Life Insurance LIC of India LIC Premium Calculator

LIC Premium Calculator

When it comes to creating more tailored and user-friendly policies, insurance firms have gone a long way. And, as a pioneer in the insurance market, LIC offers a straightforward model for calculating your policy’s premium, known as the “Premium Calculator”.

The LIC Premium Calculator is a tool that will assist you in estimating the amount of money you will have to pay in premiums. Filling out the entire form takes less than a minute, and once you’ve provided all of the required information and preferences, the tool will show you a rough estimate of the premium.

It’s crucial to remember that the LIC Premium Calculator’s result is simply an estimate, and the insurance company may do additional background checks that increase or lower the price given by the tool.

How Does LIC Premium Calculator Work?

To understand how the LIC premium calculator works, we need to go through an example:

Ashish is a Sales Officer and wants to buy an endowment plan that has a sum assured of Rs. 10 lakhs for his future. He is 30 years old and intends to pay the premiums for the following 15 years. For his endowment plan, Ashish does not want any riders or add-ons. Therefore, the LIC premium calculator provides the following details once he enters these details and hits the calculate button.

| Frequency | Total Premium Including Tax |

| Yearly | Rs. 70,008 |

| Half-Yearly | Rs. 35,418 |

| Quarterly | Rs. 17, 896 |

| Monthly | Rs. 5,965 |

How To Use LIC Premium Calculator Online?

The purpose of using the LIC premium calculator is to estimate the premium amount for insurance that you want to purchase. Here’s a quick tutorial on how to use the calculator.

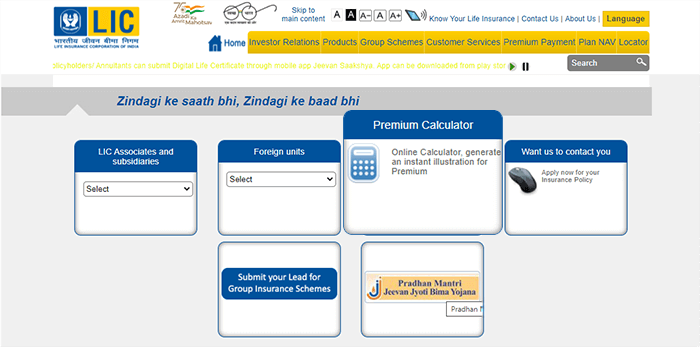

- Visit the official website of the Life Insurance Corporation of India.

- Click on the “Premium Calculator” box below. You will be then directed to another page.

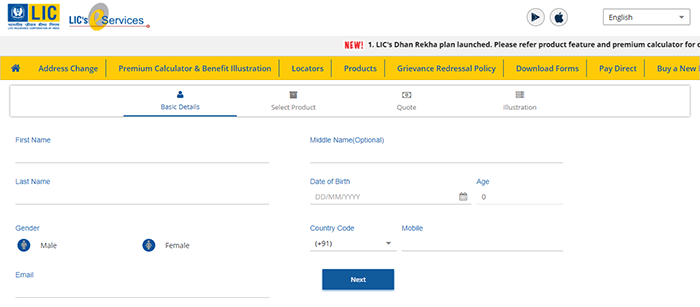

- Enter all the necessary details like name, date of birth, etc.

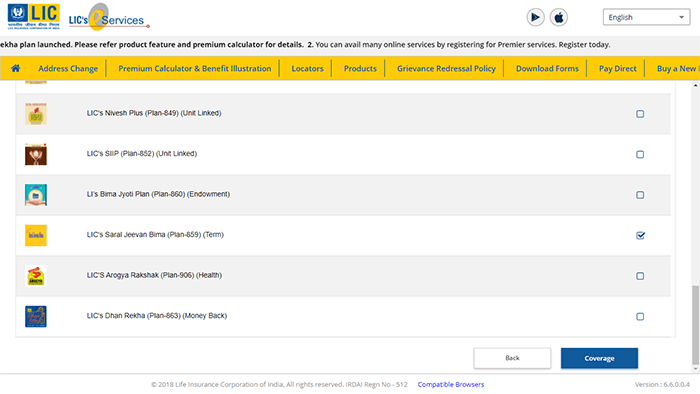

- After this, choose the type of plan that you wish to purchase, and then select “Coverage”.

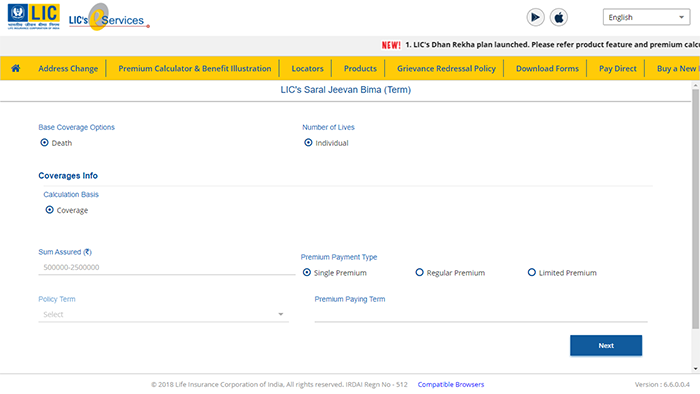

- Enter the sum assured, policy term, and tick additional coverages if you want one. Then click on “Quote”.

