Life Insurance LIC of India

LIC of India

LIC, or the Life Insurance Corporation of India, is a significant life insurance provider based in Mumbai that offers a variety of insurance products to its consumers. Insurance plans, pension plans, ULIP (Unit Linked Plans), corporate schemes, and child insurance plans are among the company’s most popular offerings.

The state-run insurer, LIC, is the country’s largest life insurance planner, with a customer base in the millions. With LIC policies, you may easily achieve long-term objectives and provide for your loved ones in the event of an unfortunate tragedy. The corporation provides a wide range of insurance products to its large customer base while also increasing the liability of the insurance holder’s savings.

All of the plans available are designed to protect the policyholder’s interests and act as trustees in their individual and collective capacities.

Key Highlights Of The Company

Here are the key highlights of the Life Insurance Corporation of India:

| Solvency Ratio | 1.55 |

| Gross Written Premium | Rs. 3,79,389.60 Cr. (2020-21) |

| Email Id | co_cc@licindia.com |

| Contact No. | +91-022 6827 6827 |

| Address | Life Insurance Corporation Of India Central Office ‘Yogakshema’ Jeevan Bima Marg Nariman Point Mumbai 400021 |

| SMS | SMS LICHELP to 56767877 |

Types of Life Insurance Plans Offered by LIC

Here are the types of life insurance plans offered by LIC. Let’s discuss them in detail!

1. LIC Endowment Plans

An endowment life insurance policy incorporates elements of life insurance with the rewards of saving. Here are the endowment plans offered by LIC.

| Name of the Plan | Age (in years) | Min. & Max. Sum Assured |

| LIC’s Bima Jyoti | Min.- 90 days Max.- 60 years | Min- Rs. 1,00,000 Max.- No Limit |

| LIC’s Bachat Plus | Min- 90 days Max- 65 years | Min- Rs. 1,00,000 Max- No Limit |

| LIC’s New Endowment Plan | Min- 8 years Max- 55 years | Min- Rs. 1,00,000 Max- No Limit |

| LIC’s New Jeevan Anand | Min- 18 years Max- 50 years | Min- Rs. 1,000,000 Max- No Limit |

| LIC’s Single Premium Endowment Plan | Min- 90 days Max- 65 years | Min- Rs. 50,000 Max- No Limit |

| LIC’s Jeevan Lakshya | Min- 18 days Max- 50 years | Min- Rs. 100,000 Max- No Limit |

| LIC’s Jeevan Labh | Min- 8 years Max- 59 years | Min- Rs. 2,00,000 Max- No Limit |

| LIC’s Aadhaar Stambh | Min Age- 8 years Max. Age- 55 years | Min.- Rs. 75,000 Max.- Rs. 300,000 |

| LIC’s Aadhaar Shila | Min Age- 8 years Max. Age- 55 years | Min.- Rs. 75,000 Max.- Rs. 300,000 |

- LIC’s Bima Jyoti

Looking for a plan that may provide you with both savings and protection? If so, choose none other than LIC Bima Jyoti. The plan offers you maximum protection in case of your demise during the period of the policy. The biggest benefit is that it offers a guaranteed lump sum payment to the user at maturity. It provides an appealing combination of protection and savings, as well as meeting liquidity requirements through a credit facility.

- LIC’s Bachat Plus

Bachat Plus from LIC is a popular plan by LIC that offers comprehensive assistance to your family in case of your death. In the case of the surviving policyholder, the lumpsum payment would be made to them. It is so flexible that you will have the option to pay your premium either as a lump sum or for a 5-year limited period, based on your preference. If the Life assured’s age at registration is less than 8 years, the risk within this policy will begin either 2 years from the policy’s start date or 2 years from the policy anniversary that overlaps with or immediately follows the completion of 8 years of age, whichever comes first.

- LIC’s New Endowment Plan

If you are looking for a plan that can provide you with both savings and protection, choose none other than LIC New Endowment Plan. The LIC New Endowment Plan gives financial support to the family of the deceased policyholder at any time before maturity. This non-linked, participating plan perfectly cater to liquidity due to its credit facility. Depending on the company’s financial performance, you may be entitled to a portion of its profits. And the biggest advantage is that if you live to the end of the policy period, you will be eligible for a maturity benefit.

- LIC’s New Jeevan Anand

The New Jeevan Anand Plan from LIC offers a good mix of protection and savings to the policyholder during the policy period. In case the buyer survives, they will get the lumpsum payment. Also, you don’t need to worry about its liquidity needs as it offers loan facilities as well. If the life insured dies within the policy period, a basic sum assured will be paid along with the sum assured on death, final supplementary bonus, vested simple reversionary bonuses, and more. Also, you are likely to receive a significant profit portion under this policy.

