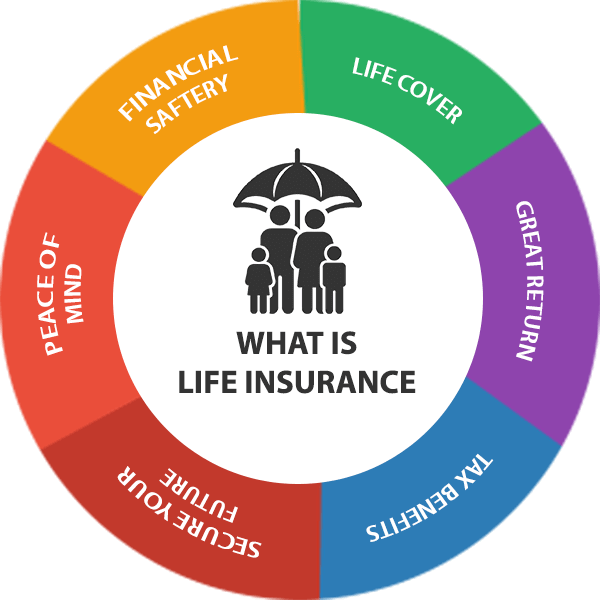

Here are some features that help make life insurance coverage a great choice for anyone:

Individuals can safeguard themselves and their families with life insurance in the event that something bad happens to the insured. The insurer pays an amount equal to the sum assured as indicated in the contract, plus any incentives that may be available.

There are some life insurance policies that offer two lucrative benefits of both insurance and investment. This simply means that one part of your premium goes towards insurance and the other part is invested in debt, equity, etc. With a strong protective covering and higher returns on your investments, you certainly get the best of both options.

A life insurance plan also acts as a saving instrument by providing maturity benefits. In case the policyholder lives to the end of the policy term without any claims, the total amount of premiums is refunded at the policy’s maturity time. For example, if you pay a yearly premium of Rs. 10,000 for a 30-year term insurance policy, you would receive the premium money back (Rs. 3,00,000) along with the bonus amount. This is only when you survive the policy tenure and you have paid all of your premiums.

Tax saving is an additional benefit when it comes to purchasing a life insurance plan. As per Section 80C of the Income Tax Act, 1961, you will be subjected to get tax benefits. Simply putting, whatever premium amount you pay for your life insurance policy, it is eligible for having a maximum tax deduction of up to Rs. 1,50,000. Besides, any payouts that you will receive from your life insurance policy will be entirely tax-free under section 10(10D). In case you have chosen for an additional health-associated rider, you are subjected to avail tax deductions under Section 80D of the Income Tax Act.

Be it your children’s education loan, credit card loan, building capital for your business, or retirement plan, dealing with such kinds of liabilities can lead to great financial as well as mental pressure. And when there is no steady source of income, such liabilities can prove even more challenging. Therefore, in order to attain your important goals, you need a significant amount of financial support that life insurance can easily provide.

Life insurance policy comes with a multitude of riders, such as Critical Illness Rider, Accidental Death Rider, Cashless Treatment Rider, etc. They provide extra protection to the individuals as well as their family members in cases where basic life insurance coverage may not come into play or need.

One of the most popular life insurance plans is term life insurance. It lasts for a set amount of time and then expires at the end of the term. The best part about a term plan is that the premiums are reasonably priced.

Because the premiums are cheap, these plans are suitable for persons who have just put their initial steps in growing their careers. The plan pays out a fixed amount in case of the demise of the insured person within the tenure.

By combining investment and insurance, ULIPs (Unit Linked Insurance Plans) provide you with the best of both spheres. Thus, you will get both life insurance as well as investment options when you will choose ULIPs. Most of the ULIPs have a lock-in period of 5 years, thus it can be considered as a long-term investment strategy. As ULIPs are linked to the capital markets, they have a great potential to deliver top-notch results in comparison to traditional life insurance plans.

However, one must check out the risk appetite and various risk factors before purchasing a plan. It is because there is also a risk of low returns and everything primarily depends upon the market’s performance.

A child insurance plan is specifically designed to protect your child’s future. It helps develop an education fund to support your child’s hopes and objectives in addition to providing life insurance. The plan combines investment and insurance features to help you build wealth for your child’s future needs. You can start investing in such plans as soon as your child is born to ensure a bright financial future for your child.

