Life Insurance LIC of India LIC Bima Jyoti

LIC Bima Jyoti

LIC Bima Jyoti (Plan No. 860, UIN No. 512N339V02) is a non-linked savings plan that offers maximum protection against the death of the policyholder and provides a one-time lumpsum payment on maturity. After buying the policy, financial assistance will also be provided to the family members on the untimely demise of the policyholder.

The major highlight of this LIC of India policy is the blend of protection and savings benefits, providing comprehensive protection to the policyholder and his family thereafter. With the policy’s dedicated loan facility, the insurance policy also perfectly caters to liquidity needs. Anyone looking to buy the policy can easily purchase the policy can choose an online or offline method, either way.

Eligibility Criteria: Are You Eligible for the Plan?

Here’s the eligibility criteria for the LIC Bima Jyoti plan;

| Minimum Age at entry | 90 days Completed |

| Maximum Age at Entry | 60 Years (Age Nearer Birthday) |

| Premium Paying Term | Policy Term minus 5 Years |

| Minimum Basic Sum Assured | Rs. 1,00,000 |

| Maximum Basic Sum Assured | No limit (Basic Sum Assured shall be in multiples Rs 25,000/- ) |

| Minimum Age at Maturity | 18 years (Completed) |

| Maximum Age at Maturity | 75 Years (Age Nearer Birthday) 65 Years (Age Nearer Birthday) for policies procured through POSP-LI & CPSC-SPV |

What are the Features & Benefits of LIC Bima Jyoti?

LIC Bima Jyoti offers a multitude of features and benefits that perfectly cater to the needs of the policyholders. Let’s discuss them in detail!

1. Death Benefit

This is the biggest benefit and feature of LIC Bima Jyoti that attracts most users to look for this policy.

If the policyholder, however, dies during the period of the policy, then the nominee/family members shall receive the premium amount (excluding extra premium, taxes, etc.). But there’s a condition that the misshape must have happened before the beginning of the date of commencement of risk.

Talking about the other scenario, if the policyholder dies after the date of commencement of risk but during the period of the policy, then the family shall receive the sum assured and guaranteed additions.

Coming to the question: What would be the sum assured on death?

Well, it would be 7X of annualized premium or 125% of basic sum assured.

2. Guaranteed Additions

This is another major benefit that a policyholder will receive with LIC Bima Jyoti!

At the end of each policy tear, there shall be guaranteed additions at the rate of Rs. 50 per thousand minimum sum assured will be added to the policy. But there’s a condition that the premium payments should have been made.

If the policyholder, however, dies during the period of the policy, then the family members shall receive the guaranteed addition for the complete year of the plan. But on the other hand, if the user hadn’t paid premiums on time, the Guaranteed Additions shall cease to accrue under a policy.

Coming to the surrender of the policy, the guaranteed addition shall be added on an equivalent basis in response to the amount of the premium received for that year.

3. Grace Period

This is another major feature that comes under the LIC Bima Jyoti policy!

During the period of the policy, a policyholder will likely get 30 days of grace period to make the payment for yearly or half-yearly, or quarterly premiums. According to the rules of the policy, the plan will be considered in force with the risk covered without any difficulty. However, if the policyholder fails to make the premium payment even during the grace period, then the policy will lapse.

Note: Remember that the aforementioned grace period applies to rider premium that should be paid in addition to the premium for the base policy.

4. Paid-up value

Another major benefit that comes into play is none other than “Paid-Up Value”. If the policyholder has already paid premiums for less than 2 years during the policy period but failed to pay the subsequent premium, then all the benefits under the policy shall be terminated.

Taking another scenario into consideration, if he/she has made the premium payments for a minimum of 2 years without duly paying the subsequent premium amount, then the plan will remain active but it would act as a paid-up policy till the end of the policy term.

5. Surrender

Surrender benefit is something that every user adheres to while choosing an insurance plan.

