Car Insurance New India Car Insurance

No Inspection. No Paper Work

* Subject To Underwriting

Compare

Car Insurance Plans

New India Car Insurance

New India Insurance is a wholly-owned subsidiary of the Indian Government under the Ministry of Finance, Government of India. It has a presence in 27 countries and offers a wide range of insurance plans. Sir Dorabji Tata founded the company in 1919 and in 1973 it was nationalized. New India is rated A by AM Best and CRISIL, indicating its high degree of financial strength.

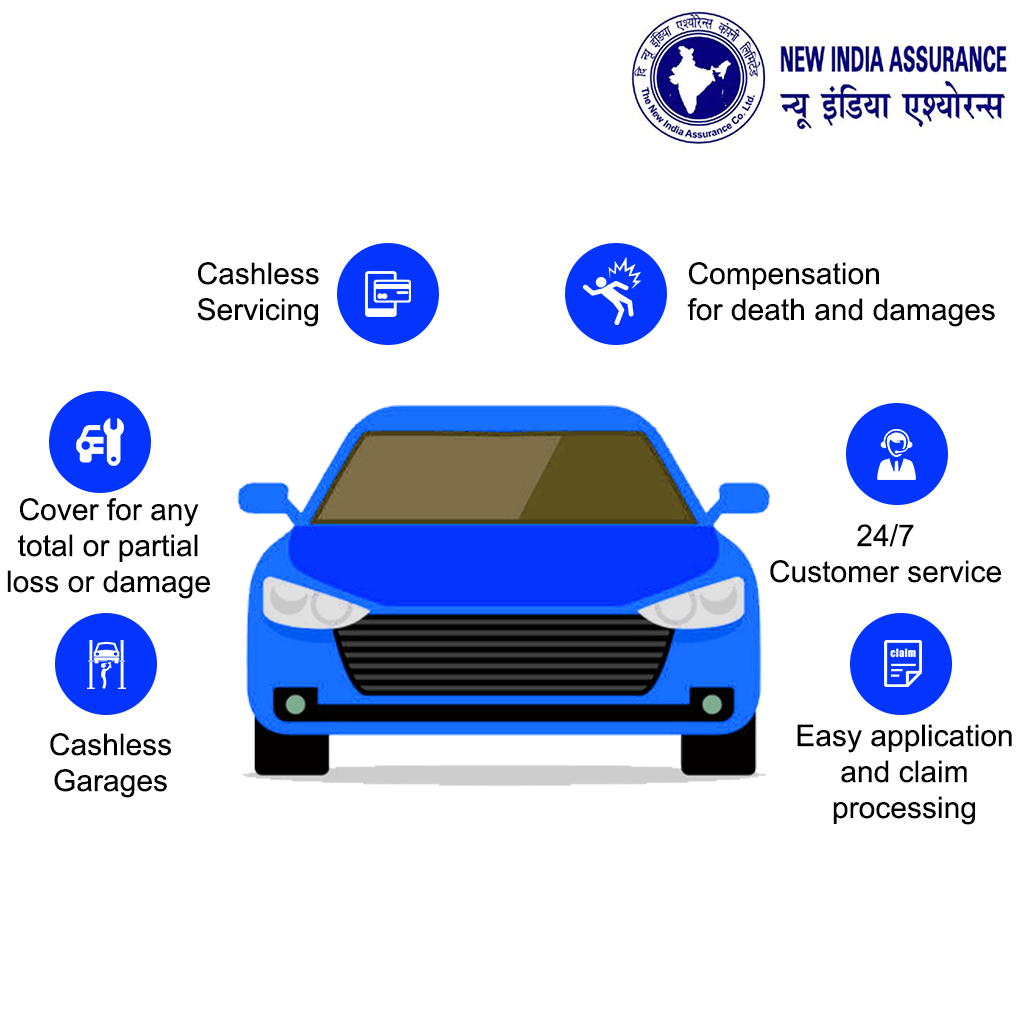

Benefits and Features of New India Car Insurance Plans

Car Insurance provides all-round protection for cars from various eventualities. New India Car Insurance offers several types of insurance plans with the following benefits and features:

- All-round coverage to include compensation for death and damages

- Range of add-ons for added protection

- Easy application and claim processing

- 24/7 customer service

- Special discounts for members of the Automobile Association of India and on the installation of anti-theft devices in cars

