Life Insurance LIC of India LIC E-Services

LIC E-Services

With the help of its e-services, the Life Insurance Corporation of India has taken immense initiatives to offer their top-notch life insurance solutions in the quickest possible way. The company’s e-services are backed up with a plethora of interesting features that were previously only available by physically visiting a branch of the company. You can now leverage the company’s e-services without leaving the comfort of your own home. There are options for making payments online, checking the status of policies, loans, and bonuses, and grievance registration, among other things.

What Are The Primary Features Of LIC E-Services?

Following are some of the primary features of LIC e-services:

Online Payment Capability: It allows users to make payments online, eliminating the need to visit a LIC branch or coordinate with an agent to pay their premiums.

Tracking Of Premium Payments: You can keep track of all of your premium payments to date.

Add New Policies: The ability to add new LIC policies to an existing account is one of the most enticing features of the LIC e-services.

Saves Time & Money: LIC e-services saves not only time but also money because it is free.

Privacy: When you use LIC e-services, your personal information is not shared with anyone, including banks and financial organizations, ensuring that your information is secure.

Paperless Processes: You can examine the terms and conditions of the LIC policy you purchased on the LIC e-services website, emphasizing the need of going paperless.

Receipt Generation: After each payment of premiums, the LIC payment gateway creates a receipt, which you can download and print to keep track of your payments.

What Are The Services Offered By LIC Online Portal?

Once you have registered yourself with LIC e-services, you can enjoy the following services:

- E-Payment: Policyholders can use LIC’s e-services to pay their renewal premiums, loan interest, and loan repayment. Net banking, debit card, credit card, BHIM, and UPI are all options available for payment.

- Bonus Status: This service allows the policyholder to view the total bonus accumulated under the policy.

- Policy Status: The policy status and other plan details, such as plan duration, sum assured, and start date, are also displayed on the e-services portal.

- Policy Schedule: Consumers can view the policy schedule on the first page of the policy bond.

- Claim Status: With the help of this service, the policyholders can examine the date of the policy’s survival benefit (if applicable) or maturity benefit during the policy tenure.

- Revival Quotation: In the event that a policy has lapsed, a revival quotation is available to the policyholder.

- Premium Due Calendar: This category displays information about the premiums due throughout the year.

- Premium Paid Certificate: Policyholders can view information of premiums paid under individual and combined policies under this tab.

- Claim History: Any claim that has been paid under the policy will be displayed under this tab, together with the details of the cheque, the amount paid, and the date on which the payment was made.

- Grievance Registration: Customers will be able to use this tool to file a grievance or complaint with the Life Insurance Corporation of India.

- Proposal Form/Policy Bond Image: Under this service, the policyholders can access scanned photographs of the policy bond and proposal form. This feature is only available to plans that have been enrolled.

- Locators: LIC’s e-Services provide a number of locators, including agent locators, that can assist you in finding local insurance agents.

- Online Loan: Under this, the policyholder is provided with online loan policy options against their insurance policy, which they can utilize for their own commercial or personal needs.

- Online Address Change: In order to preserve the line of communication, it is critical to keep the company informed about any changes in residence. With the online address change service, you can change the address easier than ever before with the help of an online procedure.

Why To Register Online For LIC E-Services?

The following is a list of advantages offered to people who sign up for LIC e-services:

Access Anytime Anywhere: It allows policyholders to access information about their insurance plans at any time and from any location.

Pay Premiums Online: With LIC e-services, you do not need to visit the branch for paying premiums. This can be done via the online method.

Know Your Claim Status: Policyholders do not need to contact LIC’s customer service or visit their office to learn about the status of their claims. The LIC’s online portal has all of the relevant information.

Free Of Cost: As LIC e-services are free of cost for registered users, it doesn’t break your bank.

Access Multiple Policies: The portal allows you to view the details of numerous policies.

Keep Track Of Premium Dues: With the help of LIC e-services, the policyholder can keep track of the next premium dues on a regular basis.

No Time Lag: The policyholder will not experience any time lag from the date of payment to receive the receipt.