The term simply means that the plan can be surrendered but he/she should have paid the premiums for 2 full years. Once the policy has been surrendered, the company shall pay the amount of surrender which is equal to higher Guaranteed Surrender Value or Special Surrender Value.

The Special Surrender Value is subject to change and may be adjusted by the Company with IRDAI’s prior consent.

6. Loan Against Policy

This is one of the biggest benefits that a policyholder may get a loan at the time of need.

It is important for a user that he/she should have paid a minimum of 2 years of the full premium to avail of the loan. However, the company’s terms and conditions may change from time to time. Talking about the maximum loan, a user may get up to 90% for in-force policies and up to 80% for paid-up policies.

At periodic periods, the interest rate to be levied for the policy loan and as applicable for the whole term of the loan will be set.

7. Free Look Period

What if you are not happy with the guidelines of the policy? Well, exactly, this is where the importance of this feature comes in!

If the Policyholder is unhappy with the terms and conditions of the policy, then he/she may return the plan to the company within 15 days of buying the policy. On the other hand, if the user had bought the policy using online mode, then he/she can return the policy within 30 days of buying the policy.

8. Waiting Period

If the Policy is bought via Point of Sales Persons-Life Insurance (POSP-LI) & CPSC-SPV, the Company will reimburse the complete premiums paid if the Life Assured dies within the first 90 days of the risk beginning, provided the policy is in force and death is not caused by an accident.

The “Sum Assured on Death” will be paid if a person dies in an accident during the waiting period. If the Life Assured’s age at the time of entry is less than eight years, this provision will not apply.

9. Payment of Premiums

Last but not the least, a policyholder has the opportunity to make the premium payment on different bases like monthly, quarterly, yearly, or half-yearly at their convenience.

How LIC Bima Jyoti Plan Work?

Let us understand this plan with the help of an example:

Mr. Ajay aged 30 buys LIC Bima Jyoti for Rs. 10 Lakhs sum assured for a premium paying term of 15 years with a period of the policy of 20 years.

Listed below is the calculated premium for the First & Second Years.

| Mode | Premium | Premium for First Year | Premium for Second Year |

| Yearly | 77790 | 80707 | 79249 |

| Half-Yearly | 39323 | 40798 | 40060 |

| Quarterly | 19875 | 20620 | 20248 |

| Monthly | 6625 | 6873 | 6749 |

The current GST rate is 4.5 percent for the first policy year, and 2.25 percent from the second year onwards.

Maturity Details:

After the completion of the period of the policy, the LIC Bima Jyoti plan offers maturity benefits (only if Mr. Ajay survives till the maturity date), requiring all the premiums to be paid on time.

| Sum Assured | Guaranteed Addition | Total Maturity |

| 1000000 | 1000000 | 2000000 |

During the period of the policy, the maturity amount is Basic Sum Assured + Guaranteed Addition. Under the plan, the guaranteed addition in this plan is Rs. 50 per 1000 of Sum Assured per year.

Premium Calculation For LIC Bima Jyoti Plan

Let’s look at an example to see what the proper premium is for a policy with a Basic Sum Assured of Rs 10 lakhs for different age groups. Let’s discuss them in detail!

| Age (In Years) | Policy Term (Premium Payment Term) | Policy Term (Premium Payment Term) | Policy Term (Premium Payment Term) |

| 15 (10) | 18 (12) | 20 (15) | |

| 20 | 1,13,217 | 87,541 | 77,153 |

| 30 | 1,13,609 | 88, 031 | 79,790 |

| 40 | 1,15,667 | 90,481 | 80, 534 |

| 50 | 1, 22, 135 | 97, 488 | 88, 178 |

What is Not Included Under the LIC Bima Jyoti?

Although the inclusions have already been mentioned under the feature and benefits section, there’s also an excluded that comes under LIC Bima Jyoti!

