Earlier, keeping track of tax payments, deductions, and refunds was a hassle. People had to manually manage paper receipts and TDS certificates, which often got lost or were prone to errors and fraudulent claims. Form 26AS solved these problems by giving a single, clear statement with all your tax info, like payments, TDS, and refunds.… Continue reading Form 26AS Explained: Your Definitive Handbook To Income Tax Statements

Category: Articles

How Mutual Funds are Taxed?

Whether you are planning for your kid’s education or retirement, mutual funds are an incredibly popular option to help reach your objectives. Not only do they give you better returns than FDs (Fixed Deposits) but they are also tax-efficient. On the other hand, investing in a regular fixed deposit can be disadvantageous, especially if you… Continue reading How Mutual Funds are Taxed?

Top Reasons Why You Should Make Financial Investments

Financial investments are crucial for building wealth and securing a stable financial future. Whether you are saving for retirement, a child’s education, or simply looking to grow your wealth, investing wisely can help you achieve your financial goals. This article explores the top reasons why you should make financial investments and how they can benefit… Continue reading Top Reasons Why You Should Make Financial Investments

Why is Long-Term Investing Important?

Investing is a critical component of financial planning and wealth building. Among the various investment strategies, long-term investing stands out as a reliable and effective approach. It involves holding investments for an extended period, typically several years or even decades, to reap the benefits of compound growth and market appreciation. In this article, we will… Continue reading Why is Long-Term Investing Important?

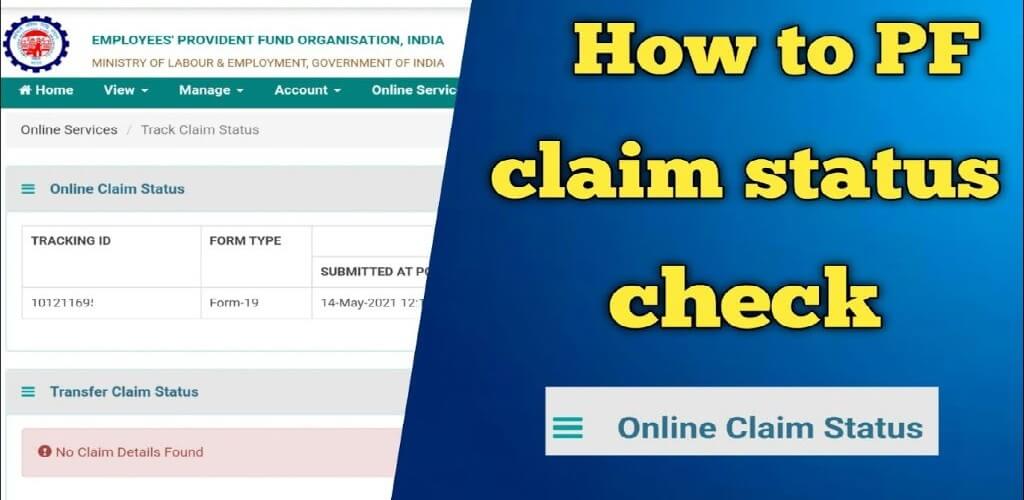

EPF Claim: How To Check Your Current Status?

If you want to enjoy the golden years of retirement, you cannot overlook the importance of savings and financial stability. In India, one of the major ways to save for retirement is through the Employee Provident Fund (EPF). It is one of the best savings plans designed to help employees make the most of their… Continue reading EPF Claim: How To Check Your Current Status?

TDS On Property Sale in India

No matter what kind of property you want to buy or sell in India, taxes always make their way into the property system. However, among taxes, one specific tax is called Tax Deducted at Source (TDS), which applies to the sale of immovable property such as land and buildings. If you’re the buyer, you need… Continue reading TDS On Property Sale in India

Section 80C Of The Income Tax Act

As living costs are rising and economies are changing, Indians are feeling the pressure to stockpile their earnings. That’s why saving on taxes has become a smart move to stay ahead of the game. However, the true game-changer is Section 80C of the Income Tax Act of 1961. It’s all about saving money on your… Continue reading Section 80C Of The Income Tax Act

Section 80D Of Income Tax Act

No matter how healthy you are or your current age, medical emergencies can occur anytime and anywhere without informing you beforehand. Health insurance is a great way to protect yourself from the risks of a medical emergency. The Government of India has introduced tax benefits under Section 80D of the Income Tax Act to encourage… Continue reading Section 80D Of Income Tax Act

Important Deductions Available in New Tax Regime

The new tax system in India has made big changes to how taxes work. It aims to make things simpler and give people more choices. Now, individuals can decide whether to calculate their taxes using the old or new systems. The new system has lower tax returns but doesn’t include some deductions and exemptions that… Continue reading Important Deductions Available in New Tax Regime

How To Check TDS Refund Status?

Since technology has now become a part of our everyday lives, it’s now become easier to check the status of your TDS refund via the online method. Just like every other domain, The Income Tax Department has a handy online tool to track your tax refund status. All you need to do is simply enter… Continue reading How To Check TDS Refund Status?