Life Insurance LIC of India LIC Merchant Portal

-

LIC Premium Collection Point

LIC Merchant Portal

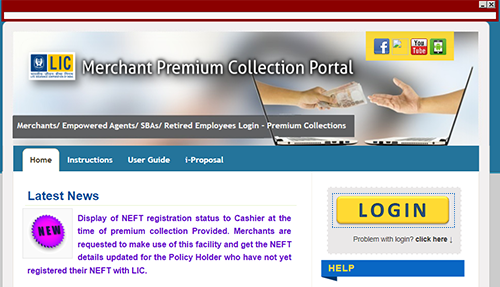

When you buy an insurance plan, you need to pay premiums for that as well. To make your premium payment easy and smooth, the Life Insurance Corporation of India (LIC) has come up with LIC Merchant Portal so that the Corporation can stay well connected to its consumers. LIC Merchants are registered, licensed, experienced and completely trustworthy individuals with the promise to make your experience with the Corporation well and hassle-free. This Merchant Portal is completely an online platform where all the tasks are performed online to maintain transparency with its customers. The merchants have to log in to their respective portals to function all the acts effortlessly.

Who is a LIC Merchant?

LIC is a wide insurance company undertaken by the Government of India and to function properly without any lag, LIC has recently introduced merchant registration. These merchants are appointed by the Corporation and act as a bridge between the insurer and its customers. Every merchant has a specific and unique user ID and password to login into their respective portals. LIC, itself provides quality training to the merchants to make them more efficient.

Their main function is to collect the premium on behalf of the company. The commission is charged to these merchants as a percentage of the premium received for the policies sold by them. But apart from this, they can also view and update the details with the help of separate merchant tools. LIC merchants are almost like LIC offices where they can offer almost all the services to the buyer. LIC merchants do have access to the LIC systems and with the help of this, they can view different policies regarding data such as loans, surrenders, policy details and etc. of the consumers.

What Are The Functions of LIC Merchants?

Apart from the premium collection, the LIC Merchants can offer their customers more than 50 product combinations of the Corporation along with the Riders. The Corporation is supportive enough to its merchants so that it has presented different unique market and sales tools to make their job flawless. The Sales, Promotions, and Marketing collaterals that LIC provides will help the merchants to elevate their business to a new level. Have a look at the functions of LIC merchants below.

Generate invoices for the collection of the premium

Invoice generation proposal with the cashier

Pending invoice

Pay invoice online

Update of any pending invoice

Deposit invoice

Paid invoice queries

Totals for cashiers

Receipts can be viewed

How To Become a LIC Merchant?

A LIC merchant or agent is an independent entity and contractor who sells and collects premiums on behalf of the company for a living. Many individuals are drawn to this profession as LIC is a trusted and oldest insurance company in the country. For becoming a LIC agent easily, have a look at the below mentioned.

Age criteria – To become a LIC merchant, you have to be 18 years old and above. For that, your date of birth certificate or any valid document as your age proof is required. If you do not have any DOB certificate, get it done to the nearby municipality or panchayat. This is a must-have document that you require.

Qualify 10th standard from school – To become a LIC merchant, you must qualify for the 10th standard exam from a school and produce the school’s official certificate issued and signed. You may produce an equivalent certificate as well from a recognized institution.

Mandatory PAN card – Among the documents, this is the last one that you will need to become a merchant of the Corporation. Having a PAN (Permanent Account Number) number or PAN card is mandatory here. So, if you choose to be a LIC merchant or agent but you do not have a PAN card, get it done by submitting the necessary documents as soon as possible.

Appear in the interview – If you have all the above-mentioned documents, you are ready to move a step forward. Go to the nearest official branch of the Corporation and meet with the development officer there. The development officer will arrange for an interview. Appear in that.

Receive the training – If you become successful in the interview, you will be eligible for receiving the training offered by the company. The training program will be for 25 hours. All the information regarding this training period will be briefed to you.

Prepare and sit for the IRDAI exam – Once your personal training period is over, you have to register for the IRDAI exam to appear in that. For the study material, you may ask the concerned LIC branch. On request, they may even offer you books free of cost. You need to score at least 40% to qualify for the exam. And to proceed further.

