Car Insurance How To Find Car Insurance Policy Number?

No Inspection. No Paper Work

* Subject To Underwriting

Compare

Car Insurance Plans

How To Check Car Insurance Policy Number?

Car insurance does more than just cover your vehicle in the event of an accident. It also safeguards you against financial liabilities, medical bills, and legal consequences. If you don’t have four-wheeler insurance, you risk financial liability in the event of an accident, which could cost you a hefty amount. You’d also be stuck paying for your own vehicle’s repairs out of pocket.

There may be times when you need to know your car insurance policy number and other information. While knowing the policy number and other details may not be important at all times, there will be situations when you will need it. You can easily find out your car insurance policy details with the help of your car’s registration number.

Continue reading to learn how to retrieve the specifics of your car insurance policy.

Ways To Find Your Car Insurance Policy Number & Other Details?

You can find your car insurance details by any one of the following methods:

1. Through IIB (Insurance Information Bureau)

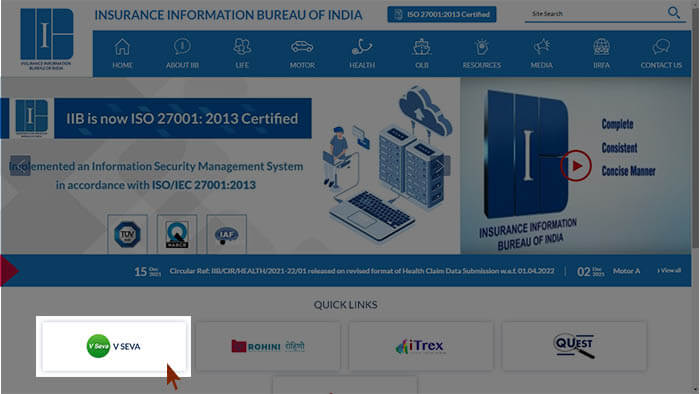

- Visit the IIB website.

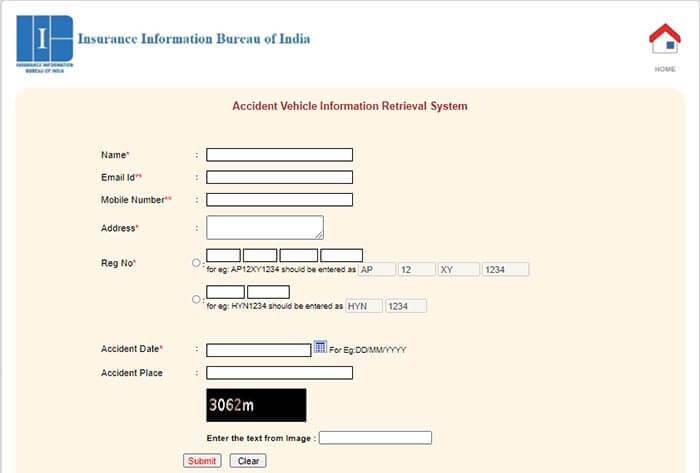

- On the home page, click the V-Seva tab under “Quick Links” to go to the “Accident Vehicle Information Retrieval System” page.

- Enter the required details like mobile number, mail, email address, car registration number, etc.

- Fill in the captcha code as displayed on the screen.

- Click the “Submit” button.

- Now the policy details will be displayed to you.

2. Through VAHAN E-Services

If you are unable to find out your car insurance policy details through IIB, you can also find it out with the help of VAHAN e-services.

FOR REGISTERED USERS:

- Visit the website of VAHAN e-services.

- Click on “Know Your Vehicle Details”.

- If you are a registered user, enter your mobile number in the given box.

- You will get a 6-digit OTP on your registered mobile number which you need to enter in the field provided.

- Now click on “Get Details”.

- Now you can continue to check your policy status.

FOR NEW USERS

- Go to the official VAHAN website.

- Select ‘Know Your Vehicle Details’ at the top of the page.

- Click “New Customer” and fill up the blank fields with your e-mail address and mobile phone number.

- An activation link and an OTP will be sent to your email address. Enter it in the required field to activate your user ID.

- By clicking the activation link, you can activate your user ID and create a password.

- To receive vehicle-related services, go to the “ONLINE SERVICES” tab after you’ve activated your account.

- After providing a valid car registration number, click Generate OTP.

- You can select which service you want to utilise by clicking on the related service.

