In the dynamic world of finance, it’s crucial for investors to understand how their investments perform. As individuals make investments, it’s important to consider various factors, such as how much money comes in and goes out, the time required to show results, and how the profits grow over time. To evaluate such performances, investors often rely on numerous financial metrics.

However, three of them – Compound Annual Growth Rate (CAGR), Internal Rate of Return (IRR), and Extended Internal Rate of Return (XIRR) – stand out as indispensable tools in the evaluation of investment avenues. Each metric serves a distinct purpose, catering to different requirements in financial analysis, thus helping investors make informed decisions about their portfolios.

Stay tuned as this comprehensive exploration will dive into the differences between CAGR Vs. IRR Vs. XIRR and other important aspects!

Understanding CAGR

CAGR, or Compound Annual Growth Rate, measures an investment’s annual growth over a specific period. It indicates the yearly profit within that timeframe, making it a valuable tool for comparing past performances and projecting future returns of financial instruments like stocks or portfolios.

The formula for calculating CAGR is as follows:

CAGR= (Ending Value/Starting Value)1/N-1

where ‘N’ stands for the total number of years over which the growth has occurred.

Suppose you invested Rs. 10,000 in a stock in 2010, and by 2020, the value of your investment had grown to Rs. 40,000. The CAGR for this investment over the 10 years would be calculated as follows:

CAGR=(40,000/10,000)1/10-1, which is approximately equal to 7.28%.

This indicates the annualized rate of growth over the specified time period.

Applications Of CAGR:

CAGR serves three major purposes:

Investment Analysis & Comparison:

- Widely used for evaluating portfolio performances and growth trends by focusing on average growth rates.

- Used for effective investment analysis and comparison.

Market Analysis & Financial Planning:

- Utilized to compare growth rates across different market sectors, aiding analysts and investors in identifying trends and opportunities. This assists in predicting future investment values for informed decision-making.

Risk Assessment:

- Helps assess investment risks by analyzing the consistency of CAGR. A consistently positive CAGR indicates steady growth and lower risk while fluctuating CAGR suggests a potentially higher level of risk.

Advantages Of Using CAGR:

The major pros of Compound Annual Growth Rate are as follows:

- Simplicity: CAGR is a straightforward metric, simplifying complex growth patterns into a single percentage for easy calculation and understanding.

- Long-Term Analysis: It is effective for analyzing long-term investment performance due to its focus on the compounding effect over time.

- Facilitates Benchmarking: It enables easy tracking and comparison of investment progress against industry standards, aiding investors in evaluating the effectiveness of their strategies.

- Reduced Risks: It offers future projections, helping investors recognize potential risks and make informed decisions about their investments.

Understanding IRR

IRR, or Internal Rate of Return, is a key metric used to assess investment profitability. It considers the changing value of money over time and acts as a special discount rate, making the future earnings of an investment equal to its initial cost.

This helps in determining how profitable an investment is expected to be. If the calculated IRR is higher than the required rate of return, the investment is considered attractive; if lower, it may be less favorable.

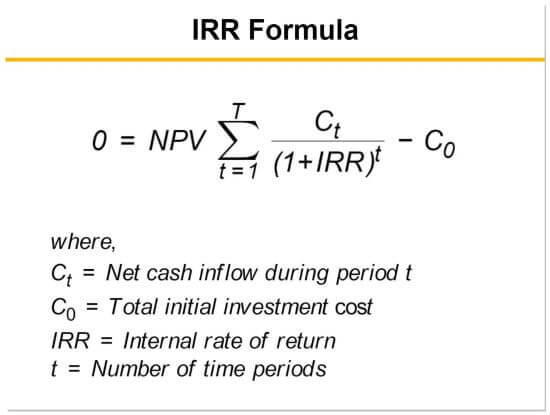

The formula for calculating IRR is as follows:

Let’s say you invest Rs. 50,000 in a company whose ‘cost of capital; is 10% and over the next 3 years, you receive cash returns of Rs. 10,000 in the 1st year, Rs. 15,000 in the 2nd year, and Rs. 20,000 in the 3rd year.

Now, if the calculated Internal Rate of Return (IRR) is equal to or more than 10%, it means that the project is good to go. Conversely, if the IRR is lower than the company’s cost of capital, it may be less appealing.

Applications Of IRR:

The 3 primary uses of IRR are as follows:

Capital Budgeting & Logical Decision-Making:

- Investors use IRR to check if an investment or project is profitable and attractive. If the calculated IRR is higher than the company’s cost of capital, then the investment is considered worthwhile.

Project Raking & Prioritization:

- IRR helps companies/shareholders rank and prioritize projects. If there are multiple projects, they can pick the one with a higher IRR, guiding them to allocate resources to the more rewarding projects.

