Life Insurance LIC of India LIC Policy Tracker

LIC Policy Tracker

Insurance policies are specifically designed to provide policyholders with life insurance and other associated benefits. If you buy an insurance plan from the Life Insurance Corporation of India (LIC), you can easily track your policy through the LIC portal and keep yourself posted about maturity date, payment date, and more.

Gone are the days when finding out the status of one’s LIC policy required a trip to a LIC branch office or contacting an agent. Checking the status of your policy is just a simple click away, thanks to the insurer’s online platform, which is known to provide a multitude of services to customers. By efficiently using the LIC’s mobile services, customers can also check the status of their insurance and premium payment.

What All Things Can Be Tracked?

Like other private branches, LIC has embraced the true potential of technology, thereby providing convenience to its customers. Now, the user can track a multitude of services offered by LIC.

Here’s the list of the services that can be tracked by LIC are:

Policy Status: You will get the basic details of the policy will be displayed such as Plan-Term, Sum Assured, Date of Commencement, unpaid premium etc.

Policy Schedule: This is the first page that constitutes the policy schedule.

Bonus Status: The total bonus earned will be displayed in this section. This incentive is only available at the time of the policy’s last payment.

Premium Paid Certificate:

Individual Policy – It shows the premiums paid under a single policy over a financial year. (This offer is valid for three financial years, including the current fiscal year.)

Consolidated — It shows the premiums paid under all of the user’s registered own life insurance (excluding spouse and children plans) during the financial year. (This offer is valid for three fiscal years, including the current fiscal year.)

Premium Due Calendar: You’ll see a list of premiums that are due throughout the year (month wise).

Claim History: This option will disclose each claim paid under the policy, including NEFT/cheque details, payment date, and payout amount.

Claim Status: This option displays the date of the policy’s Survival Benefit (if any) or Maturity Benefit (if any) due during the policy’s term.

Revival Quotations: When you revive the policy after the lapse, you will get a quotation about the price that you have to pay.

Grievance Redressal: The ability to file a complaint or grievance with the insurance company.

How To Track Your LIC Policy?

It’s essential to verify the status of your LIC coverage regularly. When you often track your policy, you can validate that you have paid your premiums on time or that your coverage is active. You may look up the status of your LIC policy both online and offline.

Follow the procedures below to track your LIC policy online:

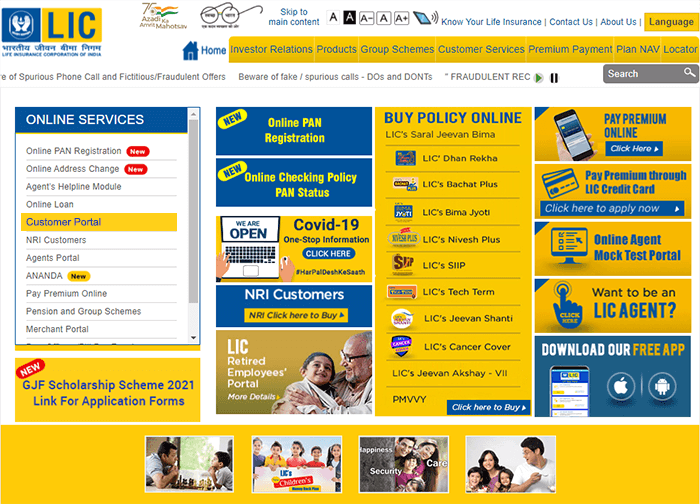

Step 1: Simply visit the LIC website, the home page will be displayed on your laptop/desktop/mobile screen. You will then see the “Online Services” section on the left side.

Step 2: You will then see the “customer portal” option, click on it.