- LIC’s Single Premium Endowment Plan

The LIC Single Premium Endowment Plan is a savings cum protection plan that provides financial protection against death during the policy period. In case of the survival of the policyholder, the user will receive the lumpsum payment at the end of the policy period. With this plan, you will get dividends based on the company’s financial performance. Also, you will receive a maturity benefit if you live to the end of the policy period.

- LIC’s Jeevan Lakshya

Jeevan Lakshya from LIC combines protection and savings and even offers an Annual Income benefit to meet the necessities of life, extremely important to the success of children. Regardless of the Policyholder’s survival or untimely death, the lumpsum amount would be paid to the user without any hassle. The plan perfectly caters to liquidity with its credit facility.

You will get an annual income benefit equal to 10% of the base sum secured under the death benefit. In addition, you will receive an assured absolute equivalent amount to 110 percent of the minimum sum assured. When the policy matures, this will be paid. This will be paid on the anniversary of the policy.

- LIC’s Jeevan Labh

The Jeevan Labh endowment plan from LIC is a restricted premium paying, non-linked, with-profit endowment plan that provides combined protection and savings. In the event of the policyholder’s untimely death before maturity, the policy provides financial help to the policyholder’s family. If the policyholder survives, the lumpsum payment will be made to them.

Under the policy, you will be liable to get a portion of the company’s profits when rewards are disclosed after the year. This insurance policy offers a credible facility of loan as it comes with a liquidity option.

- LIC’s Aadhaar Stambh

Aadhaar Stambh by LIC is specially designed for male lives and provides both protection and savings. This non-linked and life assurance plan offers maximum financial protection to the policyholder in case of his/her demise. The policy offers the entire payment to the user at maturity.

When something unpleasant happens to the life insured, it provides good monetary help to his or her family. A loyalty enhancement and the money promised will be paid if the policyholder dies after 5 years but before the policy expires.

- LIC’s Aadhaar Shila

The Aadhaar Shila plan from LIC is developed specifically for women that provides both protection and savings. in the event of the policyholder’s untimely death before maturity, this plan provides financial help to the policyholder’s family. At the time of maturity, the lumpsum payment would be made to the user. Furthermore, this plan provides liquidity through its Auto Cover as well as a credit option.

When the insured dies, it pays out a death benefit. The nominee will get a death benefit in case of the death of the user during the first five years of the policy period. If the customer survives to the end of the policy period, he or she will get a loyalty bonus as well as the sum assured at maturity.

2. LIC Whole Life Plans

A Whole Life plan is a simple regular payment whole life plan that comes with a bonus facility. It lasts for the duration of the insured’s life, as long as the premiums are paid. Let’s discuss the whole life plan offered by LIC.

| Name of the Plan | Age (in years) | Min. & Max. Sum Assured |

| LICs Jeevan Umang | Min- 90 days (completed) Max.- 55 years | Min- Rs. 2,00,000 Max. – No Limit (The Basic Sum Assured shall be in multiples of Rs. 25,000/- |

LICs Jeevan Umang

The Jeevan Umang plan from LIC provides your family with both income and protection. Till the time of maturity, the plan provides the annual survival benefit and get a lumpsum payment either on the death of the policyholder or at the time of maturity.

At the demise of the policyholder, the death benefit must be at least 105 percent of the total premiums paid. A survival bonus equivalent to 8% of the Basic Sum Assured will be paid each year if the life assured survives to the end of the premium-paying term, provided all due premiums have been paid.

3. LIC's Money-Back Plans

Following are the money-back plans offered by LIC. Let’s take a brief look at them.

| Name of the Plan | Age (in years) | Min. & Max. Sum Assured |

| LIC’s Dhan Rekha |

| Min- Rs. 2,00,000 Max.- No limit |

| LIC’s New Bima Bachat | Min- 15 years Max- 50 years | Min– ` 35,000 for term 9 years ` 50,000 for term 12 years ` 70,000 for term 15 years Max- No limit Sum Assured will be in multiples of ` 5,000 /- only. |

| LIC’s New Money Back Plan – 20 Years | Min- 13 years Max- 50 years | Min- Rs. 100,000 Max- No Limit |

| LIC’s New Money Back Plan – 25 Years | Min- 13 years Max- 45 years | Min- Rs. 100,000 Max- No Limit |

| LIC’s New Children’s Money Back Plan | Min- 0 years Max.- 12 years | Min- Rs. 100,000 Max- No Limit |

| LIC’s Jeevan Tarun | Min- 90 years Max.- 12 years | Min- Rs. 75,000 Max- No Limit |

| LIC’s Jeevan Shiromani | Min- 18 years Max.- 55 years | Min- Rs. 1,00,00,000 Max- No Limit |

| LIC’s Bima Shree | Min- 8 years Max.- 55 years | Min- Rs. 10, 00,000 Max- No Limit |