An endowment plan is a type of life insurance policy that provides both a life insurance plan and a savings account. If you purchase the finest saving plan, you can save regularly throughout time and receive a lump sum payment at maturity. If you have long-term financial goals, like supporting your child’s education, setting up your own business, purchasing a new home, or living a luxurious retirement life, purchasing an endowment plan can help you to achieve them all.

Whole life insurance is a sort of permanent life insurance that covers the insured for the rest of their lives as long as the premiums are paid on time. It is distinct from term life insurance, which provides coverage for a specific period of time. In addition to providing a death benefit, whole life insurance has a savings component that can develop financial value over time.

A money return policy is a sort of life insurance that pays out money at predetermined intervals. Throughout the policy’s term, a percentage of the sum assured is repaid to the policyholder. If the policyholder dies while the policy is still active, the beneficiaries will get the entire sum assured, regardless of any Survival Benefits that have already been paid. In a nutshell, money-back plans are liquid endowment plans.

Retirement plans aid in the accumulation of a retirement fund, thus allowing you to fully enjoy your post-retirement years. You have the option of naming your spouse as the beneficiary of your life insurance policy. In case something happens to you, your family will be financially prepared for surviving. In addition, getting the best retirement plan will assist you in paying for medical bills during your retirement years.

| Insurance company | Insurance Plan | Entry Age | Policy Term | Sum Assured |

| Aditya Birla Sun Life Insurance | Shield Plan | 18 to 65 years | 10, 20 to 30 years | From Rs 25 Lakhs to no upper limit |

| Bajaj Allianz Life Insurance | i-Secure Plan | 18 to 70 years | 10/30 years | From 20 Lakhs to no upper limit |

| Canara HSBC OBC Life Insurance | iSelect + Term Plan | 18 to 65 years | 10/30 years | From Rs 25 lakhs to no upper limit |

| Future Generali Life Insurance | Online Term Insurance | 18 to 55 years | 10/75 years | From Rs 50 lakhs to no upper limit |

| ICICI Prudential Life Insurance | Pru iProtect | 20 to 75 years | 10/30 years | From 3 lakhs to no upper limit |

| Indiafirst life Insurance | Life Plan | 18 to 60 years | 5/40 years | From 1 lakh to 5 crores |

| Max Life Insurance | Term Plan | 18 to 60 years | 10/50 years | From 25 lakhs to 100 crores |

| Reliance Nippon Life Insurance | Life Protection Plus | 18 to 60 years | 10/40 years | From Rs 25 lakhs to no upper limit |

| Exide Life Insurance | Elite Term | 21 to 60 years | 10 to 40 years | Minimum is Rs 50 lakhs, and the maximum is Rs 10 Crores |

| Aegon Life Insurance | Term Plan | 18 to 75 years | 5/40 years | From 10 lakh to no upper limit |

| IDBI Federal Life Insurance | Income Protect Plan | 25 to 60 years | 10/30 years | N/A |

| Kotak Mahindra Life Insurance | Preferred eTerm | 18 to 75 years | 10/40 years | From Rs 25 lakhs to no upper limit |

| PNBmetlife India Insurance | Mera Term Plan | 18 to 65 years | 10/40 years | From Rs 10 lakhs to no upper limit |

| SBI Life Insurance | Shubh Nivesh Plan | 18 to 60 years | 5/30 years | From Rs 75000 to no upper limit |

Under this rider, critical illnesses such as multiple sclerosis and cancer are covered. The rider includes more than 100 critical diseases. Regardless of the overall expenses paid during the actual medical treatment, the critical illness rider gives an upfront lump payment amount.

The accidental death of the insured person is covered under this rider. In case the insured person dies due to an accident, the nominees of the policyholder will receive the sum assured along with the rider benefits. This rider provides financial protection to the family members of the insured person in case of his/her sudden demise.

This rider assists in the event that the insured is permanently incapacitated as a result of an accident, rendering them unable to work for a living. Depending on the policy terms, the insurer pays a specified sum assured for a set period of time. Most insurers typically pay a percentage of the rider’s accrued benefits per month for a set number of years.

If the insured is permanently or partially disabled as a result of an accident, rendering him/her unable to work for a living, the permanent disability rider comes as assistance. Depending on the policy terms, the insurer pays a specified sum assured for a set period of time. Most insurers typically pay a percentage of the rider’s accrued benefits per month for a set number of years.

In case the policyholder is critically ill, disabled, or dead, all the future premiums are paid by the insurance provider. This rider takes off the financial burden from the insured person’s shoulder. As the insurance provider continues to pay premiums for the policy term, there is no effect on the sum assured.