Registration Process For LIC E-Services

In order to register for LIC e-services, you need to follow the below-mentioned steps:

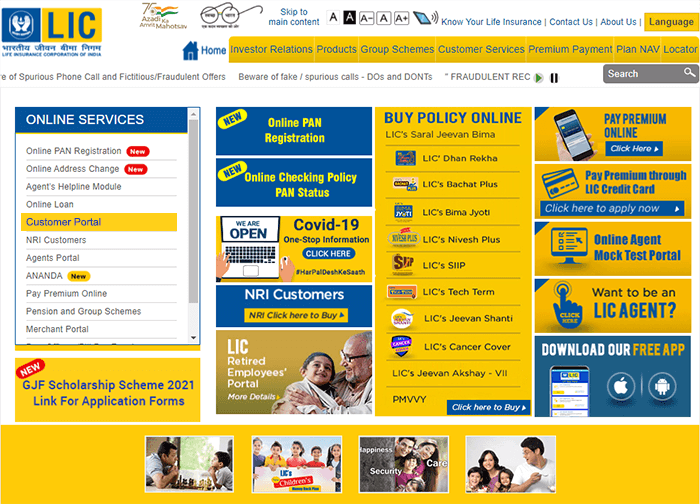

- Visit the LIC website: www.licindia.in.

- Click on ‘Customer Portal’ under the ‘Online Services’ box on the left-hand side of the screen.

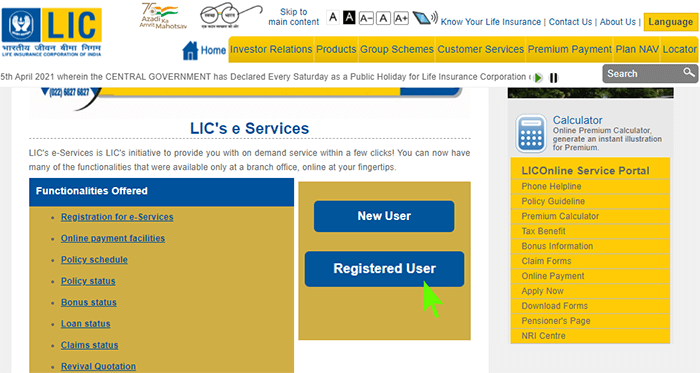

- You’ll be taken to the LIC e-services page, where you must select ‘Registration For e-Services’ from the ‘Functionalities Offered’ area.

- There will be two tabs, one labelled ‘Registered User’ and the other labelled ‘New User.’

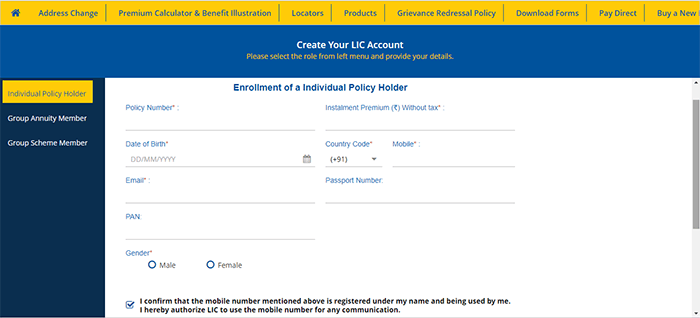

- Select ‘New User’ and fill in the required information.

- Check the box which says, ‘I confirm that the cellphone number mentioned above is registered under my name and is being used by me,’.

- After you’ve entered all of the necessary information, click ‘Proceed.’

- Following that, a user ID and password must be chosen based on the website’s terms and conditions. Your LIC portal login credentials will be this user ID and password.

- Your enrollment for LIC e-services will be confirmed with a welcome email sent to your registered email address.

- To log in, go to the LIC’s e-services page and select ‘Registered User’ before entering your user ID and password.

- You’ll be able to access a range of services once you’ve logged in to the portal, including Basic Services, e-Services, and Premier Services.

How To Use LIC’s Online Address Change Service?

To change your address on LIC’s portal, you need to follow the below-mentioned steps:

- Visit the official website of LIC.

- Under the “Online Services” section, click on “Online Address Change”.

- The link will direct to another website of LIC. Read and accept the terms and conditions, and then click on “Proceed”.