- If the policyholder commits suicide within 12 months of the start of the risk, the company is entitled to payout 80% of the total premiums paid, excluding the rider premiums, additional premiums, and taxes.

- Talking about another scenario, if the policyholder commits suicide within just 12 months from the revival date, then the corporation is entitled to pay the amount higher than 80% of the total premiums paid till the date of death. The amount, however, doesn’t include any extra premium, taxes, or rider premiums. Under this policy, the Corporation will not entertain any further claims.

The condition, however, shall not be applicable, only if the age of the life insured is below 8 years during the time of the revival of the policy.

How To Buy or Apply LIC Bima Jyoti Policy?

If you are looking to buy LIC New Bima Bachat Plan, you must first complete the following steps:

Online Method

- 1. Go to the company’s official website.

- 2. In the middle of the page, you’ll see a yellow banner that says “Buy Policy Online.”

- 3. You will then be brought to a page where you must choose the appropriate plan, i.e., LIC Bima Jyoti.

- 4. When you select the plan, you click on the policy and you will see the page with the option “click on buy online”.

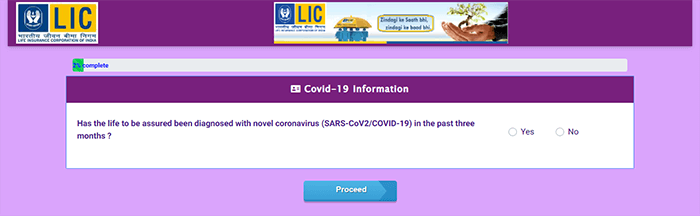

- 5. After that, you need to tick on the either yes or no for the question: Has the life to be assured been diagnosed with the novel coronavirus (SARS-CoV2/COVID-19) in the past three months?

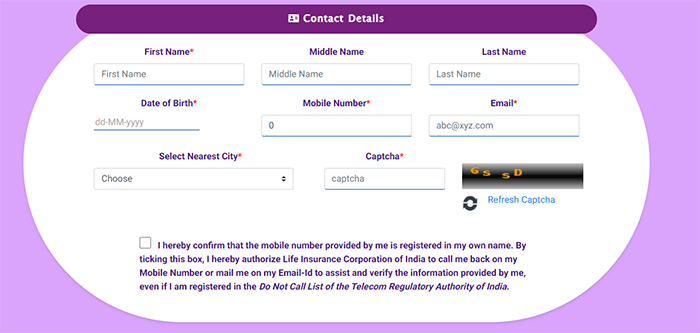

- 6. Once you select the option, you will need to enter your details like name, date of birth, mobile number, email Id, and more.

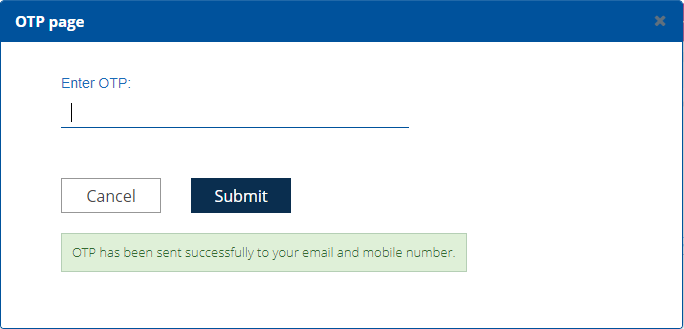

- 7. Enter the captcha code and submit. You will receive a 9 digit access id and OTP on your mobile no and email.

- 8. After that, you will need to enter OTP and proceed further.

- 9. To calculate premiums, enter the sum assured and the term, select yes from the radio button, and complete the form.

- 10. Confirm the details and proceed with payment after the proposal has been successfully submitted.

- 12. You will receive an introductory email after making your payment.

- 13. Use the platform to upload all essential paperwork. You will be sent a link. Non-medical cases will be completed using the information provided in the documents.