Gender is the second most important factor that affects the cost of your premium. Biologically speaking, women are more likely to live longer than men due to various reasons. This simply means that women need to pay fewer premiums than men.

Before purchasing a life insurance policy, the insurance company may ask you to go through a medical exam in order to access your health records. In case the individual has some history of medical conditions, such as heart disease, bypass surgery, etc., the premium rates will increase accordingly.

In addition, the insurance company will also evaluate your future medical conditions by checking your cholesterol levels, weight, blood pressure, etc. On the basis of such metrics, the premium rates will be determined.

The particulars or characteristics based on which you have chosen the policy is another factor that impacts your life insurance premium. Policies that are purchased for long-term and larger benefits usually have higher premium rates than those which are short-term and have fewer benefits.

It can be difficult to choose the right type of life insurance, but it is a pivotal decision. Here are some guidelines to help you choose the best life insurance policy:

Check Out the Reputation of the Insurance Provider:

In today’s world, a multitude of insurance providers are flooding the market. This further increases complexity and ambiguity among the individuals about where to buy from. However, you should always choose an insurance company that is well renowned or reputed among the people. With the help of reviews and ratings, you can check whether or not the company has met its customer’s expectations.

Determine The Term:

Whether you wish your life insurance to be for 10 years or 20 years, you need to be clear about the specific period of time for which your policy will run. The length of your policy should depend upon the length of your need. So. If you have some long-term needs, such as your children’s education, you can opt for 20 or 30 years plan accordingly.

Look At the Claim Settlement Ratio:

How many claims have been settled by the insurance company and in what time? – this is a very important question to consider before choosing a life insurance plan from a company. The company which has the highest claim settlement ratio is certainly the safest and the best one.

Determine Your Life’s Goal:

Be it the fact that you want to support your family after your death, raise funds for your children’s education, settle abroad, purchase or build a new house, or start up a business – you should always be clear of what your life’s goals are. It is only after determining your objectives of life, you can plan for a life insurance policy.

Compare & Analyze:

This is one of the best tricks to choose the right plan for you. There are a plethora of online platforms available where you can compare and analyze different life insurance plans so that you can make a wise decision. These websites provide you with steak comparisons of premium prices, benefits and features, available payment options, and policy terms.

Take Expert Advice:

Sometimes, it is better to take advice from professionals as they know more than common people do. Therefore, do not hesitate to contact an insurance expert because choosing a life insurance plan is certainly a critical decision that you make in your life.

All the insurance companies are well-equipped with a dedicated team in order to assist you with your queries. Be it the documentation process or the follow-up maintenance of the policy, the insurance providers are always on their toes to serve their customers in the best possible manner.

Before providing life insurance, the insurers carry out various processes, such as assessing risk factors, medical examinations, etc. After analyzing the health history, current health status, and future health risks, the premium rates are determined. In case the risks are greater, the premium rates go higher and vice versa.

In the event of the insured’s death, the nominee or dependents named by the policyholder at the time of purchase of life insurance receive a death benefit. This means that even if the death of the person (in whose name the policy is purchased) is caused by a health-related issue such as a COVID-19 outbreak, it will be covered under the policy.

In case you are caught up lying, cheating, stealing, or doing any other fraudulent activities, the insurance company may deny to settle the claim or cancel the policy.

You must tell your insurance company if you have smoked in the last 12 months. If you don’t divulge it straight away and subsequently do, you may be charged a high premium or your policy may be canceled.

No, it remains the same.

No. Deaths caused due to the ‘Act of God’ are not covered under the life insurance plan.

The amount of life insurance you require is determined by your lifestyle, spending habits, income, and the objective for which you wish to save. For instance, if you want to save for your child’s education, you need to consider the associated financial liabilities and then determine the amount of your life insurance.

Yes. Under any life insurance policy, you will be provided with a variety of options for paying premiums, such as yearly, half-yearly, quarterly, and monthly.

Yes. You need not pay any tax on the maturity of your life insurance policy. The amount you will receive as a maturity benefit will be subjected to tax deductions under the Income Tax Act, 1961.

Smart investors constantly search for financial products that deliver both safety and growth potential. The Securities and Exchange Board of India (SEBI) is developing an

Life is unpredictable, and sometimes, even the best-laid plans can get interrupted by unforeseen circumstances—job loss, medical emergencies, or sudden financial strain. When this happens,

In a world buzzing with anticipation and joy, you’re a couple who found themselves on the thrilling journey of pregnancy. Each flutter of movement brought

Life Insurance