General Insurance Companies Tata AIG General Insurance Download Policy

No Inspection. No Paper Work

Compare

Car Insurance Plans

Download Tata AIG Insurance Policy?

An insurance policy is a necessity. Whether it is a health insurance policy, a motor insurance policy, or a life insurance policy, an insurance policy works towards protecting you and your family. With so many fine details, after purchasing a policy, you may need to check the policy details from time to time. Alternatively, it’s always good to keep a downloaded copy with you at all times incase you misplace or lose the policy. This is easy to do with TATA AIG General.

Steps To Download Your TATA AIG Insurance Policy

Everything is digital these days, and therefore, you can easily download your insurance policy.

- Firstly, make sure to have a working internet connection on your device

- Log in to the email address you have used for the policy

- While purchasing the policy, TATA AIG has sent you an email with the policy document

- Open the email and follow the instructions

- You now have an electronic copy of your policy

You can also head to the TATA AIG website

- Log on to the official TATA AIG website

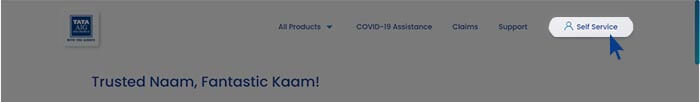

- On the homepage, click on the ‘self service’ option.

- Once the page opens, you will see a ‘download policy’ button. Click on it.

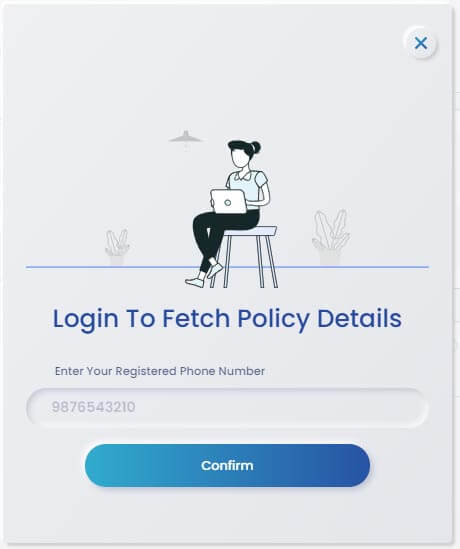

- Enter your registered phone number.

- Once you do so, enter the other details asked on the screen and follow the steps.

- Once the details are verified, your policy will be available for download.

How To Obtain A Paper Copy Of Your Insurance Policy?

When purchasing a TATA AIG insurance policy, you can ask for a paper copy of your insurance policy. It will either be handed to you or sent to you via registered post.

If at any time during the policy period, you need a hard copy, you can head to the nearest TATA AIG insurance office to know the procedure for the same. You can also contact the company’s toll-free number or email them at their customer support email address to understand how to obtain a paper copy of your TATA AIG Insurance policy.

How To Make Changes To Your Existing TATA AIG Insurance Policy?

1. Make Changes Through Endorsement:

In the insurance world, the word endorsement means making changes in your policy in order to update the information or add more features. The process of making an endorsement in your TATA AIG policy is straightforward. The insured needs to submit in writing that the insured would like an endorsement in their policy. After that, the changes are effective either

- From the date of the request OR

- From the date of the new premium approval (in case the endorsement requires the premium of your policy to be adjusted)

Examples of non-financial endorsements are:

- Changing the details of your policy’s nominee

- Changing or rectifying the name of the insured individual

- Changing or rectifying the dob of the insured

- Changing or updating the insured’s contact details (phone number/ email/ address)

*Please note: These changes can be made to your policy as long as the new information doesn’t affect your premium.

Examples of financial endorsements (any endorsement that causes a change in your policy premium)

- Adding new members to the policy (child, spouse)

- Removing insured members from the policy

- Changing the DOB or the address of the policyholder

This process can be done by emailing them at customersupport@tataaig.com or calling their toll free number on the website.

2. Make Changes Through Website:

Another way to edit your policy is on the website. But this will likely include only minor edits.

- Log on to the official TATA AIG website

- On the homepage, click on the ‘self service’ option

- Once the page opens, you will see a ‘edit policy’ button. Click on it.

- Enter your registered phone number

- Once you do so, enter the other details asked on the screen and follow the steps.

- Once the details are verified, you can make and save the edits.

Frequently Asked Questions

It is possible that changing your address will not affect your premium. However, you should check with the insurance company as a change in location might affect your policy premium, especially if it is home insurance or motor insurance, as those premiums take geographical location into consideration.

TATA AIG insurance policies allow the insured individual to add spouse or newborn to their policy. Contact your insurance company to kick start this process at the earliest.

You can head to the TATA AIG website and click on the chat option called “TARA” on the right-hand bottom of the screen. Alternatively, if you click on the ‘support’ option on the homepage, you will see the following options to contact them

- WhatsApp – +91-9136160375

- 24/7 Toll Free Number – 1800-266-7780

- Email – customersupport@tataaig.com

- Toll-free number for agents and intermediaries – 1800-267-7233

General Insurers

- Bajaj Allianz General Insurance

- Cholamandalam General Insurance

- Digit General Insurance

- Edelweiss General Insurance

- Future Generali General Insurance

- HDFC ERGO General Insurance

- ICICI Lombard General Insurance

- IFFCO Tokio General Insurance

- Kotak General Insurance

- Liberty General Insurance

- National General Insurance

- Navi General Insurance

- New India General Assurance

- Oriental General Insurance

- Reliance General Insurance

- Royal Sundaram General Insurance

- SBI General Insurance

- Shriram General Insurance

- TATA AIG General Insurance

- United India General Insurance

- Universal Sompo General Insurance

Car Insurers

- Bajaj Allianz Car Insurance

- Bharti AXA Car Insurance

- Cholamandalam Car Insurance

- Digit Car Insurance

- Future Generali Car Insurance

- HDFC Ergo Car Insurance

- ICICI Lombard Car Insurance

- IFFCO Tokio Car Insurance

- Kotak Mahindra Car Insurance

- Liberty Car Insurance

- National Car Insurance

- Navi Car Insurance

- New India Assurance Car Insurance

- Oriental Car Insurance

- Reliance Car Insurance

- Royal Sundaram Car Insurance

- SBI Car Insurance

- Shriram Car Insurance

- Tata AIG Car Insurance

- United India Car Insurance

- Universal Sompo Car Insurance