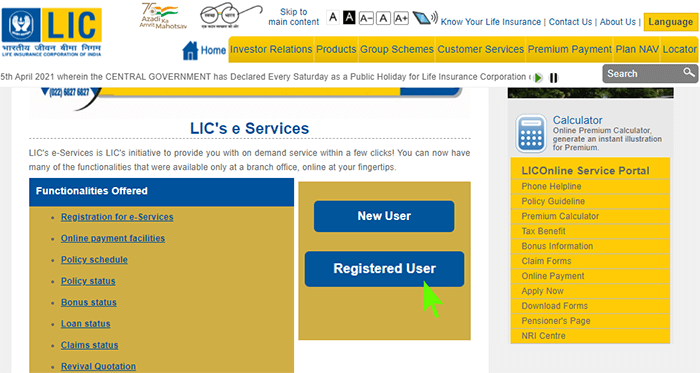

Step 3: After that, you will see two options, i.e., you will have to choose from either of the two options, i.e., New User or “Registered User”.

Step 4: If you are a new user, you can click on “New User”.

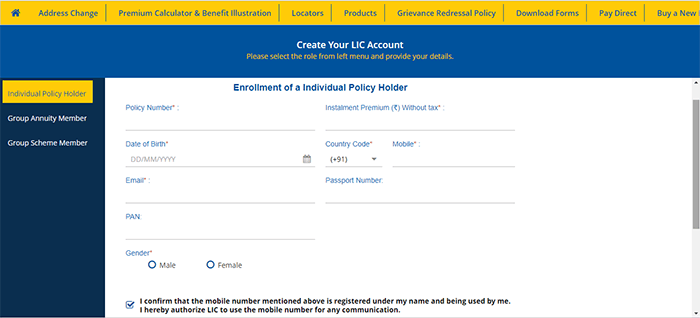

Step 5: You will be directed to the page “Create Your LIC Account”. After that, you need to fill in details like policy number, date of birth, email Id, mobile number, gender, PAN, and more. Then, you need to make the payment.

Step 6: Once you are done creating the account, you can go back to the page displaying “New User” or “Registered User”.

Step 7: You now can click on “Registered User” and enter the details.

Step 8: You will then see 4 boxes on the left-hand side, namely Self Policies, Spouse Policies, Child Policies, and All Policies.

Step 9: When you click on “self-policies”, you will see many options on the left side, including Online payment receipts, premium calendar, policy schedule, policy status, add new policies, claim status, loan status, policy premium paid statement, revival quotation, individual pension policy.

Step 10: Simply click on policy status and you will see all the details related to the policy about the upcoming premium payment, no. of people insured, date, and more.

Adding New Policies

If you are looking to add new policies for your child or spouse, you can follow the following steps:

Step 1: Having said that, click on the online services section, go to the customer portal

Step 2: You will then need to click on “Registered User” (as you are now a registered user after you successfully followed the above steps).

Step 3: Simply enter your credentials. you will be directed to the page with 4 boxes on the left-hand side, namely Self Policies, Spouse Policies, Child Policies, and All Policies.

Step 4: Click on “Self-Policies” and then you will see drop down options on the left-hand side.

Step 5: After that, you need to click on “Add new policies” to add the policies of your spouse and child.

What Can Happen if I Don't Track My LIC Policy?

If you don’t track your policy online, you might miss many important opportunities that could be costly soon. These include the inauguration of any new policy, premium payment changes, features in existing policy, and more. Also, your policy might lapse if you fail to adhere to the last date of the premium. And renewing the policy is potentially daunting and might let you drain a portion of your money.

How To Track Your Spouse and Child’s LIC Policies?

Before you know about the tracking of LIC policy status, remember that only a registered user can check the policy status of their spouse and child LIC policy.

If, however, you’re not registered, you can simply follow the above-mentioned steps. But if you are already a registered user, you can easily track the policies of your spouse and child through the following steps:

Step 1: Visit the official website of the LIC and go to the “online services” section located on the left side of the homepage. Click on the “Customer Portal” option.

Step 2: After clicking the option, you will have to click on “Registered User”.

Step 3: You then need to enter credentials that include User ID, Password, and Date of Birth.

Step 4: You will then see 4 boxes on the left-hand side, namely Self Policies, Spouse Policies, Child Policies, and All Policies.