Receive the appointment letter – Once you crack the IRDAI exam, you will be offered the appointment letter. That letter will carry a unique code. Now, for a personal interview and further guidance, you need to visit a development officer. You will be assigned as per your location by a specific development officer. Both the name and the location of the development officer will be mentioned in the appointment letter provided to you.

Interview and training – This is the last step of the entire process of becoming a LIC Merchant or agent. The assigned development officer will again take your interview but at the same time, you will be enlightened with some insights, guidance, and knowledge. He will advise you regarding how to start your journey as a LIC merchant, the success key, and other related important information. This time it will be more practical knowledge than theoretical.

If you follow all the afore-said steps religiously, you can certainly become a LIC merchant or agent successfully.

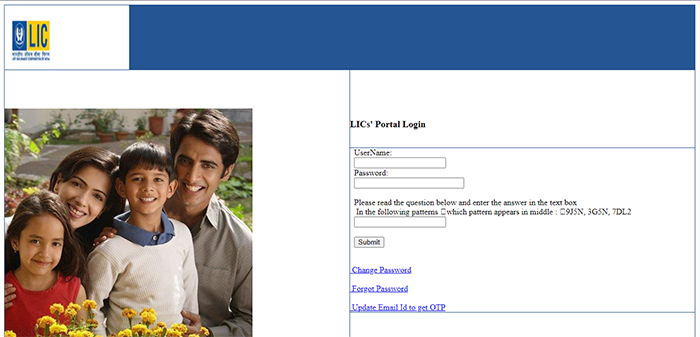

How To Login Into LIC Merchant Portal?

Follow the below steps to avail of a seamless login process to the LIC Merchant Portal.

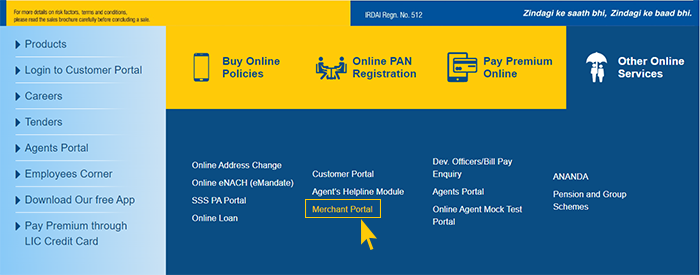

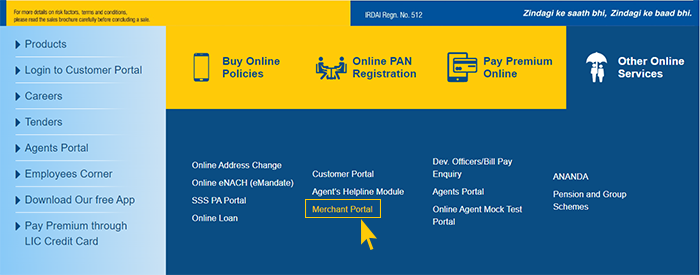

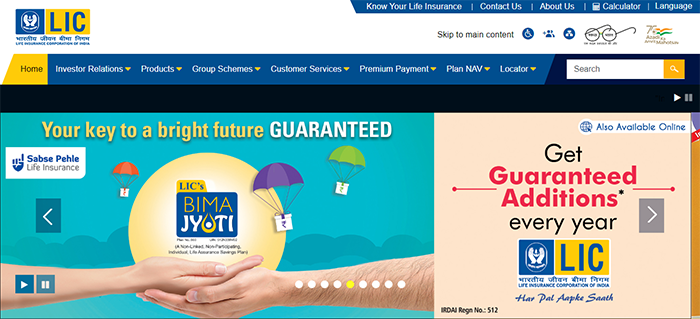

- Go to the official website of the Corporation.

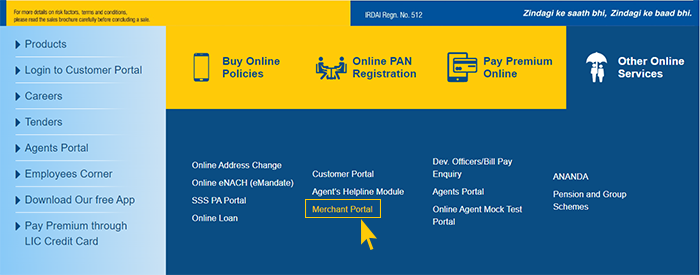

- Look for the Merchant Portal option under the Other Online Services tab that is middle of the homepage and click on that.