- 3000+ cashless garages across India

- Incurred claim ratio of 103.19% along with quick claim settlements

- No claim discount on renewal ranging from 20 to 50%

Coverage of New India Car Insurance Plans

With all-inclusive protection for your car in mind, New India Insurance offers plans that cover the following types of contingencies:

Natural reasons | Harm or damage caused due to acts of calamities such as earthquake, fire, storm, cyclone, flood, typhoon, hurricane, hailstorm, tempest, inundation, and other acts of nature. |

Man-made reasons | Damages or loss due to burglary, housebreaking, or theft, riots, or strike. |

Malicious and Terrorist acts | Coverage for damage caused due to malicious and terrorist acts |

Losses in Transit | Damages caused in transit by air, elevator, lift, waterway, road, etc. |

Accidental Acts | Damage or loss caused by accidental acts of a third party or otherwise such as self-ignition, explosion, rockslide, etc. |

Add-on Coverage Of New India Car Insurance

Coverage for Legal Liability

Coverage or reimbursement for both driver and passengers for any claims as a result of accidents.

Coverage for Accessories

Added coverage for damage or loss caused to any accessories in the vehicle like AC, fans, stereo, etc.

Personal Accident Cover

Enhanced cover for injury or death of passengers and paid driver in case of an accident.

Documents Required To Buy New India Car Insurance Policy

Buying Car Insurance is no more a long and tedious affair. You can now purchase a suitable car insurance plan online by furnishing the following details:

- Details of the vehicle, including the name of the car, its model, and year of manufacture

- Registration number and certificate

- Copy of valid driver’s license

- Insurance details, including add-ons

- Identity proof

- Address proof

- Passport size photo

- Additional details as required

How To Apply for New India Car Insurance?

Gone are the days when applying for car insurance requires multiple visits to the service provider’s office. You can now purchase car insurance plans from the comfort of your home by following the steps below:

Apply Via Probus Website

Login to our website and click on car insurance.

Enter the details required, such as your city, car name and model, year of registration, name of the previous insurer, and expiry date of your policy.

Input further information such as month and date of vehicle manufacture, date of purchase, customer details, license validity, and more for a quote.

Compare a variety of plans and choose the most suitable one.

Pay for the selected plan online via the secure payment gateway.

Receive your policy document via email within minutes of payment.

Apply via New India Official Website

Visit the company website and click on car insurance.

Click on ‘Buy Online’ and ‘Buy insurance for a new vehicle.

Enter vehicle details such as year of manufacture, type of private car, date of purchase, model, and city of registration/purchase.

Add in other information such as I.D.V. value, coverage details, the policy period, add-ons, contact details, etc.

You will see the premium and plan details on your screen.

After shortlisting the policy, click on save and continue.

Make the payment online and receive the policy document at your registered email address.

How to Renew Car Insurance with New India?

Renewing your car insurance plan on time helps you attain a better price and stay protected. Do it in a hassle-free manner by following the below-mentioned steps:

Renewal Via The Probus Website

Input basic details required. Select No Claim Bonus (N.C.B.) is applicable.

Add the value of your car and add-ons, if any.

Review the details filled in before proceeding further.

Pay online by selecting your preferred mode of payment.

Receive your renewed policy document via email within no time.

Renewal via New India Official Website

Visit the New India Insurance website and click on car insurance.

Click on Buy Online and thereafter select ‘Renew The Existing Policy From Any Insurer’.

Enter the required details such as the policy number, car registration number, policy expiration date, etc.

Add other information such as coverage details, add-ons, and details for additional discounts.

Click on ‘Save and Continue’ and proceed to pay online using your preferred mode of payment.

New India Insurance offers a hassle-free claim process that is broken down into three main categories. The steps under each category are mentioned below:

Steps for claim process in case of damage due to accident:

- Register your insurance claim by notifying the nearest office

- Fill in the claim form along with a copy of the registration certificate, driving license, and other requisite documents.

- A company-appointed surveyor will visit the site /garage and assess the damage to the car, after which he will submit a detailed report to the company.

- In case of a reimbursement claim, furnish details such as bills and cash memos as well.

- After due verification and examination, your claim will be settled, and money will be credited to your account.

Steps for claim process in case of theft:

- File an F.I.R. with the police and immediately notify the policy issuing officer.

- Submit a copy of the F.I.R. along with other details.

- Hand over the final police report on receipt.

- A surveyor will assess the details of theft as required.

- After approval of the claim and completion of formalities, you will receive the claim amount in your account.