- Complete the form’s remaining fields, including Data Entry, Insurance Information, Appointment Information, Document Upload, and Fee Payment.

- Schedule an appointment with the RTO to complete the verification process (if applicable).

- Once the payment has been completed, print the receipt and continue to check your policy status.

3. Through QR Code

The quickest way to check your car insurance status is to scan a QR code. Every car insurance policy must have a corresponding QR code with the relevant details, according to the Insurance Regulatory and Development Authority (IRDA). You can scan the QR code with your smartphone to see all of the details of your insurance coverage.

4. Through Insurer’s Website

You may look for the car insurance policy number as well as other information by going to the insurer’s official website. To see all of the details of your vehicle insurance policy, simply login to your account.

How To Check Your Car Insurance Policy Renewal Date?

You can check the status of your car insurance policy and find out when it expires in several methods. Here are a few ways to find out when your car insurance policy is need to be renewed:

- By calling the insurer’s customer support and asking them the renewal date.

- By contacting the insurance agent from whom you have bought the policy and asking about the expiry date.

- By checking your car insurance policy document.

- By visiting the website of IIB and checking the policy status.

- By visiting the website of RTO (Regional Transport Office) and knowing the policy status.

- By visiting the Parivahan Sewa website and knowing the policy status.

What Guidelines Do You Need To Follow While Checking Your Car Insurance Policy Details?

Here are some of the guidelines that you need to follow while checking your car insurance policy details:

- To verify the status of a car insurance policy, you must first obtain the policy’s registration information, without which you will be unable to proceed.

- When you enter the vehicle registration number, always make sure that there should be no space or any special character.

- If your vehicle is new, then you will require its engine number as well as the chassis number.

- It can take up to two months for IIB to acquire insurance information from issuing companies. As a result, it’s possible that you won’t be able to find information on a new vehicle on this website.

- You will be allowed to look for insurance information on a car a maximum of three times. It is forbidden to conduct searches more than three times using the same email address and phone number.

Frequently Asked Questions

If you are in an unfortunate accident and do not have the information relevant to the vehicle’s insurance policy, you may easily search up the information online by entering a few pieces of information. You can then gather information on the car’s insurance provider and file a claim for damages with ease, receiving compensation.

There are two primary reasons why a car insurance policy’s details may be missing from the IIB website. The following are the details:

- The insurance company has yet to send the information.

- Your insurance provider may take some time to submit or update the necessary information with IIB.

To check the status of your car insurance policy, you do not need to know the policy number; nevertheless, knowing the policy number makes it easier to monitor or retrieve your policy document. To verify the status of your car insurance policy, the insurance company will often want your name, contact information, date of birth, registration number, and other information.

If we talk about offline methods of checking the details of your car insurance policy, then there are two methods as follows:

- You can visit the concerned Regional Transport Office and check the details of your car policy.

- You can call your car insurance provider and ask them for the details of your car insurance policy by providing your car’s registration number.

Car Insurers

- Bajaj Allianz Car Insurance

- Bharti AXA Car Insurance

- Cholamandalam Car Insurance

- Digit Car Insurance

- Future Generali Car Insurance

- HDFC Ergo Car Insurance

- ICICI Lombard Car Insurance

- IFFCO Tokio Car Insurance

- Kotak Mahindra Car Insurance

- Liberty Car Insurance

- National Car Insurance

- Navi Car Insurance

- New India Assurance Car Insurance

- Oriental Car Insurance

- Reliance Car Insurance

- Royal Sundaram Car Insurance

- SBI Car Insurance

- Shriram Car Insurance

- Tata AIG Car Insurance

- United India Car Insurance

- Universal Sompo Car Insurance

FAQs

- Best Car Insurance Plans

- Car Insurance Benefits

- Electric Car Insurance

- Car Insurance Add-on Covers

- Car Insurance Calculator

- Car Insurance Campanies

- Car Insurance Policy Status

- Car Insurance Policy Transfer

- Comprehensive Car Insurance

- Find Car Insurance Policy Number

- First Party Vs Third Party Car Insurance

- Long Term Car Insurance

- No Claim Bonus in Car Insurance

- Third Party Car Insurance

- Used Car Insurance

- Zero Dep Car Insurance

- IDV For Car Insurance

- Private Vs Commercial Car Insurance

- How To Check Car Insurance Expiry Date Online?

Car Insurance How To Find Car Insurance Policy Number?