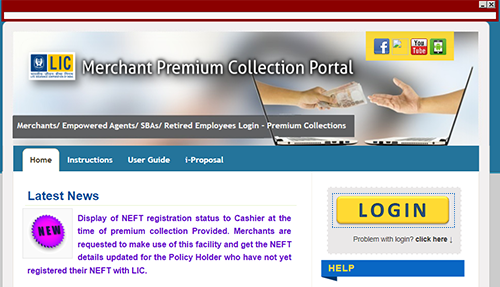

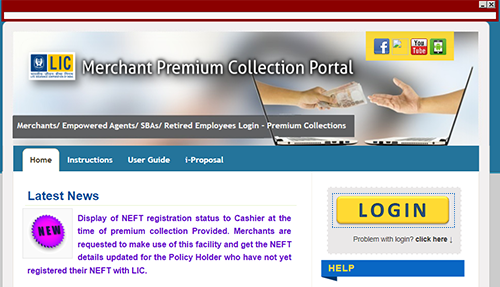

- Upon clicking, the link will take you to an external site.

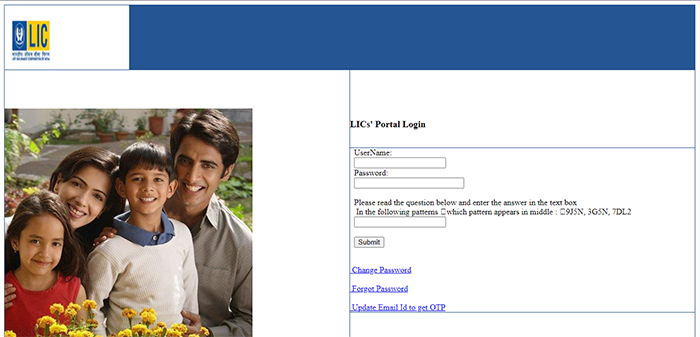

- Select the login option.

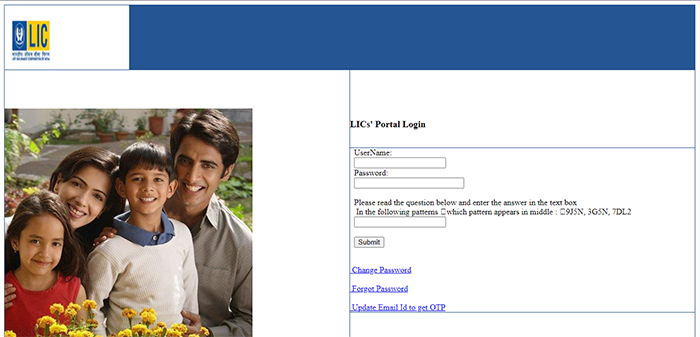

- Put your unique user ID and password without any mistake.

- Then, submit the details and the login is done.

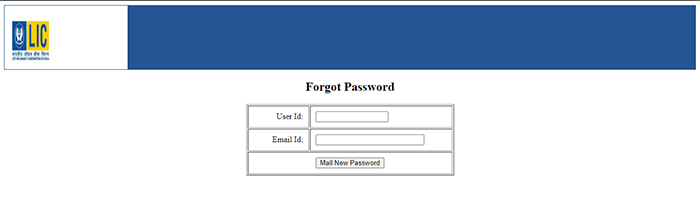

What Happens If You Forget Password of LIC Merchant Portal?

Even if you forget your password to log in, stay relaxed. By following the below steps, you can easily come out of this situation.

- Go to the official website of Life Corporation of India (LIC).

- Under the Other Online Services tab, you will find the Merchant Portal option. Click on that.

- Go for the login option.

- On LIC’s Portal Login page, you will find the ‘Forgot Password’ option. Click on that.

- Enter your unique User ID and registered email ID there and click on the ‘Mail New Password’ option.

- A mail will be sent to your given mail ID on the behalf of the company, containing a new password.

- Then, proceed by entering the new password and your job is done.

- For better safety, you can create your own password at your convenience. To do that, follow the further instructions.