Steps for claim process in case of liability claim:

- Notify the company of the accident that may give rise to a liability claim

- Furnish summons of the Court to the company on receipt

- Fill in the claim form along with a copy of the registration certificate, the driving license, and the F.I.R.

- On approval of the claim, the money will be credited to your account in line with your insurance plan.

Documents For Register a Claim

The following documents are required to ensure a quick and easy claim settlement:

- Duly filled claim form in the prescribed format.

- Copy of the driving license.

- Certificate of registration.

- Copy of the F.I.R., if applicable.

- Estimate of damage or repairs.

- Copies of cash memos, bills, etc.

- Copy of the policy document and proof of payment.

- Any other details as required by the insurance company.

Exclusions

Car insurance is a solicited way to keep your vehicle protected. However, it does not cover certain damages such as:

- Consequential loss

- Wear and tear or losses due to breakdowns

- Damages caused while driving under the influence of alcohol or without a valid driving license

- Losses caused due to extraordinary circumstances such as civil war

- Claims arising out of contractual liability

- Losses occurring due to the use of the vehicle in contravention of the ‘limitation as to use.’

Steps To Calculate Car Insurance Premium Online

There are a plethora of car insurance plans available today. And comparing and contrasting plans will help you assess the offerings under each one of them before making a choice that suits your needs. One of the things you’ll notice with the different plans is varying premiums. The premium varies due to several reasons, and some are:

- The car – Some vehicles have a higher premium as compared to others. Higher the CC, the higher the premium. The insurer takes the car’s model and car’s variant into consideration when you choose add-ons and other packages.

- Age of vehicle – Typically, the premium for older vehicles is lesser as newer vehicles are more.

- Your location – Premiums are higher in urban areas as there are higher chances of claims because of numerous reasons like vandalism, theft, traffic, etc.

- Fuel type – As compared to diesel or petrol vehicles, CNG cars attract higher premiums because of higher repair costs.

- Insured’s Declared Value – For lower IDV, the premium will be lesser and vice-versa.

You can read more about the factors that affect car insurance on the Probus website. Alternatively, use the car insurance calculator below to compute your premium.

Calculator on the New India Insurance Website

Step 1 – Visit the website and browse to the car insurance section.

Step 2 – Fill in the details required, such as your name, contact number, existing policy details, vehicle details such as model name and date of manufacture, etc.

Step 3 – Click on Get Quote

Step 4 – You will receive an instant quote at your email address

Frequently Asked Questions

Car Insurers

- Bajaj Allianz Car Insurance

- Bharti AXA Car Insurance

- Cholamandalam Car Insurance

- Digit Car Insurance

- Future Generali Car Insurance

- HDFC Ergo Car Insurance

- ICICI Lombard Car Insurance

- IFFCO Tokio Car Insurance

- Kotak Mahindra Car Insurance

- Liberty Car Insurance

- National Car Insurance

- Navi Car Insurance

- New India Assurance Car Insurance

- Oriental Car Insurance

- Reliance Car Insurance

- Royal Sundaram Car Insurance

- SBI Car Insurance

- Shriram Car Insurance

- Tata AIG Car Insurance

- United India Car Insurance

- Universal Sompo Car Insurance

Car Insurance by Models

- Audi Car Insurance

- BMW Car Insurance

- Chevrolet Car Insurance

- Datsun Car Insurance

- Fiat Car Insurance

- Force Car Insurance

- Honda Car Insurance

- Hyundai Car Insursnce

- Jeep Car Insursnce

- KIA Car Insurance

- Mahindra Car Insursnce

- Maruti Car Insursnce

- MG Motor Car Insurance

- Renault Car Insurance

- Skoda Car Insurance

- TATA Car Insurance

- Toyota Car Insurance

- Volkswagen Car Insurance

FAQs

- Best Car Insurance Plans

- Car Insurance Benefits

- Electric Car Insurance

- Car Insurance Add-on Covers

- Car Insurance Calculator

- Car Insurance Campanies

- Car Insurance Policy Status

- Car Insurance Policy Transfer

- Comprehensive Car Insurance

- Find Car Insurance Policy Number

- First Party Vs Third Party Car Insurance

- Long Term Car Insurance

- No Claim Bonus in Car Insurance

- Third Party Car Insurance

- Used Car Insurance

- Zero Dep Car Insurance

- IDV For Car Insurance

- Private Vs Commercial Car Insurance

- How To Check Car Insurance Expiry Date Online?

New India FAQ

Car Insurance New India Car Insurance