Life Insurance LIC of India Best LIC Plans To Invest

Best LIC Plans To Invest

Life insurance policies are an indispensable part of life as it plays a pivotal role in carving the uncertainties of life. When it comes to life insurance policies, LIC (Life Insurance Corporation of India) is the first name that occurs to everyone’s mind as it is not only one of the most trusted but also a leading insurance company in India for ages. LIC started its journey in 1956 and since then it has been serving its customers faithfully fulfilling each requirement of them without any fail and has built up a customer base of over 250 million in India. Along with the life plans, LIC has also come up with different scholarships and programs that help others to grow.

LIC has presented a sack full of life insurance products ranging from retirement plans, endowment plans, term plans, ULIP plans to plans for children, money back plans, and many more with lots of variants to cater to the varied needs of every individual. These plans are dynamic and flexible and are designed in a customer-friendly manner, keeping in mind the needs of the consumers. As life is uncertain; any unfortunate unforeseen incident may happen at any point in life, these plans offer you enough financial protection and safeguard you and your family, even in your absence. LIC has always kept its promise, “Zindagi Ke Saath Bhi, Zindagi Ke Baad Bhi” and is still thriving. Here we will talk about the best LIC plans for 2024 to invest in.

Best LIC Plans To Invest in 2024

As LIC has come up with a bundle of life insurance plans along with lots of variants with varied benefits, here the top 10 best LIC plans 2021 have been selected and brief details of each plan will be discussed. Let us have a look at the below table.

| Plan Name | Plan Type | Entry Age | Maximum Maturity Age | Sum Assured | Policy Term | Policy Paying Term |

| LIC’s Jeevan Umang | Whole Life Plan | Minimum – 90 days Maximum – 55 years | 100 years | Minimum – Rs. 2 lakhs Maximum – No upper limit | 100 – age of entry | 15, 20, 25, and 30 years |

| LIC’s New Bima Bachat Plan | Money Back Plan | Minimum – 15 years Maximum – 50 years | 59 years for term 9 years, 62 years for term 12 years, 65 years for term 15 years | Minimum – Rs. 35,000 for term 9 years, Rs. 50,000 for term 12 years, Rs. 70,000 for term 15 years | 9, 12, and 15 years | Single premium |

| LIC’s Pradhan Mantri Vaya Vandana Yojana | Senior citizen plan | Minimum – 60 years Maximum – No upper limit | – | Purchase price (for annual pension mode) | 10 years | Yearly, half-yearly, quarterly, and monthly. |

Minimum – Rs. 1,56,658 Maximum – Rs. 14,49,086 | ||||||

| LIC’s Tech Term Plan | Term Assurance Plan | Minimum – 18 years Maximum – 65 years | 80 years | Minimum – Rs. 50 lakhs Maximum – No upper limit | 10 to 40 years | Regular premium and limited premium |

| LIC’s Nivesh Plus | ULIP Plan | Minimum – 90 days Maximum – 70 years and 35 years | 85 years for Option 1 50 years for Option 2 | Minimum – Rs. 1 lakh Maximum – No upper limit | 10 years to 25 years | Single premium |

| LIC’s New Jeevan Shanti | Pension Plan | Minimum – 30 years Maximum – 79 years and 35 years | Vesting age | Purchase price | – | Yearly, half-yearly, quarterly, and monthly |

Minimum – 31 years Maximum -80 years | Minimum – Rs. 1,50,000 Maximum – No upper limit | |||||

| LIC’s Bima Jyoti | Endowment plan | Minimum – 90 days Maximum – 60 years | 75 Years 65 Years for policies procured through POSP-LI & CPSC-SPV | Minimum – Rs. 1 lakh Maximum – No upper limit | 15 to 20 years | Policy term minus 5 years |

| LIC’s New Children’s Money Back Plan | Children + Money Back Plan | Minimum – 0 years Maximum – 12 years | 25 years | Minimum – Rs. 1 lakh Maximum – No upper limit | 25 minus age of entry | 25 minus age of entry |

| LIC’s Arogya Rakshak | Health Plan | Minimum: Adult – 18 years Dependent children – 91 days Maximum: Adult – 65 years Dependent children – 20 years | – | Minimum – Rs. 2.5 lakhs Maximum – 10 lakhs | Adults: 80 minus age at entry, 70 minus age at entry Dependent child – 25 minus age at entry | Yearly and half-yearly |

| LIC’s New Jeevan Anand Plan | Endowment Plan | Minimum – 18 years Maximum – 50 years | 75 years | Minimum – Rs. 1 lakh Maximum – No upper limit | Minimum – 15 years Maximum – 35 years | Yearly, half-yearly, quarterly, and monthly. |

