Car Insurance Cholamandalam Car Insurance

No Inspection. No Paper Work

* Subject To Underwriting

Compare

Car Insurance Plans

Cholamandalam Car Insurance

In 2001, Mitsui Sumitomo Insurance Company, who is one of the largest insurance companies in Japan, and one of India’s leading industrial houses, Murugappa Group from Chennai, formed a joint venture called Cholamandalam MS General Insurance Co. Ltd. In no time, they spread their operations across the country.

During the year 2011-2012, Cholamandalam MS General Insurance Co. Ltd. received an award for the ‘in time claims settlement’ with a wide range of offerings like health, travel, marine, property, motor, etc. the organization has become recognized throughout the country.

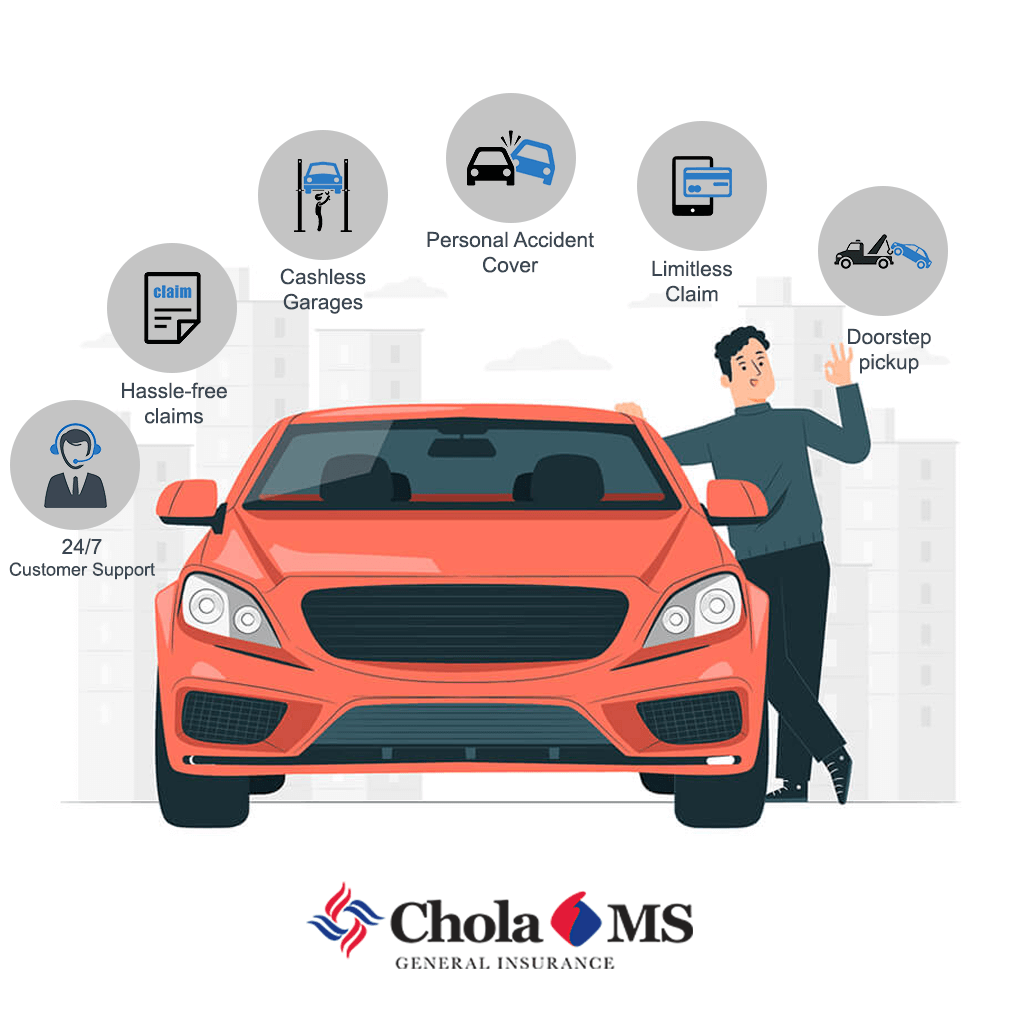

Benefits and Features Of Cholamandalam Car Insurance Plans

Chola MS insurance plans are designed to offer high coverage at affordable rates. Here’s why you should opt for Cholamandalam car insurance:

- 24/7 customer support

- Hassle-free claims process

- Over 7100+ cashless garages

- Dual coverage of third-party claims

- Instant claim processing via live video streaming

- Unlimited liability for third-party injuries

- Doorstep pickup, repair, and drop

- Customizable IDV to suit your needs

- Indemnity for third-party property

- Personal accident cover of up to Rs. 15 lakhs in financial support to the policy owner (registered vehicle owner) and their family members

- Limitless claim until you exhaust your IDV

Coverage of Cholamandalam Car Insurance Plans

|

Natural Reasons |

Damage to the car because of natural calamities such as rockslide, landslide, earthquake, hurricane, cyclone, lightning, fire, etc. |

| Man-made Reasons | Damage or a complete loss due to man-made reasons such as burglary, accidents, theft, malicious acts, strikes, etc. |

| Personal Accident Cover | This offers protection for the driver/owner against uncertain events or accidents. |

| Third-party Liability | Protection from any liabilities arising because of accidental injury or death caused to or by any third party (person or vehicle). |

| Own Damage Cover | You can get complete coverage in case of own damages in the following scenarios:

|

Add-on Coverage

Lock and Key Replacement

Cover reimbursement of expenses towards obtaining a duplicate ignition key, total lock replacement, new lockset, replacement of keys, or any repair

Tire Protect

Reimbursement for tires if it’s damaged because of a cut, burst, etc.

Vehicle Replacement Advantage Cover

Based on certain terms and conditions, you can replace the insured vehicle and its declared accessories with applicable charges and taxes. This includes coverage for road tax and registration charges.

Hydrostatic Lock Plus Cover

This add-on covers the cost of replacing or repairing gearbox, engine, underbody damage due to ingress of water, etc.

Consumables Plus Cover

After an accident, the actual cost of repairing consumables are covered under this add-on.

Waiver of Depreciation

This cover protects you against the damage or loss of parts of a vehicle subject to a deduction of depreciation.

A few additional value-added services include:

- Phone assistance

- Battery jump start

- Delivery of fuel

- Towing for the accidental breakdown

Documents Required To Apply For Cholamandalam Car Insurance

You can effortlessly complete the process with just a few documents like:

- Car make

- Car model

- Car variant

- Fuel type

- Date of registration

- City of registration

- Year of manufacture

- Your name

- Mobile number

- Email ID

- Aadhar number

How To Apply For Cholamandalam Car Insurance?

You can buy car insurance online within a matter of a few clicks!

Apply Via Probus Website

Log onto our website and click on car insurance.

Enter a few basic details like your city, car make, model, variant, year of registration, previous insurer, and policy expiry.

You will need to fill in a few more details for a precise quote like manufacture month & year, purchase date, customer type, license validity, etc.

Compare and contrast a few plans and choose one that’s best suited for you.

Make an online payment from several convenient methods.

Within no time, you’ll have your policy in your inbox.

Apply On Cholamandalam Official Website

Log onto the website and click on ‘buy new insurance for car’

Enter a few basic details like car make, model, variant, year of manufacture, your name, email address, mobile number, etc.

Compare and contrast a few plans and choose one that’s best suited for you

Make an online payment from several convenient methods

Within no time, you’ll have your policy

How to Renew Car Insurance With Cholamandalam?

Don’t wait until the last day to renew your car insurance policy. Do it online within minutes!

Renewal Via The Probus Website

Visit the website and click on car insurance.

Choose the insurer

You will be redirected to the official website, where it will ask you to input a few basic details

Review all the details and make changes if needed

Make the online payment

Within no time, you’ll have your policy

Renewal Via Cholamandalam Official Website

Login to our website and click on ‘renew policy’

Enter your policy number

Choose the policy of your choice

Make an online payment

Within no time, you’ll have your policy

How To Claim Car Insurance With Cholamandalam?

Policyholders receive quick help via a seamless claim process. You can either choose a cashless claim or reimbursement.

