Car Insurance How To Check Car Insurance Policy Status?

No Inspection. No Paper Work

* Subject To Underwriting

Compare

Car Insurance Plans

How To Check Car Insurance Policy Status?

An insurance policy is your safeguard against any unfortunate incident. Your car insurance policy does exactly that. It protects you and your car on the road. Did you know that according to Indian law, it is illegal to drive your car on the road without a valid insurance policy? It’s a fineable offense and hence, you must make sure your insurance policy is valid.

But if you already have a car insurance policy in place and you need to check the status of your policy, what do you do? There are multiple paths you can explore to get this information. But the first step to do is prepare all your necessary documents, such as:

- Your driving license

- Your car registration certificate

- Your insurance policy number and other details

- Phone/email address and address used to purchase the insurance policy

With these important documents in your hand, you can easily check the status of your car insurance policy. You can either do so online or offline methods, and we will show you how to go about both these methods.

Ways To Check Car Insurance Policy Status

Listed below are four different ways to check your insurance policy status online or offline:

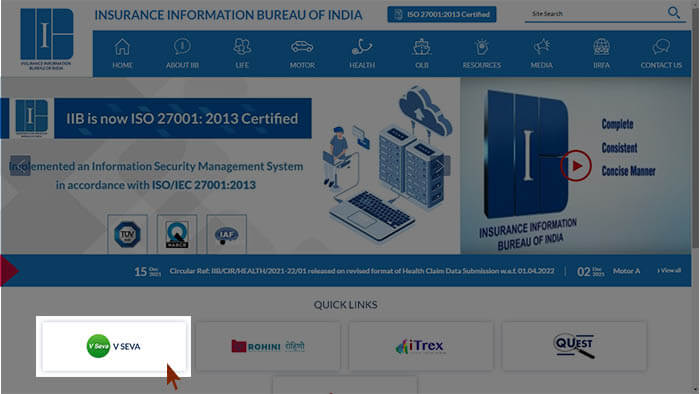

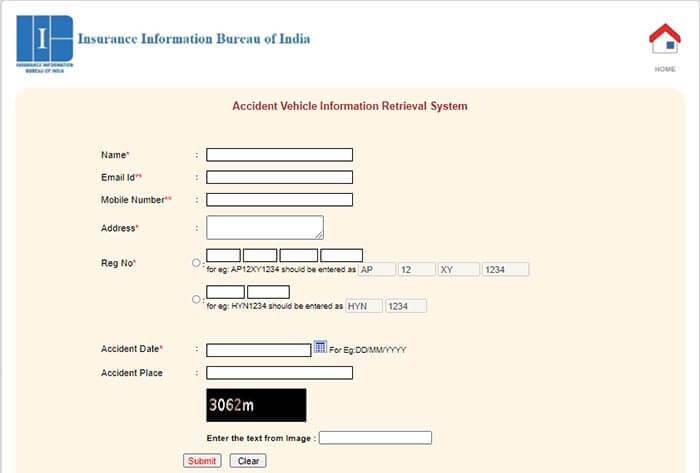

1. Via Insurance Information Bureau of India

The Insurance Information Bureau of India was started in 2010 to meet the needs of the citizens and the insurance industry. The website collates information about vehicles and insurance policies and creates a database accessible to all.

- The first thing to do is log on to the IIIB website.

- Once you are on the website, click on the V-Seva button (indicated with a green icon). This will take you to a page where you will need to fill in some important details.

- Your name, phone number and email address

- Your actual address

- The vehicle registration number as indicated through an example on the website

- Details about the incident

- As you finish the authentication, you will be taken to a page that will display all the relevant details.

- If, in case, your vehicle details are not displayed, there is nothing to worry. It’s because it takes at least two months from when insurance companies submit data to when it appears in the IIIB database.

Things To Keep In Mind While Using IIIB As A Resource

- Only 3 searches are allowed per each email address/phone number

- Data is available only from April 2010 onwards

- No special characters can be used while entering the vehicle registration number.