Stock Buyback Program Assessment:

- Companies use IRR to see if buying back their own stocks is a better investment than using the funds for other things like buying other companies or growing the business.

Advantages Of Using IRR:

IRR has the 3 notable advantages:

- Incorporates Time Value Of Money: Since IRR considers the changing value of money over time, it provides a more accurate measure of investment profitability.

- Easy To Use & Understand: IRR is easy to calculate and offers a straightforward comparison of a project’s worth. New investors and business owners can quickly assess potential cash flows and make informed decisions on capital projects and budgeting.

- No Requirement Of Hurdle Rate: Unlike other methods, IRR doesn’t rely on a subjective hurdle rate or cost of capital. This reduces the risk of inaccuracies in determining the rate.

Understanding XIRR

XIRR, or Extended Internal Rate of Return, calculates annualized returns for investments with irregular cash flows. It is an extension of IRR that considers all cash flows and outflows, including their dates, providing a highly precise assessment of returns.

The metric is particularly useful for Systematic Investment Plans (SIPs) with different purchase prices and installment periods, making it a common choice for evaluating returns on mutual fund SIPs.

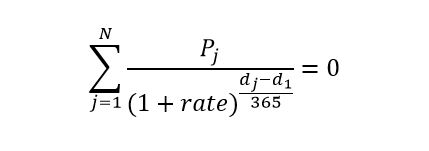

As one can see below, the formula for XIRR is a bit complex, because it involves the timing and amounts of cash flows.

Therefore, XIRR is commonly calculated using financial software or spreadsheet tools like Microsoft Excel.

Suppose you invest Rs. 1,000 today in an equity mutual fund, receive Rs. 400 after six months, and another Rs. 800 a year later. The XIRR function would then provide the annualized rate of return considering these irregular cash flows with their respective dates.

Typically, a 12% XIRR is considered favorable for equity funds, a 7.5% XIRR is considered good for debt funds. Thus, if your XIRR is lower than 12%, it is not a favorable investment.

Applications Of XIRR:

XIRR is utilized for 3 main purposes:

SIP Evaluation:

- XIRR is vital for evaluating SIPs in mutual funds, providing an accurate measure of the annualized return.

Mutual Funds Comparison:

- XIRR is used for comparing the performance of different mutual funds, especially those with distinct investment strategies or objectives.

Tracking Financial Progress:

- Whether savings for education or retirement, using XIRR helps measure investment performance toward achieving long-term financial objectives.

Advantages Of Using XIRR:

The key strengths of Extended Internal Rate of Return are as follows:

- Precise Measurement: XIRR offers high precision in measurement because it considers both timing and amount of cash flows.

- Enhanced Decision-Making: In the complex process of project financing, the metric gives a clear picture of annualized returns, helping businesses make smart decisions.

- Highly Applicable & Versatile: XIRR is versatile, fitting various investments like mutual funds, real estate, and project financing. Its flexibility makes it valuable in various financial settings.

CAGR Vs. IRR Vs. XIRR

| Parameters | CAGR | IRR | XIRR |

| Nature Of Calculation | Calculates the annual growth rate of an investment over a specific period of time. | Represents the discount rate at which the NPV (Net Present Value) of cash flows from an investment becomes zero. | It is an extension of the IRR that accommodates irregular cash flow and uneven time intervals. |

| Cash Flow Events | One Outflow & One Inflow Each | Multiple Inflows and/or Outflows at Regular Intervals | Multiple Inflows and/or Outflows at Regular/Irregular Intervals |

| Type Of Return | Compounding | ||

| Timing Considerations | Neglects the timing aspects of cash flows. | Considers the timings of cash flows. | |

| Complexity Level | Lower | Medium | Higher |

| Accuracy | Lower | Medium | Higher |

| Versatility | Lower (Effective only for evaluating annual growth rate.) | Lower (Effective only for projects with consistent cash flows.) | Higher (Adaptable to a broader range of investment scenarios. It considers both cash flow irregularities and timings.) |

The Bottom Lines

Choosing between ‘CAGR Vs. IRR Vs. XIRR’ depends on the nuances of your investment being evaluated. Simply put, CAGR is great for steady, long-term investments, IRR is useful for projects with regular cash flows, and XIRR is the go-to tool for handling irregular cash flows and varying time intervals. Each has its role depending on the nature of your investment or project!

Whether you go for CAGR’s smoothed calculations, IRR’s equilibrium-seeking nature, or XIRR’s highly flexible and precise approach, understanding these metrics puts you in control of decoding investment returns and sets you up for success in the evolving financial market.