Have a look below to know more about these best LIC plans for 2023-2024.

1. LIC’s Jeevan Umang Policy

It is one of the best investment plans in India that has come up with income coupled with protection benefits to you and your family. This plan not only offers an annual survival benefit from the end of the premium paying term till maturity but also provides a lumpsum amount at the time of maturity or at the event of the unfortunate demise of the policyholder during the policy term.

Key highlights of the policy:

In case of unfortunate and unforeseen demise of the insured person during the active policy period, the death benefit is paid to the beneficiary or nominee on both the cases – on death before the commencement of the risk and on death after the commencement of the risk.

If the insured person survives the entire premium payment tenure for an active plan, then the survival benefit equal to 8% of the sum assured is paid to the life assured at the end of the premium paying term whereas as a maturity benefit, the sum assured along with multiple bonuses paid to the insured.

The loan facility is also available under this policy that is subject to the terms and conditions of the company.

To make your policy stronger, different rider benefits are available such as LIC Accidental Death and Disability Rider Benefit, LIC Accidental Rider Benefit, LIC New Term Assurance Rider, LIC New Critical Illness Rider, and LIC Premium Waiver Benefit.

2. LIC’s New Bima Bachat Policy

It is a participating non-linked savings as well as protection plan, where the premium is paid in a lump sum at the outset of the policy. This is a dynamic and flexible money back plan that has come up with multiple rider benefits to choose from to make this policy stronger.

Key highlights of the policy:

In case of death during the first five policy years, the Sum Assured on Death (1.25 times the single premium or Basic Sum Assured, whichever is higher) is payable to the beneficiary whereas, on death after completion of five policy years, the Sum Assured on Death along with Loyalty Addition is paid.

You can also opt for receiving the death benefit in installments over the chosen period of 5 or 10 or 15 years instead of a lump sum amount that makes this plan the best investment plan for regular income.

This plan also offers survival and maturity benefits.

Under this plan, one can avail of the loan facility any time after the completion of one policy year. The loan will be equal to 90% of the surrender value as of the date of sanction of the loan.

3. LIC’s Pradhan Mantri Vaya Vandana Yojana

It is a Non-Linked, Non-Participating, Pension Scheme subsidized by the Government of India with a modified rate of pension to provide financial support to the senior citizens so that they can live their golden age tension-free. LIC of India is solely authorised to operate this scheme and it can be purchased both online and offline.

Key highlights of the plan:

If the pensioner survives the policy term of 10 years, not only pension in arrears will be provided to him/her, but also a purchase price along with the final pension installment will be payable by this policy as maturity benefit.

In case of the unfortunate and untimely demise of the pensioner during the policy term of 10 years, the purchase price will be refunded to the beneficiary or nominee as the death benefit.

The loan facility is available under this plan, after the completion of 3 policy years. The maximum loan that can be granted will be 75% of the Purchase Price.

The plan offers the flexibility to choose any mode of payment of purchase price – yearly, half-yearly, quarterly, and monthly. The pensioner also has an option to choose either the amount of pension or the Purchase Price.

4. LIC’s Tech Term Plan

Tech Term is a Non-Linked, Non-participating, Pure Risk Premium Plan that can be purchased only online at your convenience. This plan offers financial protection to the family of the insured person in case of untimely, unfortunate demise of the life assured.

Key Highlights of The Plan:

It is one of the best investment plans in India as this plan is dynamic and flexible. It offers you the flexibility to choose from Single Premium, Regular Premium and Limited Premium Payment, Policy Term, and also Premium Paying Term.