- LIC’s Dhan Rekha

The Dhan Rekha Life Insurance Plan from LIC offers an appealing combination of protection and savings. This Non-Participating, Individual, Savings plan provides financial assistance to the policyholder’s family in the event of the policyholder’s untimely death during the policy term. In the case of the survival of policyholders, the guaranteed lumpsum payments at the time of maturity.

The “Sum Assured on Death” plus Accrued Guaranteed Additions shall be paid on death during the policy period following the date of initiation of risk. A specific proportion of the Basic Sum Assured will be paid if the life assured survives for each of the stated durations during the policy period, providing the policy is in force.

- LIC’s New Bima Bachat

The LIC’s New Bima Bachat is a money-back plan that offers financial protection against death during the policy term in exchange for the payment of survival benefits. Under the policy, the premium is paid in total at the outset of the policy. once the policy matures, the single premium and loyalty amount will be returned to the user.

If the Life Assured lives to the end of the policy term, the “Sum Assured on Maturity,” including any Loyalty addition, will be paid.

- LIC’s New Money Back Plan – 20 Years

The LIC New Money Back Plan-20 Years is an ideal combination of death protection throughout the policy. In case of the death of the policyholder, the plan offers financial assistance to the family. However, in the case of the survival of the policyholder, the entire payment would be paid without any difficulty.

If the policy is in full force death benefit, bonuses are payable on death within the policy period, including “Sum Assured on Death” and vested Simple Reversionary Bonuses and Final Additional Bonus. Where the “Sum Assured on Death” is the greater of 125 percent of the Basic Sum Assured or 10 times the annualised premium.

- LIC’s New Money Back Plan – 25 Years

The LIC New Money Back Plan-25 years provides maximum protection to the policyholder against his/her death and monthly payments on survival. This non-linked participating plan gives financial assistance to the family of the deceased policyholder at any time before completion, as well as a lump sum amount to the surviving policyholders at maturity.

If the policy is in full force, the policyholder will be entitled to share in the Corporation’s earnings and will be eligible for Simple Reversionary Bonuses based on the company’s experience.

- LIC’s New Children’s Money Back Plan

LIC’s New Children’s Money Back Plan is specially designed to meet the growing needs of the children that include education, marriage through Survival Benefits.

It also includes risk protection for the child’s life during the policy term, as well as many survival rewards if the child survives to the end of the defined periods. For a child aged 0 to 12 years, any parent or grandparent can purchase the plan. If the Life Assured survives the policy anniversary or immediately follows the completion of ages 18, 20, or 22, then the minimum Sum Assured of 20% will be paid on each occasion, providing the policy is still in operation.

- LIC’s Jeevan Tarun

It offers an appealing combination of protection and savings features. This non-linked plan is tailored to fulfil the scholastic and other needs of growing children, with annual Survival Benefit payments. This is a customizable plan in which the applicant can choose the proportion of Survival Benefits to be received during the policy’s term at the planning phase.

After the completion of 20 years of age, a secure percentage of Sum Assured shall be payable on each policy anniversary. For inforce maturing policies, a specified proportion of the Sum Assured will be payable on maturity if the Life Assured survives the stipulated maturity date.

- LIC’s Jeevan Shiromani

The Plan is a limited premium payment money back life insurance plan that is specifically developed for the High Net-worth Individuals market. It has a minimum Basic Sum Assured of Rs. 1 crore to cater to the needs of the individual and his/her family.

A specific proportion of the Basic Sum Assured will be paid if the life assured survives each of the specified durations during the policy term. After paying premiums for at least one full year’s premium and completing one policy year, a loan facility is provided under this plan, according to certain criteria as indicated in the plan terms.

- LIC’s Bima Shree

The plan is a limited premium payment money back life insurance plan primarily intended for a specific group of Elite Cumulative People. If you are someone who wants to provide maximum financial protection to your family and can invest a huge amount, this is an ideal investment to make.