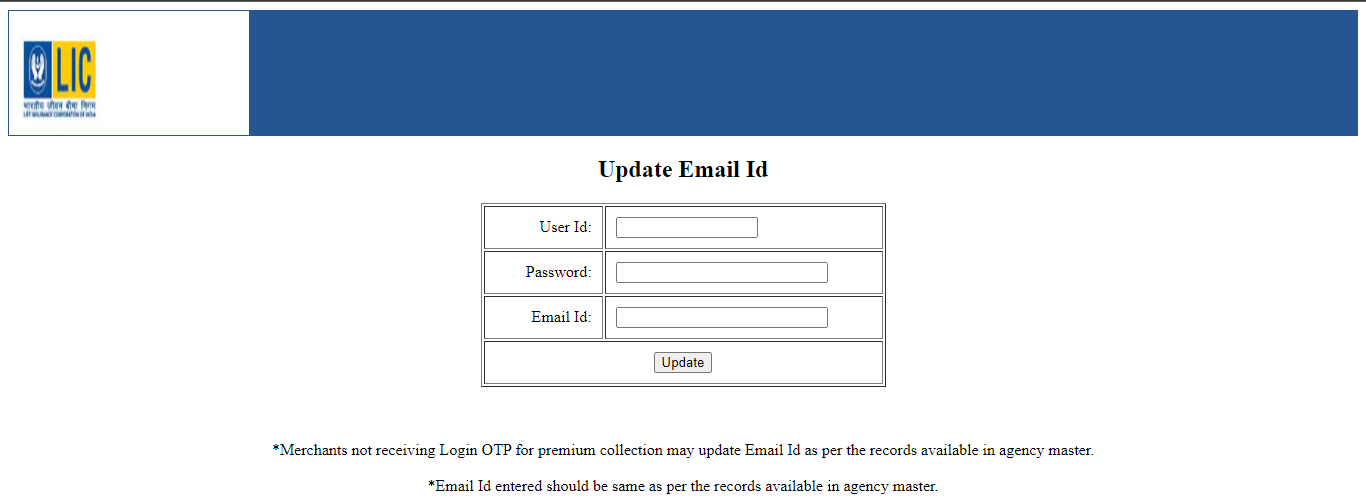

How To Update email ID For LIC Merchant Portal?

One Time Password (OTP) is an important aspect to do any kind of online transaction. It is advisable that if you are not receiving Login OTP for premium collection, you may need to update your Email Id as per the records available in agency master. If you want to update your email ID to get OTP in a hassle-free way, follow the below steps carefully.

- Go to the official website of the LIC of India.

- Under the Online Services tab, look for the Merchant Portal option and click on that.

- Select the Login option to open the LIC’s Portal Login page.

- Click on the ‘Update Email Id to get OTP’ option.

- Fill in with the necessary details such as user ID, password, and email ID.

- Then, click on the Update option and you are done.

- Remember that the email ID that you have entered should be the same as per the records available in agency master.

Use of Net Banking For Generating Online Invoice Payment For LIC Merchant Portal

A LIC merchant can easily use net banking to pay invoices that involve cash with the help of the LIC Merchant Portal platform. For that, follow the below steps.

Go to the official website of the Life Corporation of India and log in to your merchant portal.

Then go to Merchant Tools and select the ‘Pay Invoice Online’ option and click on that.

All the pending invoices will be displayed before you. From those, you can select one as per your choice and submit it.

Double check the balance of your invoice payment and confirm it.

Then, you can choose your bank for online payment and you will be directed to the selected bank’s payment portal.

Pay the amount. Upon successful payment, you will be redirected to the website of the Corporation.

There your PG ID will be displayed and you may allow them to print their payment acknowledgment if required.

What Are LIC Merchant Grievances?

As a merchant, if you have any complaints against the Corporation you can write those to them in the LIC Merchant Complains section. For clear instructions, follow the below details.

Open the page of Merchant Portal from the official website of LIC.

Log in to your Merchant Portal putting your unique user ID and password.

Now click on the LIC Merchant Complains option selected from the drop-down menu.

Write down your complaints so that the Corporation can solve those out and then submit them.

Frequently Asked Questions

The following e-services a LIC merchant can avail of once he/she is registered for that.