Instead of getting the death benefit as a lump sum amount, you can also opt for the benefits in installments and thus it becomes one of the best investment plans for regular income, even in your absence.

This plan offers special discounts for non-smokers and women.

Though this plan does not come with any maturity benefit and loan facility, you can always avail of enhanced benefits and facilities by opting for any of the riders, just by paying a little extra amount.

5. LIC’s Nivesh Plus

It is a Unit Linked, Non-Participating, Single Premium Individual Life Insurance plan that offers insurance as well as investment covers throughout the term of the policy, once the single premium is paid. You can buy this plan both online and offline as per your convenience and this plan is subject to market risks that have to be borne by the policyholder only.

Key Highlights of The Plan:

Under this plan, you can invest your money in any of the four fund options and they are Bond Fund, Secured Fund, Balanced Fund, and Growth Fund.

In case of death before the Date of Commencement of Risk, an amount equal to the Unit Fund Value will be paid whereas, on death after the Date of Commencement of Risk, Basic Sum Assured less Partial Withdrawals, or Unit Fund Value, whichever is higher, will be paid.

Different charges are applicable for this plan such as premium allocation charge, mortality charge, fund management charge, accident benefit charge, switching charge, partial withdrawal charge, discontinuance charge and, etc.

In case of survival of the Life Assured the date of maturity, an amount equal to Unit Fund Value shall be payable as maturity benefit.

6. LIC’s New Jeevan Shanti

If you want the investment plan for retirement to spend your golden days in full financial protection and security, this plan is ideal for you as this plan offers an opportunity to choose between Single Life and Joint Life Deferred Annuity. This is a non-linked, non-participating, individual, single premium, deferred annuity plan that can be purchased both online and offline according to your convenience.

Key highlights of the plan:

The annuity rates are guaranteed at the inception of the policy and annuities are payable post deferment period throughout the lifetime of the annuitant.

In case of unfortunate demise of the life assured, Purchase Price plus Accrued Additional Benefit on Death minus Total annuity amount payable till death or 105% of Purchase Price, whichever is higher, is paid as the death benefit.

The beneficiary can receive the death benefit as a lump sum amount or he/she can do annuitization of the death benefit or else, can also opt for receiving the death benefit in installments over the chosen period of 5 or 10 or 15 years.

Though tax exemption benefits and loan facilities can be availed of under this policy, there is no maturity benefit offered by the plan.

7. LIC’s Bima Jyoti Policy

It is a non-linked, non-participating, individual, life assurance savings plan that comes with dual benefits of savings and protection as well. This is one of the best investment plans in India as it takes care of the family financially, even in the absence of life assured. It can be purchased offline through agents or by other intermediaries and also online by visiting the official website of the company.

Key highlights of the plan;

This plan offers a waiting period of 90 days and a free look period of 15 days (30 days in case of online sale). A loan facility is available under this policy provided at least two full years’ premiums have been paid and are subject to the terms and conditions of the company.

The death benefit is paid to the beneficiary in case of the unfortunate and untimely demise of the life assured. This benefit can be received as a lump sum amount or in installment for a certain period of time.

Sum Assured on Maturity, which is equal to the Basic Sum Assured, is offered as the maturity benefit.

To enjoy the enhanced protection of the plan, one can also opt for any of the five Rider benefits as per your choice.

8. LIC’s New Children’s Money Back Plan

This is one of the best investment plans for children in India as LIC has specially designed this plan keeping in mind the different needs of children such as educational needs, marriage, and other requirements of growing children through the survival benefits. It is a Non-linked, Participating, Individual, Life Assurance money back plan.

Key highlights of the plan:

In case of the survival of the Life Assured, on each of the policy anniversaries coinciding with or immediately following the completion of ages 18 years, 20 years, and 22 years, 20% of the Basic Sum Assured on each occasion will be paid while the policy is in -force.

As the maturity benefit, the Sum Assured on Maturity, which is equal to 40% of the Basic Sum Assured along with vested Simple Reversionary Bonuses and Final Additional Bonus is paid by the policy.

The death benefit is also available under the policy that can be received either as a lump sum amount or in installments for a certain specified period of time.