- The LIC premium calculator will display the premium details on a yearly, half-yearly, quarterly, and monthly basis.

What Are The Factors Responsible For Calculating LIC Premium?

Following are the factors that are considered by LIC to calculate its premium:

Age: Young individuals tend to pay lower premiums as compared to older ones. Therefore, if you are young, the LIC premium amount will be low; whereas, if you are an old person, your LIC premium will be higher.

Gender: The amount of premium paid by women is relatively lower than men due to the fact that they live longer than men on average. Therefore, LIC charges fewer premium amounts for women as compared to men.

Sum Assured: Sum assured also has a significant impact on the policy’s premium amount. If you choose to increase the sum assured, the premium amount will also increase accordingly.

Type Of Plan: Another aspect that influences your LIC insurance premium is the type of coverage you select. Policies with bigger benefit amounts over longer terms tend to be more expensive than policies with smaller benefit amounts over shorter terms.

Policy Term: The policy term plays a crucial role in determining the cost of the premium. The longer the tenure, the higher will be the premium amount.

Frequently Asked Questions

The premium amount calculated by the calculators is simply an estimate. Once you’ve finalized the policy, you’ll need to contact LIC to acquire the specific figures. Certain fees or taxes may not always be taken into account by the premium calculator. A potential buyer should keep in mind that these tools are designed to make the policy purchasing process easier. As a result, it does not always provide the final policy price, but rather a price that is as close to actuals as possible.

No. The LIC premium calculator tool will only assist you in gaining a better understanding of the prospective premium costs that you may be required to pay.

There are several applications under which you can calculate LIC premiums, such as ALL IN ONE PREMIUM CALCULATOR, LIC Customer, MY LIC, etc.

You need to follow the below-mentioned steps:

- Visit the official website of the company and click on “Online Services”.

- Click on the tab “Registered User”, and submit your ID and password for logging in to your account.

- Now, you will be directed towards the LIC e-services page. Click on any one of the two options available: “Consolidated Premium Paid Statement” OR “Individual Policy Premium Paid Statement”.

- Choose the financial year and various other details, and then download the premium payment receipt in PDF form.

No. The LIC premium calculator has no costs associated with it.

LIC Plans

- LIC Aadhaar Shila

- LIC Aadhaar Stambh

- LIC Amritbaal

- LIC Arogya Rakshak

- LIC Bachat Plus

- LIC Bhagya Lakshmi

- LIC Bima Jyoti

- LIC Bima Ratna

- LIC Bima Shree

- LIC Cancer Cover

- LIC Dhan Rekha

- LIC's Dhan Sanchay

- LIC Dhan Varsha

- LIC's Dhan Vriddhi

- LIC's Index Plus

- LIC Jeevan Akshay VII

- LIC Jeevan Amar

- LIC Jeevan Azad

- LIC Jeevan Dhara-II

- LIC's Jeevan Kiran

- LIC Jeevan Shiromani

- LIC New Bima Bachat

- LIC New Children's Money Back Plan

- LIC New Endowment Plan

- LIC New Endowment Plus Plan

- LIC New Jeevan Anand

- LIC New Jeevan Shanti

- LIC New Jeevan Tarun

- LIC Jeevan Labh

- LIC Jeevan Lakshya

- LIC Jeevan Umang

- LIC New Money Back Plan - 20 Years

- LIC New Money Back Plan - 25 Years

- LIC Pradhan Mantri Vaya Vandana Yojana

- LIC New Tech Term

- LIC’s SIIP

- LIC Single Premium Endowment Plan

Life Insurers

- Aditya Birla Sun Life Insurance

- Aegon Life Insurance

- Aviva Life Insurance

- Bajaj Allianz Life Insurance

- Bharti Axa Life Insurance

- Canara HSBC Life Insurance

- Edelweiss Tokio life Insurance

- Exide Life Insurance

- Future Generali Life Insurance

- HDFC Life Insurance

- ICICI Prudential Life Insurance

- Ageas Federal Life Insurance

- Indiafirst life Insurance

- Kotak Mahindra Life Insurance

- Life Insurance Corporation of India

- Max Life Insurance

- PNBMetlife India Insurance

- Pramerica Life Insurance

- Reliance Nippon Life Insurance

- SBI Life Insurance

- TATA AIA Life Insurance

FAQs

- Best LIC Plans To Invest

- LIC Child Plans

- How To Get Duplicate LIC Bond?

- LIC Customer Care

- LIC E-Services

- LIC Kanyadan Policy

- LIC Lapsed Policy Revival Scheme

- LIC Login Process

- LIC Merchant Portal

- LIC Payment Process

- LIC Policy Address Change

- LIC Policy Receipt Download

- LIC Policy Status

- LIC Policy Tracker

- LIC Premium Calculator

- LIC Registration

- Sukanya Samriddhi Vs Kanyadan Policy

- Surrender LIC Policy

- How To File Claim Under LIC?