The “Sum Assured on Maturity” plus any accrued Guaranteed Additions and Loyalty Addition, will be paid on the life assured surviving to the date of maturity. On the other hand, if the policyholder survives at the end of the policy, the “Sum Assured on Maturity” including any accrued Guaranteed Additions and Loyalty Addition will be paid.

4. LIC Term Assurance Plans

Term insurance is a type of insurance that is purchased for a specific period or a particular number of years. Here are the term assurance plans offered by LIC. These are as follows:

| Name of the Plan | Age (in years) | Min. & Max. Sum Assured |

| LIC’s Tech Term | Min- 18 years Max- 65 years | Min- Rs. 5,00,000 Max- No Limit |

| LIC’s Jeevan Amar | Min- 18 years Max- 65 years | Min- Rs. 25,00,000 Max- No Limit |

| LIC’s Saral Jeevan Bima | Min- 18 years Max- 65 years | Min- Rs. 5,00,000 Max- Rs. 25,00,000 |

LIC’s Tech Term

LIC’s Tech-Term is a profit-free “Online Term Assurance Policy” that protects the insured’s family’s finances in the event of his or her untimely death. With no middlemen involved, this plan will only be accessed through an online application process.

The Corporation will not give any claim except for an equivalent amount to 80% of the premiums paid if the policyholder (irrespective of its mental condition) attempts suicide within 12 months from the date of revival.

The Jeevan Amar plan from LIC is a pure protection plan that allows you to choose between two types of death benefits: level Sum Assured and growing Sum Assured. This non-linked plan allows the policyholder to make the payment of premiums in three ways: single, regular, or limited. In case of the death benefit payment, you can choose either in monthly installments or in lumpsum.

If the Policyholder is dissatisfied with the policy’s “Terms and Conditions,” the Policyholder may return the policy to the Corporation within 15 days of receiving the policy bond, If the Policyholder is dissatisfied with the terms and conditions of the policy. The user also needs to state his/her reasons for objections.

LIC’s Saral Jeevan Bima

Saral Jeevan Bima Plan from LIC is a non-participating and pure risk life insurance plan that protects the insured’s family financially in the event of his or her untimely death during the period of the policy.

If the Life Assured dies during the waiting period for reasons other than an accident, an amount equivalent to 100% of all premiums received will be paid. This policy will only cover death as a result of an accident if it occurs within 45 days of the risk beginning. The company, however, will not be liable to pay the sum assured.

These insurance plans are ideally suited for senior citizens and those who are preparing for a secure future, ensuring that you never miss out on life’s greatest pleasures. LIC offers the following pension plans:

| Name of the Plan | Age (in years) | Min. & Max. Sum Assured |

| Pradhan Mantri Vaya Vandana Yojana | Min- 60 years Max- No limit | Depending on the minimum premium |

| LIC’s Jeevan Akshay – VII | Min- 30 years Max- 85 years | Depending on the minimum premium |

| LIC’s New Jeevan Shanti | Min- 30 years Max- 80 years | No Limit |

| LIC’s Saral Pension | Min- 40 years Max- 80 years | No Limit |

Pradhan Mantri Vaya Vandana Yojana

The Pradhan Mantri Vaya Vandana Yojana (Modified-2020), introduced by 2020 by the Government of India. The plan has a modified rate of pension and has increased the time of sale of this plan for a further three years, beginning in the Financial Year 2020-21.

At the start of each year, the guaranteed rates of pension for policies sold during a year shall be reviewed and decided by the Ministry of Finance, Government of India, according to the terms and circumstances of this plan.

LIC’s Jeevan Akshay – VII

Under this plan of LIC, the policyholder would have an option to choose the type of annuity from the list of ten alternatives in exchange for a lump sum payment. The user has an option to buy the plan via an online or offline method. The annuity rates are guaranteed at the inception of the policy and annuities are payable throughout the lifetime of the Annuitant(s).

The Annuity shall be paid in arrears, i.e., after one year, six months, three months, and one month from the date of policy commencement, depending on the annuity payment method.

This is a regular premium policy with the choice of a single life or joint life deferred annuity for the Policyholder. The annuity rates are specified at the beginning of the policy, and annuities are paid once the deferment period has ended for the rest of the Annuitant’s life (s).

If the annuitant dies or the policy is surrendered during the deferred period, the Additional Benefit on Death for the policy year in which the death/surrender occurs will accumulate until the end of the policy month.

LIC’s Saral Pension

According to the Insurance Regulatory and Development Authority of India (IRDAI) standards, this is a Standard Immediate Annuity plan with the same terms and conditions issued by all life insurers. On payment of a lump sum amount, the Policyholder has the option of choosing between two types of annuities.