1. Cashless Claim

A cashless claim is when the insurer pays directly at the network garage and you must pay only a minimal amount. For this, you have to:

- Register a claim via phone or the website

- The surveyor will visit the site and examine your vehicle

- Submit all needed documents for verification

- After approval, the insurer will pay the needed costs

2. Reimbursement

This process requires you to pay out of your pocket and the insurer will reimburse you later. For this, you have to:

- Register a claim via phone or the website

- A surveyor will come to examine the damage

- Submit a claim with the needed documents like the RC book, your driver’s license, etc.

- Submit bills, original invoices, etc.

- After verification and examination, the claim will be approved, and money will reach your account.

Exclusions Of A Cholamandalam Car Insurance Policy

While comprehensive car insurance plans cover a whole lot of services, the following isn’t included within the policy for private vehicles:

- Accidental loss or damage due to willful negligence

- Loss or damage, intentional or other if you are driving under the influence of alcohol or drugs

- Loss, damage, or liability arising in instances where the car is being used outside the scope of limitations or is being driven by a minor or a driver not duly licensed

- Resulting loss, breakdown, wear and tear, or mechanical failures

- Loss or damage caused by nuclear activity or war

Steps To Calculate Car Insurance Premium Online

It is advisable to be prudent while buying car insurance by comparing the many plans available in the market. Usually, the premium is affected by certain factors such as year of purchase, place of registration, make of the car, car model and variant, etc. You can read about this on our website. Alternatively, you can calculate the premium payable under different policies with the help of a car insurance calculator.

Calculator On Cholamandalam Official Website

Step 1 – Visit the official website and click on ‘get quote’

Step 2 – You have to enter some basic details like your vehicle registration number, car brand, car model and variant, name, contact number, email ID, etc.

Step 3 – Click on get quote

Step 4 – The calculator will calculate your premium and instantly send it to your email address.

Frequently Asked Questions

Primarily, car insurance is a tool that safeguards you, your family, and your vehicle from any uncertainties. Besides that, Cholamandalam car insurance offers a plethora of USPs that make it a premium choice. With a solid cover, you get a plethora of add-ons, round-the-clock support, efficient costing, and more.

Cholamandalam FAQs

Car Insurers

- Bajaj Allianz Car Insurance

- Bharti AXA Car Insurance

- Cholamandalam Car Insurance

- Digit Car Insurance

- Future Generali Car Insurance

- HDFC Ergo Car Insurance

- ICICI Lombard Car Insurance

- IFFCO Tokio Car Insurance

- Kotak Mahindra Car Insurance

- Liberty Car Insurance

- National Car Insurance

- Navi Car Insurance

- New India Assurance Car Insurance

- Oriental Car Insurance

- Reliance Car Insurance

- Royal Sundaram Car Insurance

- SBI Car Insurance

- Shriram Car Insurance

- Tata AIG Car Insurance

- United India Car Insurance

- Universal Sompo Car Insurance

Car Insurance by Models

- Audi Car Insurance

- BMW Car Insurance

- Chevrolet Car Insurance

- Datsun Car Insurance

- Fiat Car Insurance

- Force Car Insurance

- Honda Car Insurance

- Hyundai Car Insursnce

- Jeep Car Insursnce

- KIA Car Insurance

- Mahindra Car Insursnce

- Maruti Car Insursnce

- MG Motor Car Insurance

- Renault Car Insurance

- Skoda Car Insurance

- TATA Car Insurance

- Toyota Car Insurance

- Volkswagen Car Insurance

FAQs

- Best Car Insurance Plans

- Car Insurance Benefits

- Electric Car Insurance

- Car Insurance Add-on Covers

- Car Insurance Calculator

- Car Insurance Campanies

- Car Insurance Policy Status

- Car Insurance Policy Transfer

- Comprehensive Car Insurance

- Find Car Insurance Policy Number

- First Party Vs Third Party Car Insurance

- Long Term Car Insurance

- No Claim Bonus in Car Insurance

- Third Party Car Insurance

- Used Car Insurance

- Zero Dep Car Insurance

- IDV For Car Insurance

- Private Vs Commercial Car Insurance

- How To Check Car Insurance Expiry Date Online?

Car Insurance Cholamandalam Car Insurance