- Online payment

- Policy status

- Bonus status

- Loan status

- Claims status

- Revival Quotation

- Premium due calendar

- Premium paid certificate

- Policy Bond/Proposal form image

- Grievance registration

- Facility to register a complaint/grievance with the insurer

- Process of various services and online forms

- Either, you can click on the ‘Click Here’ option. And with that, a new window will open with the invoice.

- Or you can go to the Merchant Tools section and there you will find the ‘Queries’ option. Click on that. then, if they have the receipt number, you can click on the ‘View Receipt’ option.

- Or else, you can also avail of the customer care services of the Corporation to get your problem solved.

For any query, complaint, or issue, the LIC Merchants and agents can contact the Corporation by availing either of the following options.

Email ID: agent_support@licindia.com, dev_support@licindia.com

Phone number: 022-67090501 or 022-67090502

No, till now LIC does not have the facility to link the Aadhaar Number either through SMS or WhatsApp.

The Corporation itself advises changing your LIC Merchant password regularly, for better safety, at least once every 15 days.

IProposal is a mechanism for online submission of the Proposal Data to the attached branch office of SBA or Empowered Agent. Once a IProposal is successfully submitted, the data is sent to the branch using the network, and a proposal number is automatically obtained from the Branch and the data is merged with the Branch proposal master.

Yes, having an email account is mandatory for generating OTP, which is an essential part of the payment.

LIC Plans

- LIC Aadhaar Shila

- LIC Aadhaar Stambh

- LIC Amritbaal

- LIC Arogya Rakshak

- LIC Bachat Plus

- LIC Bhagya Lakshmi

- LIC Bima Jyoti

- LIC Bima Ratna

- LIC Bima Shree

- LIC Cancer Cover

- LIC Dhan Rekha

- LIC's Dhan Sanchay

- LIC Dhan Varsha

- LIC's Dhan Vriddhi

- LIC's Digi Term Plan

- LIC's Digi Credit Life

- LIC's Index Plus

- LIC Jeevan Akshay VII

- LIC Jeevan Amar

- LIC Jeevan Azad

- LIC Jeevan Dhara-II

- LIC's Jeevan Kiran

- LIC Jeevan Shiromani

- LIC New Bima Bachat

- LIC New Children's Money Back

- LIC New Endowment

- LIC New Endowment Plus

- LIC New Jeevan Anand

- LIC New Jeevan Shanti

- LIC New Jeevan Tarun

- LIC Jeevan Labh

- LIC Jeevan Lakshya

- LIC Jeevan Umang

- LIC New Money Back Plan - 20 Years

- LIC New Money Back Plan - 25 Years

- LIC Pradhan Mantri Vaya Vandana Yojana

- LIC New Tech Term

- LIC’s SIIP

- LIC Single Premium Endowment

- LIC Yuva Term

- LIC Yuva Credit Life

Life Insurers

- Aditya Birla Sun Life Insurance

- Aegon Life Insurance

- Aviva Life Insurance

- Bajaj Allianz Life Insurance

- Bharti Axa Life Insurance

- Canara HSBC Life Insurance

- Edelweiss Tokio life Insurance

- Exide Life Insurance

- Future Generali Life Insurance

- HDFC Life Insurance

- ICICI Prudential Life Insurance

- Ageas Federal Life Insurance

- Indiafirst life Insurance

- Kotak Mahindra Life Insurance

- Life Insurance Corporation of India

- Max Life Insurance

- PNBMetlife India Insurance

- Pramerica Life Insurance

- Reliance Nippon Life Insurance

- SBI Life Insurance

- TATA AIA Life Insurance

FAQs

- Best LIC Plans To Invest

- LIC Child Plans

- How To Get Duplicate LIC Bond?

- LIC Customer Care

- LIC E-Services

- LIC Kanyadan Policy

- LIC Lapsed Policy Revival Scheme

- LIC Login Process

- LIC Merchant Portal

- LIC Payment Process

- LIC Policy Address Change

- LIC Policy Receipt Download

- LIC Policy Status

- LIC Policy Tracker

- LIC Premium Calculator

- LIC Registration

- Sukanya Samriddhi Vs Kanyadan Policy

- Surrender LIC Policy

- How To File Claim Under LIC?