If the annuitant, spouse, or any of the annuitant’s children is diagnosed with any of the specified critical illnesses, the policy can be surrendered at any time after six months from the date of the beginning of the policy according to the Corporation’s medical examiner.

6. LIC ULIP Plans

A ULIP is an investment and insurance product that allows policyholders to pay their premiums annually or monthly, depending on their preferences. Let’s take a look at the ULIP plans offered by LIC.

| Name of the Plan | Age (in years) | Min. & Max. Sum Assured |

| LIC’s Nivesh Plus | Min- 90 days Max- 70 years | The Sum Assured options are: Option 1: 1.25 times of Single Premium; Option 2: 10 times of Single Premium |

| LIC’s SIIP | Min- 90 days Max- 70 years | Age below 55 Years: 10 times of Annualized Premiums Age 55 years and above times Annualized Premiums |

| LIC’s New Endowment Plus | Min- 90 days Max- 50 years | 10 times of Annualized Premiums |

LIC’s Nivesh Plus

Nivesh Plus is a premium plan offered by LIC that provides insurance and investment coverage throughout the policy’s duration for a single premium. This unit-linked single premium individual life insurance plan allows you to choose the preferred sum insurance at the time of policy beginning.

This plan gives you the option of selecting the type of Sum Insured from the outset while allowing you to invest in the premium in one of four different types of investment funds.

LIC’s SIIP

The LIC SIIP provides both insurance and investment protection throughout the policy’s duration. This regular-premium individual life insurance plan is available both offline and online while offering you the option of investing premiums in one of four different types of investment funds.

For the policy’s term, you can pay premiums at yearly, half-yearly, quarterly, or monthly intervals. During the policy’s term, the method of premium payment must be selected at the point of purchase, but it can be changed (to one of several regular premium payment modes) at any future policy anniversary.

LIC’s New Endowment Plus

The New Endowment Plus plan from LIC provides investment cum insurance coverage during the policy’s life. This plan was created just for you to give a solid balance of safety and long-term savings, as well as more flexibility in building a better life and realising your aspirations.

The policy allows you to make premium payments in either of the types of investment funds available under the policy. based on the fund’s Net Asset Value (NAV), the unit fund is subject to a variety of charges, and the value of the units may rise or fall.

7. LIC Micro Insurance Plans

Micro-insurance policies are designed to increase insurance coverage among the most economically vulnerable members of society. Here are the types of microinsurance plans offered by LIC. Let’s discuss them in detail!

| Name of the Plan | Age (in years) | Min. & Max. Sum Assured |

| LIC’s Bhagya Lakshmi | Min- 18 years Max- 55 years | Min- Rs. 20,000 Max.- Rs. 50,000 |

| LICs New Jeevan Mangal | Min- 18 years Max- 55 years | Min- Rs. 10,000 Max.- Rs. 50,000 |

| LIC’s Micro Bachat Plan | Min- 18 years Max- 55 years | Min- Rs. 50,000 Max.- Rs. 200,000 |

LIC’s Bhagya Lakshmi

The Bhagya Lakshmi Plan, offered by LIC, is a non-profit plan that provides financial security and helps people save money while also serving as an insurance and investment tool. In the event of the policyholder’s death, the nominee will receive the lumpsum amount along with the death benefit. During the premium-paying duration of the policy, premiums might be paid on a yearly, half-yearly, quarterly, or monthly basis as per the convenience of the policyholder.

LICs New Jeevan Mangal

The LIC’s New Jeevan Mangal Plan is a protection-oriented plan that includes an Accident Benefit, which gives double risk coverage in the event of accidental death. As per the policy’s conditions, the policy will be regarded in force, with risk coverage continuing uninterrupted during the grace term. The Policy will lapse if the premium is not paid before the grace period expires.

LIC’s Micro Bachat Plan

Looking for a plan that may provide you with both savings and protection? If so, your search ends here! The Micro Bachat from LIC is an individual life assurance plan that provides financial support to the policyholder’s family in the event of the policyholder’s untimely death during the policy term.