The policy can be surrendered at any time provided two full years’ premiums have been paid and that is subject to the terms and conditions of the company.

9. LIC’s Arogya Rakshak

It is a Non-Linked, Non-Participating, Regular Premium, Individual, Health Insurance plan that offers you cover and fixed benefits against certain specified health risks and also stands by your side at the time of medical emergency and thus keeps you and your family financially strong at difficult times. It is a comprehensive and one of the best investment plans in India for health under which you can include your spouse, dependent children, and your parents.

Key highlights of the plan:

This plan is flexible enough to offer you the option to choose among multiple benefit limits and premium payment options.

The insured person can also increase the health cover by way of Auto StepUp Benefit and No Claim Benefit and one can avail of lump sum benefit irrespective of actual medical costs.

This plan has come up with a wide range of health benefits such as hospital cash benefit, major surgical benefit, ambulance benefit, premium waiver benefit, daycare procedure benefit, medical management benefit, and many more.

Though this plan does not offer any maturity benefit but has presented multiple death benefits such as Auto Health Cover Benefit.

10. LIC’s New Jeevan Anand Plan

It is a Non-linked, Participating, Individual, Life Assurance plan that not only takes care of liquidity needs but also offers protection to the family of the insured person in case of the untimely demise of the life assured.

Key highlights of the policy:

The policy will participate in profits of the Corporation and will be entitled to receive Simple Reversionary Bonuses declared as per the experience of the Corporation during policy term while the policy is in force.

Under this policy, four rider benefits are available that can be obtained to aval of the maximum benefit of the policy by just paying a little extra premium. A maximum of three riders can be availed under a policy.

The death benefit available under this policy can be enjoyed either by taking it as a lump sum amount or in installments for a specified period of time.

Maturity benefits and loan facilities are also available with this policy.

Why Should You Choose LIC To Buy a Life Insurance Plan?

As the insurance market is flooded with a number of life insurers that have come up with multiple life insurance plans with different variants and various benefits, it has become difficult for a policy-seeker to find an ideal life insurance company that can cater to the varied needs of the individuals. But if you can keep in mind certain parameters while choosing the most suitable company, the job will be easier. To make it simpler for you, after assessing every potential parameter, it has been found that the Life Insurance Corporation of India (LIC) is the most suitable one for you. To know the reasons, follow the below details.

Strong Background – LIC is an Indian statutory insurance and investment corporation that is undertaken by the Ministry of Finance, Government of India. It is in force since 1956 and over 245 insurance companies and provident societies were merged to create it. Looking at its background, it can be assured that LIC will never disappoint you.

Claim Settlement Ratio – One buys a life insurance plan so that it can be helpful in the most needed time. For that, the claim settlement ratio plays a pivotal role as it reflects the credibility of the company. According to the IRDA Annual Report, the incurred claim settlement ratio of LIC is 96.69% in the financial year of 2020-2021, which is higher than many other life insurers in India. This data confirms that the company is reliable enough to stay on your bucket list.

Distribution Network – As of 2019, LIC functions with 2048 fully computerized branch offices, 8 zonal offices, around 113 divisional offices, and 1408 satellite offices along with the Central Office. The company is well connected with its customers through 73 customer zones and 25 metro-area service hubs along with a network of 1,537,064 individual agents, 342 Corporate Agents, 109 Referral Agents, 114 Brokers, and 42 Banks for soliciting life insurance business from the public. So, it can be easily said that whenever you need LIC, you can always find it beside you.

Solvency Ratio – A solvency ratio stands for the potential of the company to meet its long-term financial goal. It is generally said that if the solvency ratio is higher, the company has a higher capability to handle the financial crisis. According to the IRDA Annual Report, the solvency ratio of LIC is 1.55 as of March 2020, which highlights the company’s potential to pay off the lump sum claim amount of its customers.

Flexibility – To address the needs of its customers, LIC has come up with multiple options and has made its plans flexible enough so that it can cater to the varied needs of individuals. You can build your own plan choosing the benefits according to your convenience.