- Enter your policy number, mobile number, email ID, and click on “Check And Generate OTP”.

- After this, your Aadhaar Card will be verified for the process followed by eKYC verification.

- After receiving the update from LIC, the policyholder must double-check the information by login into the portal.

Frequently Asked Questions

The LIC’s e-Services are available to everyone who has purchased a life insurance policy from the company. To take advantage of these services, simply register on the LIC site.

The steps for checking the policy status under the LIC e-services portal are as follows:

- Visit the official website of the company.

- Select either “New User” or “Registered User” from the drop-down menu (if you are a new user, you have to first register).

- Enter your username and password as your login credentials.

- Select “Policy Status” from the drop-down menu.

- You’ll see a list of all of the LIC policies you’ve signed up for.

- To find out the status of any of the policies in the list, click on the policy number.

The details that must be filled in include:

- Any one of your LIC policies

- Policy number

- Date of birth of the individual mentioned in the policy document

- Installment premium

- Individual’s email ID

- Individual’s mobile number

In case you are facing any problem with your LIC e-services, you can call the company’s 24*7 number +91 22 6827 6827.

Hover over the menu on the left side of the home page once you’re on the homepage of your online LIC account. A tab labelled ‘Consolidated Premium Paid Statement’ will appear, from which you can download your premium payment statement.

LIC Plans

- LIC Aadhaar Shila

- LIC Aadhaar Stambh

- LIC Amritbaal

- LIC Arogya Rakshak

- LIC Bachat Plus

- LIC Bhagya Lakshmi

- LIC Bima Jyoti

- LIC Bima Ratna

- LIC Bima Shree

- LIC Cancer Cover

- LIC Dhan Rekha

- LIC's Dhan Sanchay

- LIC Dhan Varsha

- LIC's Dhan Vriddhi

- LIC's Digi Term Plan

- LIC's Digi Credit Life

- LIC's Index Plus

- LIC Jeevan Akshay VII

- LIC Jeevan Amar

- LIC Jeevan Azad

- LIC Jeevan Dhara-II

- LIC's Jeevan Kiran

- LIC Jeevan Shiromani

- LIC New Bima Bachat

- LIC New Children's Money Back

- LIC New Endowment

- LIC New Endowment Plus

- LIC New Jeevan Anand

- LIC New Jeevan Shanti

- LIC New Jeevan Tarun

- LIC Jeevan Labh

- LIC Jeevan Lakshya

- LIC Jeevan Umang

- LIC New Money Back Plan - 20 Years

- LIC New Money Back Plan - 25 Years

- LIC Pradhan Mantri Vaya Vandana Yojana

- LIC New Tech Term

- LIC’s SIIP

- LIC Single Premium Endowment

- LIC Yuva Term

- LIC Yuva Credit Life

Life Insurers

- Aditya Birla Sun Life Insurance

- Aegon Life Insurance

- Aviva Life Insurance

- Bajaj Allianz Life Insurance

- Bharti Axa Life Insurance

- Canara HSBC Life Insurance

- Edelweiss Tokio life Insurance

- Exide Life Insurance

- Future Generali Life Insurance

- HDFC Life Insurance

- ICICI Prudential Life Insurance

- Ageas Federal Life Insurance

- Indiafirst life Insurance

- Kotak Mahindra Life Insurance

- Life Insurance Corporation of India

- Max Life Insurance

- PNBMetlife India Insurance

- Pramerica Life Insurance

- Reliance Nippon Life Insurance

- SBI Life Insurance

- TATA AIA Life Insurance

FAQs

- Best LIC Plans To Invest

- LIC Child Plans

- How To Get Duplicate LIC Bond?

- LIC Customer Care

- LIC E-Services

- LIC Kanyadan Policy

- LIC Lapsed Policy Revival Scheme

- LIC Login Process

- LIC Merchant Portal

- LIC Payment Process

- LIC Policy Address Change

- LIC Policy Receipt Download

- LIC Policy Status

- LIC Policy Tracker

- LIC Premium Calculator

- LIC Registration

- Sukanya Samriddhi Vs Kanyadan Policy

- Surrender LIC Policy

- How To File Claim Under LIC?