8. LIC Withdrawn Plans

For various classes and segments of the Indian economy, LIC offers many withdrawn plans. Here’s the list of the following withdrawn plans offered by LIC. Let’s take a look at them!

| Name of the Plan | Age (in years) | Min. & Max. Sum Assured |

| LIC’ Jeevan AROGYA | Min Age- 18 days Max. Age- 65 years | No Limit |

| LIC’s Cancer Cover | Min Age- 20 years Max. Age- 65 years | Min- Rs. 10,00,000 Max- Rs. 50,00,000 |

LIC’ Jeevan AROGYA

LIC’s Jeevan Arogya is a unique non-participating non-linked plan which provides health insurance cover against certain defined health risks. One of the biggest benefits of the plan is that it provides you with timely assistance in the context of health emergencies while offering comprehensive financial protection to the family. Whether you are a Principal Insured or Other Insured Life, your premium will be determined by your age, gender, health insurance option, and payment method.

LIC’s Cancer Cover

Cancer Cover from LIC is a continuous premium payment health insurance plan that provides maximum financial protection to the policyholder. If the user is diagnosed with early and/or Major Stage Cancers throughout the period, this plan may help you out! For the first five years following the policy’s issuance, the premium rates under this plan are guaranteed. With this plan, the premium rates for future years may be revised based on the company’s experience.

Why Go With Life Insurance Corporation of India?

Here are the reasons to choose Life Insurance Corporation of India:

1. A Multitude of Products: Life Insurance Corporation offers a variety of products that can be customized to meet your needs and budget. Some of the plans include money back, endowment, and whole life insurance plans that perfectly cater to an individual’s insurance needs at a reasonable cost.

2. High Claim Settlement Ratio: In FY 2019-20, Life Insurance Corporation had a claim settlement ratio of 96.69 percent. For those who don’t know, the high claim settlement ratio showcases the credibility of an insurance company. In the case of LIC, the CSR is exceptional and can be availed without thinking twice.

3. Award-Winning Services: Life Insurance Corporation has received many awards such as the BFSI digital innovation award, Aashirwad awards, 8th Annual Greentech HR excellence award, Golden peacock award-national training, brand icon award times of India, to name a few.

4. Excellent Customer Support: Customers are valued by the organization, which delivers exceptional customer service. Life Insurance Corporation is one of the nation’s largest and oldest suppliers of cheap life insurance policies and programs. Their toll-free customer service number is available 24 hours a day, 7 days a week. This allows the customer to have constant contact with the insurance provider.

5. Simplified Purchasing Process: A life insurance policy from LIC is simple to buy and apply for. For a consultation or to purchase a life insurance policy, you can go to a LIC branch office. You can also use SMS to acquire information about the life insurance plan you want to buy. Existing and new consumers will find it easier to use online customer support.

Know the Premium Calculation Of LIC of India Plans

If you are looking to know the exact premium amount of LIC of India, you need to visit the official website of the company. To give you a proper explanation, let’s take an example to understand it properly!

Rahul has decided to purchase “LIC New Jeevan Anand plan”, “LIC Saral Jeevan Beema”, and “LIC Jeevan Lakshya” to secure the financial future of his loved ones. Based on the age, name of the policy, age, sun assured, here is the premium amount that Rahul has to pay.

| Name | Age in Years | Name of the Policy | Policy Term | Sum Assured | Total Premium |

| Rahul | 30 years | LIC New Jeevan Anand | 15 years | Rs. 100,000 | Rs. 8,444 (Including tax of Rs. 364) |

| Rahul | 30 years | LIC Saral Jevan Beema | 20 years | Rs. 5,00,000 | Rs. 23,966 (including tax of Rs. 3,656) |

| Rahul | 30 years | LIC Jeevan Lakshya | 25 years | Rs. 1,00,000 | Rs. 4,562 (Including of Rs. 196) |

How To Invest In LIC Policies?

If you want to purchase one of LIC of India products, you must first complete the following steps:

Online Method

- 1. Go to the company’s official website.

- 2. You will see a yellow-coloured banner in between, i.e., “Buy Policy Online”.

- 3. After that, you will be directed to the page wherein you need to select the right plan as per your needs.

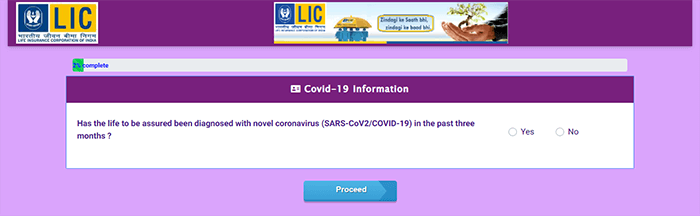

- 4. When you choose a plan, let’s say LIC Bachat Plus, the page shall ask you the question “Has the life to be assured been diagnosed with the novel coronavirus (SARS-CoV2/COVID-19) in the past three months ?”