- If your vehicle information is not displayed, submit a query so someone will get in touch with you

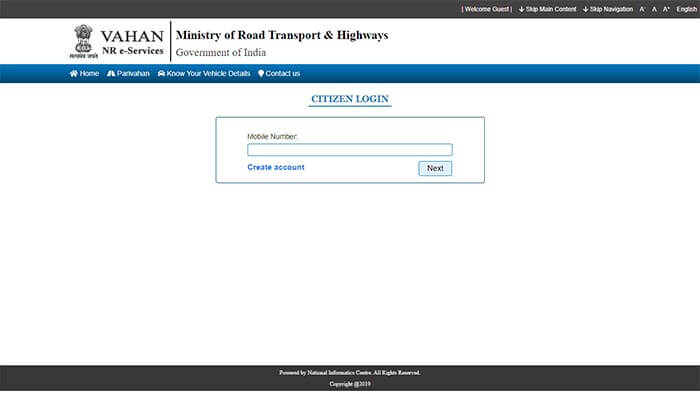

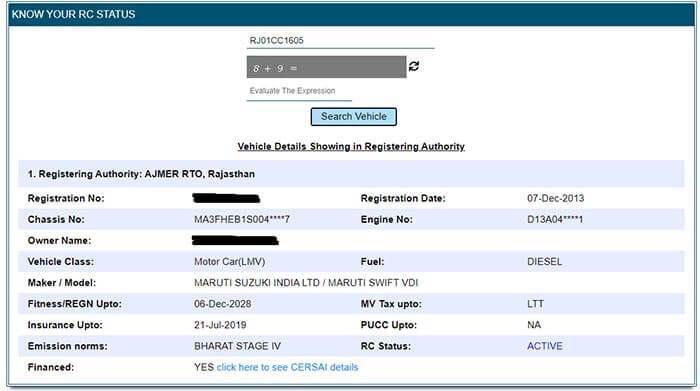

2. VAHAN e-Services

VAHAN is another great resource provided for citizens by the Ministry of Road Transport and Highways. This is a repository of all data related to vehicles, permits, insurance policies, etc. The online portal allows citizens to apply for permits, licenses, renew the same and check your insurance policy status. The following steps will help you check your car insurance policy status:

- Log on to the Vahan website

- Click on “Know Your Vehicle” option

- You can either log in from the homepage or create an account with your phone number and email address

- Enter your vehicle details like your car’s registration number and the verification code then click on the option ‘search’

- On the page that open, you will be able to check your insurance policy status.

2. Through Local RTO

In case you can’t find the information you need on both these online portals, you can consider your local RTO as your next stop. The nearest Regional Transport Office is the best source of offline information when it comes to anything related to your vehicle.

Find out the location and head to the RTO with all your necessary documents. This includes your driving license, insurance policy details, your car’s RC and any important document you might need. Being prepared before you go to the RTO will cut down on time where you need to look for information or ask someone at home to look for important documents.

The officials at the RTO can help with the information or direct you to the right resource to obtain your car insurance policy status.

4. From Your Insurance Provider

Lastly, Probus can always help you look for your insurance policy status. A few simple steps will help you find out the information you need. All you have to do is reach out to the team of experts at Probus who can address every single query of yours in an unbiased manner.

Knowing the status of your car insurance policy is handy in case of an accident, or if you need to know when to renew it. A good car insurance policy will keep you and your car safe on the road.

Car Insurers

- Bajaj Allianz Car Insurance

- Bharti AXA Car Insurance

- Cholamandalam Car Insurance

- Digit Car Insurance

- Future Generali Car Insurance

- HDFC Ergo Car Insurance

- ICICI Lombard Car Insurance

- IFFCO Tokio Car Insurance

- Kotak Mahindra Car Insurance

- Liberty Car Insurance

- National Car Insurance

- Navi Car Insurance

- New India Assurance Car Insurance

- Oriental Car Insurance

- Reliance Car Insurance

- Royal Sundaram Car Insurance

- SBI Car Insurance

- Shriram Car Insurance

- Tata AIG Car Insurance

- United India Car Insurance

- Universal Sompo Car Insurance

FAQs

- Best Car Insurance Plans

- Car Insurance Benefits

- Electric Car Insurance

- Car Insurance Add-on Covers

- Car Insurance Calculator

- Car Insurance Campanies

- Car Insurance Policy Status

- Car Insurance Policy Transfer

- Comprehensive Car Insurance

- Find Car Insurance Policy Number

- First Party Vs Third Party Car Insurance

- Long Term Car Insurance

- No Claim Bonus in Car Insurance

- Third Party Car Insurance

- Used Car Insurance

- Zero Dep Car Insurance

- IDV For Car Insurance

- Private Vs Commercial Car Insurance

- How To Check Car Insurance Expiry Date Online?

Car Insurance How To Check Car Insurance Policy Status?