- 14. MSP will contact you if you require medical assistance. LIC will underwrite the case after the medical.

- 15. LIC will assign a policy number and provide details to your registered email address after receiving the decision.

- 16. You will receive a copy of the policy by mail as well as by post.

Offline Method

If you are willing to buy the policy in person, then you can simply visit the LIC Branch near your location. But make sure you bring all your respective documents and then go to the branch to get all the information related to the insurance that you need and buy the policy.

However, if you continue to have issues, you can contact Probus Insurance for assistance.

Frequently Asked Questions

Here’s the list of the frequently asked questions related to LIC Bima Jyoti!

When you opt for the Bima Jyoti Plan LIC, you have two options of receiving the death benefit as a total of the entire amount of sum insured. Alternatively, the death benefit may be received in installments over 5/ 10 or 15 years.

Here’s the list of the documents that you need to submit if you are looking to purchase the LIC Bima Jyoti Plan:

- Date of Birth Proof

- ID Proof

- Latest Photographs

- Your Bank Account Details

A lapsed policy can be revived if it is purchased within 5 years after the date of the First Unpaid Premium but before the maturity date of the policy.

LIC Plans

- LIC Aadhaar Shila

- LIC Aadhaar Stambh

- LIC Amritbaal

- LIC Arogya Rakshak

- LIC Bachat Plus

- LIC Bhagya Lakshmi

- LIC Bima Jyoti

- LIC Bima Ratna

- LIC Bima Shree

- LIC Cancer Cover

- LIC Dhan Rekha

- LIC's Dhan Sanchay

- LIC Dhan Varsha

- LIC's Dhan Vriddhi

- LIC's Index Plus

- LIC Jeevan Akshay VII

- LIC Jeevan Amar

- LIC Jeevan Azad

- LIC Jeevan Dhara-II

- LIC's Jeevan Kiran

- LIC Jeevan Shiromani

- LIC New Bima Bachat

- LIC New Children's Money Back Plan

- LIC New Endowment Plan

- LIC New Endowment Plus Plan

- LIC New Jeevan Anand

- LIC New Jeevan Shanti

- LIC New Jeevan Tarun

- LIC Jeevan Labh

- LIC Jeevan Lakshya

- LIC Jeevan Umang

- LIC New Money Back Plan - 20 Years

- LIC New Money Back Plan - 25 Years

- LIC Pradhan Mantri Vaya Vandana Yojana

- LIC New Tech Term

- LIC’s SIIP

- LIC Single Premium Endowment Plan

FAQs

- Best LIC Plans To Invest

- LIC Child Plans

- How To Get Duplicate LIC Bond?

- LIC Customer Care

- LIC E-Services

- LIC Kanyadan Policy

- LIC Lapsed Policy Revival Scheme

- LIC Login Process

- LIC Merchant Portal

- LIC Payment Process

- LIC Policy Address Change

- LIC Policy Receipt Download

- LIC Policy Status

- LIC Policy Tracker

- LIC Premium Calculator

- LIC Registration

- Sukanya Samriddhi Vs Kanyadan Policy

- Surrender LIC Policy

- How To File Claim Under LIC?

Life Insurers

- Aditya Birla Sun Life Insurance

- Aegon Life Insurance

- Aviva Life Insurance

- Bajaj Allianz Life Insurance

- Bharti Axa Life Insurance

- Canara HSBC Life Insurance

- Edelweiss Tokio life Insurance

- Exide Life Insurance

- Future Generali Life Insurance

- HDFC Life Insurance

- ICICI Prudential Life Insurance

- Ageas Federal Life Insurance

- Indiafirst life Insurance

- Kotak Mahindra Life Insurance

- Life Insurance Corporation of India

- Max Life Insurance

- PNBMetlife India Insurance

- Pramerica Life Insurance

- Reliance Nippon Life Insurance

- SBI Life Insurance

- TATA AIA Life Insurance