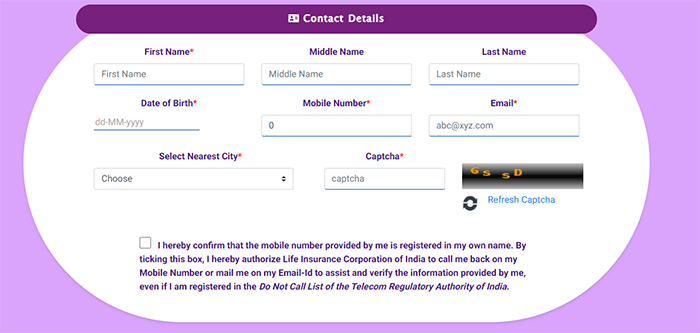

- 5. After that, you will need to enter your gender, date of birth, and then continue.

- 6. Make sure your insurance information will be mailed to your registered address.

Offline Method

- If you prefer to purchase the coverage in person, go to a local LIC branch. You will acquire all of the insurance information you require when you visit the site before purchasing a policy.

- However, if you continue to encounter problems, you can seek help from Probus Insurance.

Claim Process For LIC of India Policies

Claims settlement is a critical component of providing service to policyholders. As a result, the Corporation has placed a high priority on the timely settlement of Maturity and Death Claims.

The following is the method for settling maturity and death claims:

Maturity Claims:

- The amount is payable at the end of the policy period in the case of endowment policies. At least two months before the due date of payment, the Branch Office that services the policy sends out a letter advising the policyholder of the date on which the insurance amounts are payable to the policyholder. The policyholder must send the Discharge Form, along with the Policy Document, NEFT Mandate Form (Bank A/c Particulars with supporting proof), KYC requirements, and other documents, duly completed. Payment is processed in advance upon receipt of these documents, ensuring that the maturity amount is credited to the policyholder’s bank account on the due date.

- Some plans, such as Money Back Policies, provide for periodic payouts to policyholders if premiums are paid up to the anniversary due for the Survival Benefit. Payments are released without requiring the Discharge Receipt or Policy Document in certain circumstances where the amount payable is up to Rs.500,000/-.

Death Claims:

If the premiums are current and the death occurs within the grace period, the death claim amount is payable. The Branch Office requests the following requirements upon receiving notification of the Life Assured’s death:

a) Claim form A – Claimant’s Statement, which includes information about the dead as well as the claimant.

b) Certified Death Register extract

c) If age is not admitted, documentary proof of age

d) If the insurance is not nominated, assigned, or issued under the M.W.P. Act, it serves as proof of title to the deceased’s estate.

e) Original Policy Document

If death occurs within three years of the date of risk or the date of revival/reinstatement, the following additional forms are required.

- Claim Form B – Medical Attendant’s Certificate, which must be completed by the deceased’s medical attendant during his or her last illness.

- Claim Form B1 – if the life assured required hospital treatment.

- Claim form B2 – should be filled out by the Medical Attendant who cared for the dead previous to his last sickness.

- Claim Form C – Certificate of Identity and Burial or Cremation, which must be filled out and signed by a person of good character and responsibility.

- If the assured was an employee, claim form E – Certificate from the employer.

If the death was caused by an accident or an unnatural cause, certified copies of the First Information Report, Post-mortem Report, and Police Investigation Report are required.

These additional documents are required to ensure that the claim is genuine, i.e. that the deceased omitted no material facts that would have affected our approval of the proposal at the time of proposal. Furthermore, these forms aid us in the event of an investigation by Corporation officials.

New Plans: LIC Index Plus, LIC Jeevan Utsav

Frequently Asked Questions

Here are the frequently asked questions about LIC of India:

The user’s email address will be requested while making a payment. The payment receipt will be sent to the email address provided during the transaction. The receipt will be accessible for download in the apps “Paytm – My Order,” “PhonePe – History,” “Google Pay – All Payment Activity,” and “Amazon Pay – Your Orders,” among others. This feature is not available in the “Mobikwik” app, but the payment receipt will be emailed to the email address provided when making the payment.

Only once the mandate has been successfully authenticated by the customer’s bank and the response has been posted in NACH master at the zone’s NACH centre will the premium be deducted.

PCMC Department, Jeevan Seva Annex Building, S.V. Road, Santacruz (West), Mumbai 400 054 accounts for all consolidated payments from banks and service providers.

E-receipts are sent to policies with a registered email address, while printed receipts are sent to policyholders without a registered email address via regular mail.