Step 5: When you click on “self-policies”, you will see many options on the left side, including Online payment receipts, premium calendar, policy schedule, policy status, add new policies, claim status, loan status, policy premium paid statement, revival quotation, individual pension policy.

Step 6: You will click on “Policy Status”, you will see “All Policies, Self-Policies, Spouse policies, Child Policies”.

Step 7: You can easily click on “Spouse Policies” and “Child Policies” to track their policies.

Frequently Asked Questions

Here are the frequently asked questions related to the tracking of your LIC policy;

If you don’t check your policy status on a regular basis, you risk having your coverage lapse. It will cost you a lot of money because you will have to pay additional premiums to keep the insurance active. It will also take into account your efforts in obtaining long-term protection for you and your family. To remain on top of things, keep track of premiums, due dates, and other details. Check the status of your LIC policy to get the most out of it.

There are no fees associated with receiving LIC policy status updates. However, depending on your carrier, SMS charges may apply if you utilize that service. Similarly, if you use IVRS services, you may incur call charges. You can just log in and read the details if you are a registered member on the web portal.

LIC Plans

- LIC Aadhaar Shila

- LIC Aadhaar Stambh

- LIC Amritbaal

- LIC Arogya Rakshak

- LIC Bachat Plus

- LIC Bhagya Lakshmi

- LIC Bima Jyoti

- LIC Bima Ratna

- LIC Bima Shree

- LIC Cancer Cover

- LIC Dhan Rekha

- LIC's Dhan Sanchay

- LIC Dhan Varsha

- LIC's Dhan Vriddhi

- LIC's Digi Term Plan

- LIC's Digi Credit Life

- LIC's Index Plus

- LIC Jeevan Akshay VII

- LIC Jeevan Amar

- LIC Jeevan Azad

- LIC Jeevan Dhara-II

- LIC's Jeevan Kiran

- LIC Jeevan Shiromani

- LIC New Bima Bachat

- LIC New Children's Money Back

- LIC New Endowment

- LIC New Endowment Plus

- LIC New Jeevan Anand

- LIC New Jeevan Shanti

- LIC New Jeevan Tarun

- LIC Jeevan Labh

- LIC Jeevan Lakshya

- LIC Jeevan Umang

- LIC New Money Back Plan - 20 Years

- LIC New Money Back Plan - 25 Years

- LIC Pradhan Mantri Vaya Vandana Yojana

- LIC New Tech Term

- LIC’s SIIP

- LIC Single Premium Endowment

- LIC Yuva Term

- LIC Yuva Credit Life

Life Insurers

- Aditya Birla Sun Life Insurance

- Aegon Life Insurance

- Aviva Life Insurance

- Bajaj Allianz Life Insurance

- Bharti Axa Life Insurance

- Canara HSBC Life Insurance

- Edelweiss Tokio life Insurance

- Exide Life Insurance

- Future Generali Life Insurance

- HDFC Life Insurance

- ICICI Prudential Life Insurance

- Ageas Federal Life Insurance

- Indiafirst life Insurance

- Kotak Mahindra Life Insurance

- Life Insurance Corporation of India

- Max Life Insurance

- PNBMetlife India Insurance

- Pramerica Life Insurance

- Reliance Nippon Life Insurance

- SBI Life Insurance

- TATA AIA Life Insurance

FAQs

- Best LIC Plans To Invest

- LIC Child Plans

- How To Get Duplicate LIC Bond?

- LIC Customer Care

- LIC E-Services

- LIC Kanyadan Policy

- LIC Lapsed Policy Revival Scheme

- LIC Login Process

- LIC Merchant Portal

- LIC Payment Process

- LIC Policy Address Change

- LIC Policy Receipt Download

- LIC Policy Status

- LIC Policy Tracker

- LIC Premium Calculator

- LIC Registration

- Sukanya Samriddhi Vs Kanyadan Policy

- Surrender LIC Policy

- How To File Claim Under LIC?