Online Facility – To keep pace with the growing demand for digitalization, LIC has also come up with different online facilities so that the customers can handle their plans online, at ease. Not only can you buy certain policies online, but also you can register your pan number, change the address, avail of a loan facility, and many more. Apart from these, LIC’s free mobile app is also available for the benefit of the customers.

Market Share – According to the IRDA Annual Report the premium underwritten in the financial year of 2019-2020 of LIC is Rs. 3,79,389.60 crores, which shows the company’s strong ability to handle any financial situation in near future. So, once you have bought a life plan from LIC, be sure you are safe and protected.

Number of Policies – If your chosen insurer fits all the parameters but it does not have enough numbers of policies to address your needs, then that is of no use. A good life insurer has to have a wide range of policies so that you can have enough options to choose from. LIC has come up with a sack full of life insurance plans with multiple variants and unique benefits to fit the requirements of its consumers. So, it is assured that you can buy the most suitable life plan from LIC only.

Customer Service – LIC policy documents are available both in English and Hindi. Apart from that, you can contact the company by calling them on their 24×7 contact number or you can also mail them or else, you can walk into an official branch of the company to seek help. Their experts will be there always at your doorstep, at your service.

How To Purchase a LIC Plan?

LIC offers an online buying process for certain plans and for other life insurance plans the offline buying process is available. Have a look at below to know more about both the buying processes.

Online Buying Process:

To avail of the online buying process, follow the below steps.

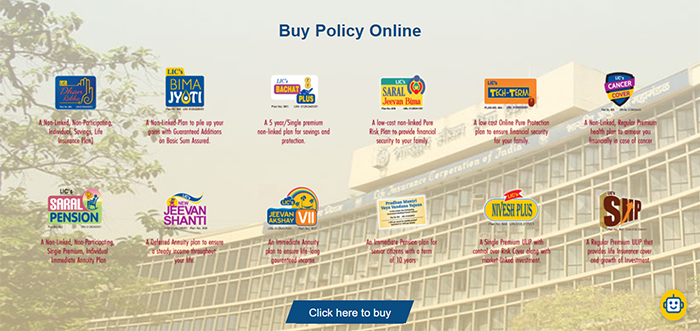

- Visit the offcial website of LIC. In the middle of the page, you will see a column named ‘Buy Policy Online’.

- Once you click on your desired policy, you will be redirected to a new page. Under the name of the policy, click ‘Buy Online’.

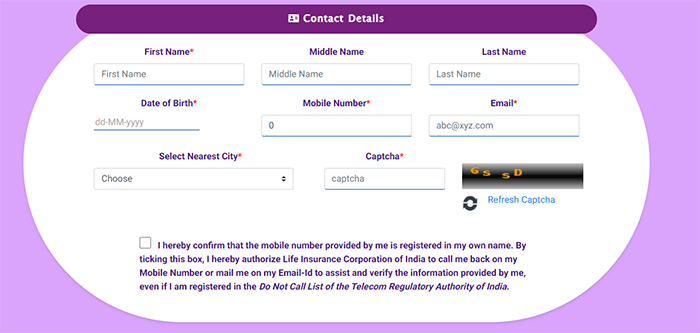

- Fill in the blanks with the required information and select the desired plan that you want to buy.

- Once you submit the information, a representative will verify, on behalf of the company.

- Once your verification is done, you will be registered for buying that particular life plan and you may proceed with the further process.

Offline Buying Process:

If you are more comfortable with the offline buying process, you can visit the nearest official branch of the company and their experts will guide you throughout the buying process. You can also contact one of the company’s licensed and registered agents to seek further help in the buying process. Apart from these, you can also contact the insurer via mail or just by calling them to receive assistance in this process.

If you face any issue while availing of the above-mentioned buying processes, you can also contact Probus Insurance to buy a life plan of LIC.

Frequently Asked Questions

The Net Asset Value (NAV) represents the net value of an entity and is calculated as the total value of the entity’s assets minus the total value of its liabilities. It represents the per share/unit price of the fund on a specific date or time.

On the official website, under the LIC Online Service Portal, you will find the ‘Claim Form’ option. Click on that and look for the desired claim form that you want. Click on that and download.