Yes, tobacco/alcohol use affects premium calculations. Because tobacco/alcohol use is harmful to one’s health, those who use both are deemed to be at high risk. The premium amount increases if you report that you use smoke or alcohol regularly.

Yes, COVID-19-related death is now covered by LIC insurance coverage.

Family members will have to submit proof establishing their entitlement to receive the policy benefit if the nominee dies or is not specified in the policy.

A new mandate form must be submitted to the LIC Servicing Branch office, along with new bank details.

Premiums must be paid in full over the cash counter in the branch till the due date. Premiums will be collected by NACH in the future.

Yes, an 18% GST slab is applied to the premium charged for a plan.

There are no maturity benefits with LIC term insurance plans, thus you won’t get anything. The death benefit is the only benefit you receive. In your absence, your family or loved ones can benefit from the sum assured.

Under the LIC Term Insurance policies, LIC provides a 30-day grace period for yearly and half-yearly premium payments.

All claims reported are settled within 30 days of receipt of required evidence, according to the Insurance Regulatory Authority of India (IRDAI), and if further inquiry is required, the claim is resolved within 120 days of receipt of required documents.

You must visit the bank’s or service provider’s website.

On the web page, you must specify the date on which you want your account charged and then click the payment consent button.

The authorised bank will deduct funds from your account, consolidate payments, and send the total to LIC.

The service provider is being repaid the double payment, which will be transferred back to your account. The refund process may take 6 to 8 days. Please contact bo eps1@licindia.com with any further questions.

If the amount has been deducted from your account and has not been corrected in your policy for more than 10 days, please contact your banker, as the money may be sitting in your banker’s suspense account, waiting to be reversed.

LIC Plans

- LIC Aadhaar Shila

- LIC Aadhaar Stambh

- LIC Amritbaal

- LIC Arogya Rakshak

- LIC Bachat Plus

- LIC Bhagya Lakshmi

- LIC Bima Jyoti

- LIC Bima Ratna

- LIC Bima Shree

- LIC Cancer Cover

- LIC Dhan Rekha

- LIC's Dhan Sanchay

- LIC Dhan Varsha

- LIC's Dhan Vriddhi

- LIC's Digi Term Plan

- LIC's Digi Credit Life

- LIC's Index Plus

- LIC Jeevan Akshay VII

- LIC Jeevan Amar

- LIC Jeevan Azad

- LIC Jeevan Dhara-II

- LIC's Jeevan Kiran

- LIC Jeevan Shiromani

- LIC New Bima Bachat

- LIC New Children's Money Back

- LIC New Endowment

- LIC New Endowment Plus

- LIC New Jeevan Anand

- LIC New Jeevan Shanti

- LIC New Jeevan Tarun

- LIC Jeevan Labh

- LIC Jeevan Lakshya

- LIC Jeevan Umang

- LIC New Money Back Plan - 20 Years

- LIC New Money Back Plan - 25 Years

- LIC Pradhan Mantri Vaya Vandana Yojana

- LIC New Tech Term

- LIC’s SIIP

- LIC Single Premium Endowment

- LIC Yuva Term

- LIC Yuva Credit Life

LIC FAQs

- Best LIC Plans To Invest

- LIC Child Plans

- How To Get Duplicate LIC Bond?

- LIC Customer Care

- LIC E-Services

- LIC Kanyadan Policy

- LIC Lapsed Policy Revival Scheme

- LIC Login Process

- LIC Merchant Portal

- LIC Payment Process

- LIC Policy Address Change

- LIC Policy Receipt Download

- LIC Policy Status

- LIC Policy Tracker

- LIC Premium Calculator

- LIC Registration

- Sukanya Samriddhi Vs Kanyadan Policy

- Surrender LIC Policy

- How To File Claim Under LIC?

Life Insurers

- Aditya Birla Sun Life Insurance

- Aegon Life Insurance

- Aviva Life Insurance

- Bajaj Allianz Life Insurance

- Bharti Axa Life Insurance

- Canara HSBC Life Insurance

- Edelweiss Tokio life Insurance

- Exide Life Insurance

- Future Generali Life Insurance

- HDFC Life Insurance

- ICICI Prudential Life Insurance

- Ageas Federal Life Insurance

- Indiafirst life Insurance

- Kotak Mahindra Life Insurance

- Life Insurance Corporation of India

- Max Life Insurance

- PNBMetlife India Insurance

- Pramerica Life Insurance

- Reliance Nippon Life Insurance

- SBI Life Insurance

- TATA AIA Life Insurance