The free look period for this plan is 15 days from the date of receipt of the policy bond stating the reasons for objections.

You can partially withdraw the units at any time after the fifth policy anniversary, subject to the following:

- In the case of minors, partial withdrawals shall be allowed only after Life Assured is aged 18 years or above.

- ii. Partial withdrawals may be in the form of a fixed amount or in the form of a fixed number of units.

- iii. The Maximum amount of Partial Withdrawal as a percentage of the fund during each policy year shall be dependent on the policy year.

- A pre-specified partial withdrawal charge will be deducted from the Unit Fund Value.

Yes, AHC is available for the dependent children for a period of 15 years or till the policy anniversary on which the age of the insured child is 25 years, whichever is earlier.

Guaranteed Surrender Value = (GSV Factor x Purchase Price) minus total annuity amount payable up to the date of surrender. The applicable Guaranteed Surrender Value (GSV) Factors will be like the following:

| Policy year | 1 | 2 | 3 | 4 | 5 and above |

| GSV Factor | 75% | 75% | 75% | 90% | 90% |

If the premiums are not paid within the grace period, the policy can still be revived within a period of 5 consecutive years from the date of the first unpaid premium. Once you have paid all the due premiums along with the interest, only then the policy will come into force.

The minimum and maximum age will be 30 years and 70 years respectively, at the end of the premium paying term.

Yes, the pre-policy medical examination is necessary to obtain this policy.

LIC Plans

- LIC Aadhaar Shila

- LIC Aadhaar Stambh

- LIC Amritbaal

- LIC Arogya Rakshak

- LIC Bachat Plus

- LIC Bhagya Lakshmi

- LIC Bima Jyoti

- LIC Bima Ratna

- LIC Bima Shree

- LIC Cancer Cover

- LIC Dhan Rekha

- LIC's Dhan Sanchay

- LIC Dhan Varsha

- LIC's Dhan Vriddhi

- LIC's Index Plus

- LIC Jeevan Akshay VII

- LIC Jeevan Amar

- LIC Jeevan Azad

- LIC Jeevan Dhara-II

- LIC's Jeevan Kiran

- LIC Jeevan Shiromani

- LIC New Bima Bachat

- LIC New Children's Money Back Plan

- LIC New Endowment Plan

- LIC New Endowment Plus Plan

- LIC New Jeevan Anand

- LIC New Jeevan Shanti

- LIC New Jeevan Tarun

- LIC Jeevan Labh

- LIC Jeevan Lakshya

- LIC Jeevan Umang

- LIC New Money Back Plan - 20 Years

- LIC New Money Back Plan - 25 Years

- LIC Pradhan Mantri Vaya Vandana Yojana

- LIC New Tech Term

- LIC’s SIIP

- LIC Single Premium Endowment Plan

Life Insurers

- Aditya Birla Sun Life Insurance

- Aegon Life Insurance

- Aviva Life Insurance

- Bajaj Allianz Life Insurance

- Bharti Axa Life Insurance

- Canara HSBC Life Insurance

- Edelweiss Tokio life Insurance

- Exide Life Insurance

- Future Generali Life Insurance

- HDFC Life Insurance

- ICICI Prudential Life Insurance

- Ageas Federal Life Insurance

- Indiafirst life Insurance

- Kotak Mahindra Life Insurance

- Life Insurance Corporation of India

- Max Life Insurance

- PNBMetlife India Insurance

- Pramerica Life Insurance

- Reliance Nippon Life Insurance

- SBI Life Insurance

- TATA AIA Life Insurance

FAQs

- Best LIC Plans To Invest

- LIC Child Plans

- How To Get Duplicate LIC Bond?

- LIC Customer Care

- LIC E-Services

- LIC Kanyadan Policy

- LIC Lapsed Policy Revival Scheme

- LIC Login Process

- LIC Merchant Portal

- LIC Payment Process

- LIC Policy Address Change

- LIC Policy Receipt Download

- LIC Policy Status

- LIC Policy Tracker

- LIC Premium Calculator

- LIC Registration

- Sukanya Samriddhi Vs Kanyadan Policy

- Surrender LIC Policy

- How To File Claim Under LIC?